Hargreaves Lansdown’s volatile share price has rebounded strongly since March 2024, although it is still way off its 2019 peak. Broker Jefferies has issued a buy rating for the platform’s stock in the belief that its fortunes are turning around under new chief executive Dan Olley and Peel Hunt recently reaffirmed its buy rating.

Nonetheless, Hargreaves Lansdown remains one of the UK’s most shorted stocks judging by the percentage of its share capital disclosed to be in the hands of short sellers (5.5% at the end of April 2024, according to the Financial Conduct Authority).

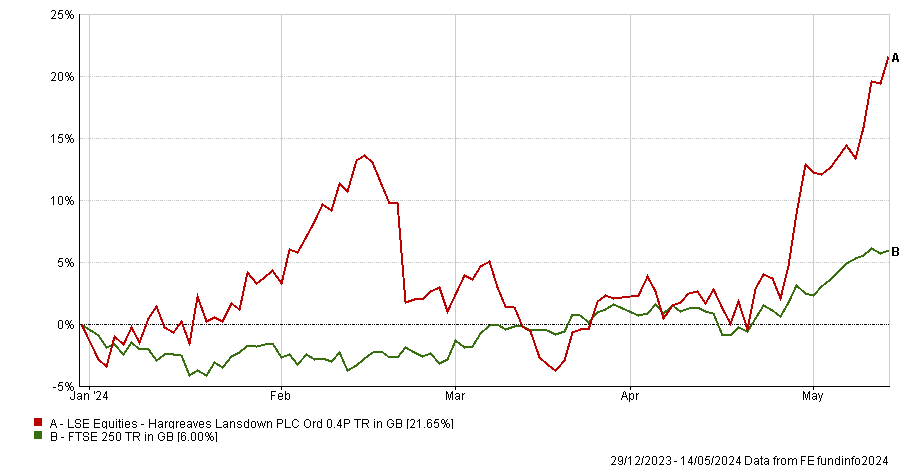

Hargreaves Lansdown’s share price year-to-date vs FTSE 250

Source: FE Analytics

Analyst recommendations are split with six analysts expecting Hargreaves Lansdown to underperform, five saying it will outperform, three buys, four holds and one sell, according to the Financial Times as of 9 May 2024.

So, who is right? And should you buy, hold or fold Hargreaves Lansdown’s shares?

Eric Burns, chief analyst at Sanford DeLand, sides with Jefferies and Peel Hunt. Hargreaves Lansdown is a high beta play, so he expects its shares to perform well if the UK and global stock markets – which hit fresh highs last week – continue to rise.

“I struggle to follow the logic of being short a stock like HL when the FTSE is reaching new highs on a daily basis. Rising markets provide an organic uplift to assets under administration – HL’s key performance metric – even without it adding new customers,” he explained.

“Following the sell-off, we have a business with a free cash flow yield we estimate of about 7.1% this year, rising to 7.5% next. This puts it very much in the ‘value’ category.”

Peel Hunt agreed that the platform looks cheap. “Hargreaves Lansdown is now trading on a December 2024E EV/EBIT of c.8x, or a price-to-earnings ratio of 12x, well below the other listed platforms,” the broker said on 30 April 2024, reiterating its buy recommendation. “We do not believe the longer-term prospects are being reflected in the share price.”

Sanford DeLand has held Hargreaves Lansdown (HL) in its CFP SDL Buffettology fund since October 2014. It also owns AJ Bell in its CFP SDL Free Spirit fund. “We love platform businesses; they are very scalable and tend to exhibit the sort of returns we are looking for,” Burns said.

“In the case of HL, return on average equity is in excess of 50% and conversion of reported earnings into free cash flow is high. Despite all the negativity you will hear, this is a business that has grown revenue at a 10%+ compound annual rate over the past 10 years during which time active clients have gone from 507,000 to over 1.8m. It’s the sort of steady compounder we like.”

Hargreaves Lansdown has benefitted from the higher rate environment through its popular Active Savings product which enables savers to achieve a better rate of return on cash, Burns added.

“There have also been regulatory concerns regarding the interest platforms earn on client cash balances although this appears to be ameliorating,” he noted.

Julian Roberts, an equity analyst at Jefferies, argued that although Hargreaves Lansdown is not the cheapest investment platform, its pricing is competitive – and fees are not as critical to customer loyalty as the platform’s detractors may believe.

“Platform fees of 45 basis points (bps) are capped at £45 a year for shares. On an average account size of c. £75,000, that is 6bps. It is more than AJ Bell, which caps out at £25 (3⅓ bps), but the £20 difference is quite slim in the scheme of things, and HL would point to execution cost savings due to their larger size and network. This does not hold for all asset classes, but absolute differences are not huge,” Roberts explained.

“Perhaps more importantly, in our survey of UK savers this year, the two most expensive platforms were also the most popular, so we doubt that the target market is as price sensitive as people might think. Brand and service probably matter more.”

Roberts thinks that Hargreaves Lansdown’s sheer size masks its success at bringing in new customers. “HL fishes for new clients in the same pool as all of its competitors, but it loses them from a much bigger one. Lose 10% of 1.8m customers, and you need 180,000 new ones to replace them. AJ Bell can lose 10% and only need 35,000 new ones to grow,” he said.

“HL added 34,000 net new customers in the quarter to March 2024, versus 15,000 at AJ Bell, but the gross numbers are even further apart. We see this as a sign of brand strength.”

For Hargreaves Lansdown, this represented a 48% jump in net new clients compared to the first quarter of 2023, as its new cash ISA and ready-made pension portfolios proved popular.

Positive market movements also helped the platform to grow its assets under administration by 5% during the first quarter of this year to £149.7bn, according to Peel Hunt. Net inflows improved to £1.6bn, which was above consensus expectations.

Since coming onboard as CEO last year, Olley has had “a real impact”, Roberts continued. The former dunnhumby boss has “re-jigged the sequence and content of the investment programme, replaced the chief technology officer, brought in a new strategy office and a new corporate affairs director, and there have been results”.

The most recent addition to the investment programme is a range of passively-managed model portfolios, which will start trading next month.

On the other side of the equation, short-sellers have had plenty of reasons to bet against the stock during the past few years.

Having owned the platform for a decade, Burns acknowledged its fall from grace. “If you combine difficult market conditions with the unwanted connection to the [Neil] Woodford affair and a spat with its founder then I guess that’s fodder for the shorters,” he said.

The platform’s shareholders, Burns included, are hoping these headwinds are in the past and that momentum has turned in Hargreaves Lansdown’s favour.

In a further potential fillip to shareholders, Burns suggested that HL might join the increasing ranks of British companies catching the attention of overseas buyers.