As the final member of the ‘Magnificent Seven’ – NVIDIA – releases its results today, investors will be wondering how long their reign can continue and whether it still makes sense to bet the farm on artificial intelligence and technology.

Invesco’s multi-asset team is pondering the same question. The firm’s Summit Growth portfolios placed an outsized bet on the ‘Magnificent Seven’, which was implemented cheaply and simply using a Nasdaq 100 ETF. Lead manager David Aujla is now wondering whether to take it off the table.

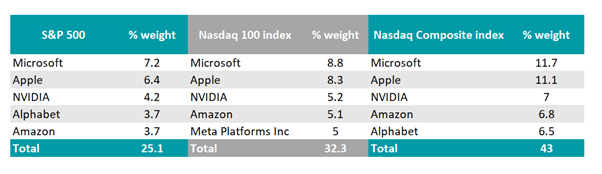

The Nasdaq 100 has higher weightings than the S&P 500 to its largest positions, as the table below shows, so Invesco moved 20% of its US equity exposure into the Invesco EQQQ Nasdaq 100 UCITS ETF to go overweight technology.

US indices’ top five positions with respective weights

Source: Invesco

Meanwhile, the Summit Growth portfolios’ US exposure also includes a core 60% allocation to the Invesco S&P 500 UCITS ETF and a 20% allocation to an actively-managed US core/growth fund.

Aujla invested in the Invesco EQQQ Nasdaq 100 UCITS ETF in early July 2022 after removing the Invesco US Value Equity fund (which had performed strongly in the first half of 2022).

Since then, the Nasdaq 100 has returned 44% in sterling total return terms compared to 27% for the S&P 500 (from 6 July 2022 to 15 February 2024). “We’re reviewing it given how well it’s done,” Aujla said.

Over the same time period, the two highest risk iterations of Summit Growth (funds four and five) returned 15.7% and 19.2%.

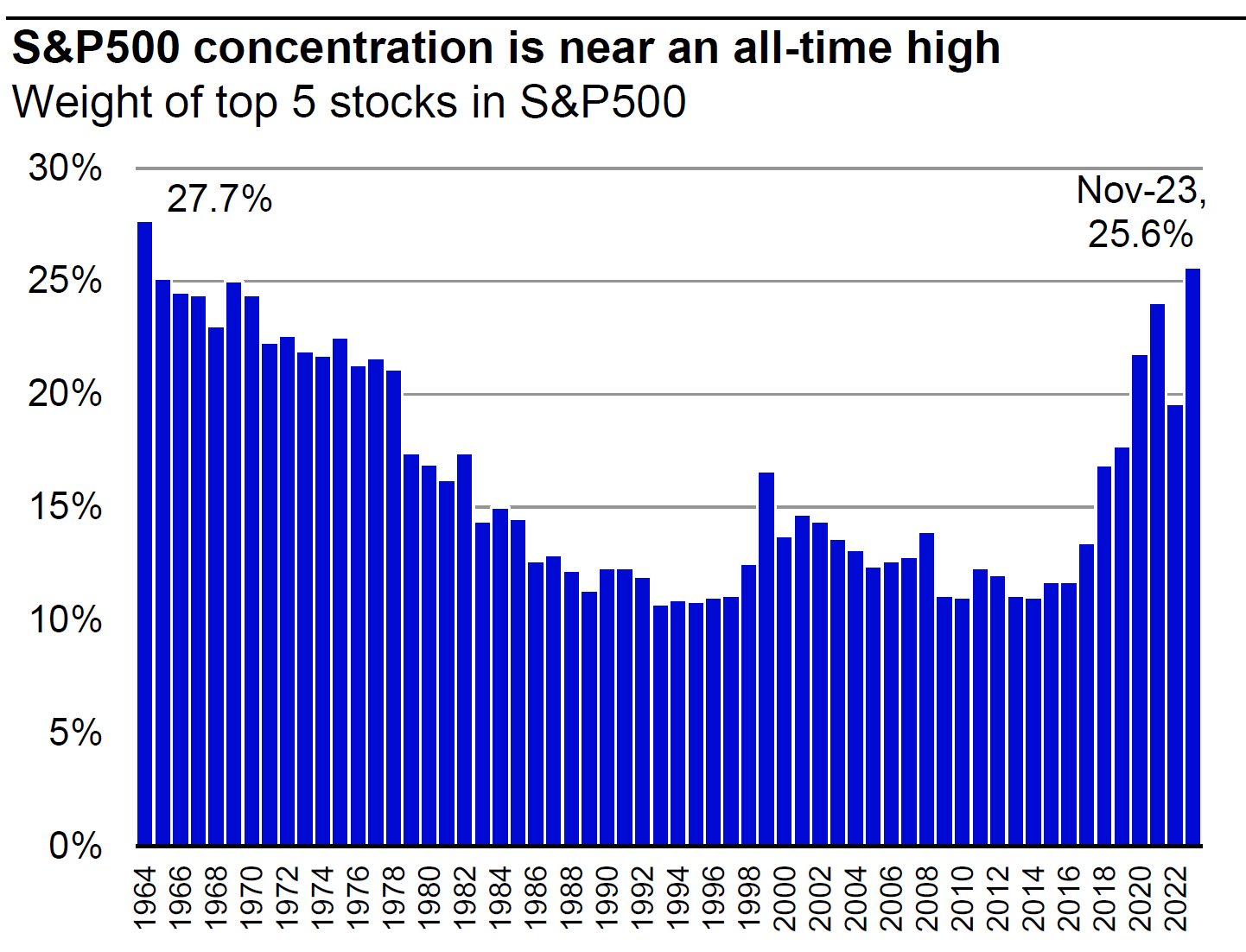

Aujla is concerned about market concentration. The US equity market has not been as bunched up into its largest holdings since the 1960s, as the chart below shows; so an investment strategy playing upon that concentration is not without risks.

