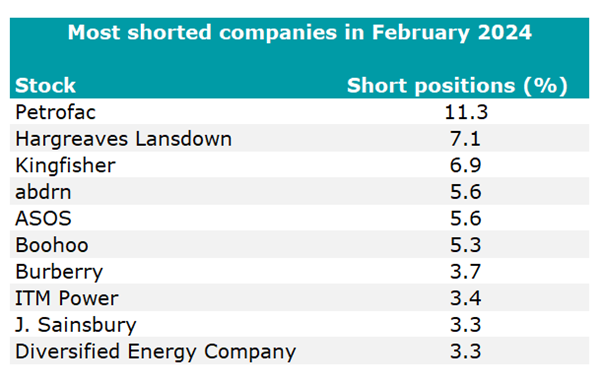

Hargreaves Lansdown was the second most shorted UK stock in February, judging by the percentage of its share capital in the hands of short sellers, which stood at 7.1%.

BlackRock, Citadel Advisors, Marshall Wace, Millenium International Management, Qube Research & Technologies and the Canada Pension Plan Investment Board all disclosed to the Financial Conduct Authority that they have been betting against the investment platform.

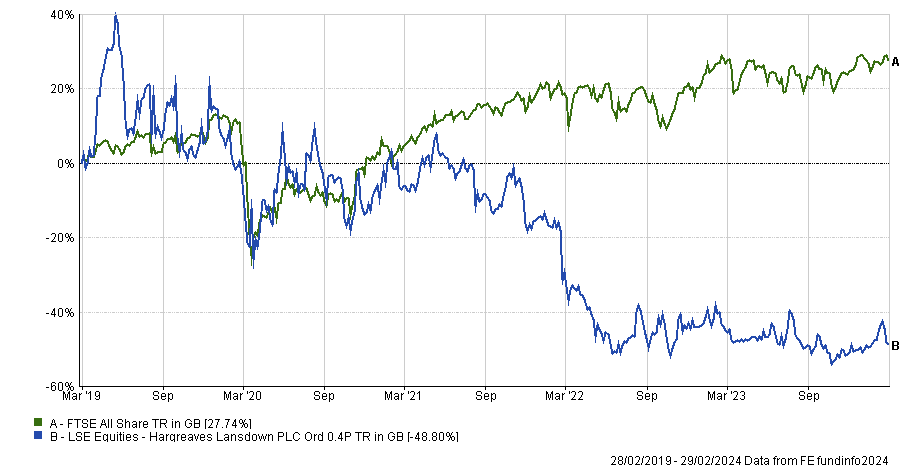

Hargreaves Lansdown was relegated from the FTSE 100 index to the FTSE 250 in December 2023. Its share price fell by 9.4% during 2023 and is down 48.8% in the five years to 29 February 2024.

Share price performance of Hargreaves Lansdown vs FTSE All Share over 5yrs

Source: FE Analytics

Yet several brokers are recommending that their clients invest in Hargreaves Lansdown. Four rate it a strong buy and three more have a buy rating, while three are neutral, five recommend selling the stock and two have a strong sell recommendation, according to Barclays.

Jefferies announced a buy rating for Hargreaves Lansdown after its half-year results on 22 February “slightly exceeded consensus”, according to equity analyst Julian Roberts.

Inflows and outflows both increased, bringing net flows down from £1.6bn to £1bn year-on-year, missing consensus expectations of £1.5bn. Hargreaves Lansdown attributed the outflows to cash withdrawals related to cost-of-living increases and to clients transferring money to banks’ cash ISAs.

In response, Hargreaves Lansdown has launched its own 4.8% fixed-term cash ISA, which is available on its Active Savings platform.

Market movements, however, added £7.2bn to the firm’s assets under administration, taking assets up 6% during the second half of 2023 to a record £142.2bn.

“We have long known that inflows were not the problem – declining retention and therefore rising outflows were,” Roberts said.

To address this, Hargreaves Lansdown is planning to pivot towards self-invested personal pensions (SIPPs) and defined contribution (DC) pensions, which tend to be stickier assets. The platform is also improving its navigation tools, communication and marketing.

Hargreaves Lansdown recently hired Richard Hebdon to lead its digital transformation strategy. He joined from RELX, the global information services provider, where he was chief technical officer for a division of LexisNexis.

The firm also has a relatively new chief executive officer (CEO) in Dan Olley, who replaced Chris Hill in November 2022 and was previously CEO of dunnhumby, a data science company for retailers. Olley and Hebdon both have extensive experience leading digital transformations.

Furthermore, Deanna Oppenheimer stepped down as chair in December 2023 after six years and was replaced by Alison Platt, who was chair of Dechra Pharmaceuticals.

Roberts said: “The key is flows, and we are reassured that a new-look data team and C-suite are looking at the micro and macro options. There is no magic wand for the CEO to wave, but we look forward to hearing more about plans in the pension sector later in the year. That could bring in persistent sticky flows.”

Hargreaves Lansdown’s results also revealed that the platform has been earning considerable revenues from dormant cash in clients’ accounts.

The margin on cash increased from 168 basis points (bps) to 216bps during the second half of 2023 due to higher interest rates. This amounted to 36% of the firm’s £368m in revenues, or £133m – more than fund fees (£120m).

Jefferies’ analysts pointed out that Hargreaves Lansdown passed rate increases through to clients in January and stated in its results that it does not double dip (i.e. it doesn’t charge customers a fee for holding their cash as well as earning interest).

Roberts had previously thought Hargreaves Lansdown’s biggest problem was attrition due to older clients leaving or going into drawdown. However, demographic trends have changed and people in their thirties now outnumber people born in the 1960s for the first time.

Younger investors “have less money, but they will save for longer,” Roberts said. “Hargreaves Lansdown is not quite out of the woods yet, but there is light between the trees.”

Separately, the UK’s most shorted stock is still Petrofac, a service provider to the energy industry. Hargreaves Lansdown is in second place, followed by DIY giant Kingfisher, fund manager abdrn and fashion retailers ASOS, Boohoo and Burberry.

The UK’s most shorted stocks in February 2024

Source: Financial Conduct Authority