Source: Invesco, data to Nov 2023

“Concentration doesn’t stay that way forever and tends to unwind,” Aujla said. “It does cause you to rethink. Optically those stocks look dear.”

The ‘Magnificent Seven’ may have shot the lights out last year, but going forward Aujla is looking elsewhere. On a five-year view, “we think there will be better returns outside the US than inside,” he said.

This disparity between US equity valuations and other developed markets is just one of several anomalies evident in markets today. Aujla said exploiting these mismatches will be the key to generating investment returns going forward.

The contrasts between developed and emerging markets, and between China versus other emerging markets, are unusually wide, he continued. China is “incredibly cheap” so Aujla thinks that “on a three-year view it will do quite well.” The Summit Growth portfolios are overweight emerging market equities.

Meanwhile, the relative valuation gap between small-caps versus large-caps is as wide as it has been since the financial crisis. With small-caps, “if you fell asleep and woke up three years from now, I think you’ll be pleased you owned some,” Aujla said.

Small-caps have higher long-term growth potential and are more domestically focused than large-caps, so a portfolio of global small-caps provides better regional diversification. The management teams of smaller companies tend to own more stock so their interests are better aligned with investors.

Aujla likes UK small-caps in particular. “I think they have been quite beaten up and valuations are particularly depressed meaning strong future performance potential. Any sterling strength should also be a benefit due to their more domestic nature,” he explained.

Invesco’s Summit Growth portfolios invest in an in-house global small-cap fund and Aujla has added an in-house UK small-cap fund alongside that to increase domestic exposure.

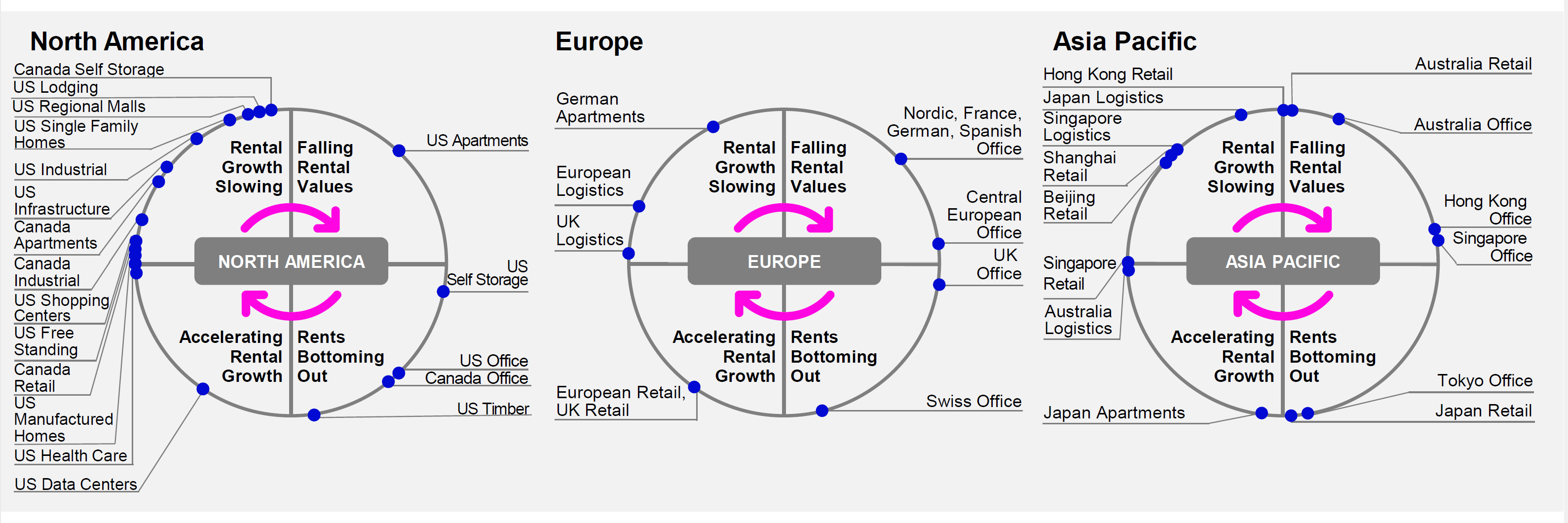

Elsewhere, Aujla also has a positive outlook for listed real estate, which should benefit from falling rates and where “valuations are pretty cheap across the world”. Global listed real estate is “really diverse” because “it’s a bit like a clock”, he explained – different sectors within different countries do well at different times as rents rise and fall, as the chart below shows.

Source: Invesco Real Estate as of 31 Dec 2023

Within fixed income, Aujla has a barbell approach with government bonds on the one side for their defensive qualities, then high yield and emerging market debt – where he is overweight – on the other side. High yield bonds are offering 8% yields, so with an active manager who can avoid defaults and tilt towards higher quality names, “you’re being paid to take risk.”