What can you do with $80bn leftover cash? Admittedly, it’s a nice problem to have, but the answer wasn’t a straightforward one for Google parent Alphabet, which sat on the cash for a while before deciding only this year to pay its first dividend.

What took it so long? That’s what Richard Saldanha, FE fundinfo Alpha Manager of the Aviva Global Equity Income fund, asked.

“After all its funding was done, including the capital expenditure programme Alphabet was sitting on $80bn after. In some ways, you could ask: What took it so long to paying it out as a dividend?,” he said.

But while this is an interesting development for income investors, who now gain access to a whole new set of income opportunities in US technology, the manager was more excited about the broader trend and the growth potential, rather than the dividend itself.

While this might look like a sizable amount in terms of dollars, the yield percentage is not going to set the pulse racing, at just about 0.5%. However, cash isn’t only accumulating on Alphabet’s books, but also across the industry and Saldanha sees only one direction that this trend could go.

“This opens up a new opportunity set and we expect this trend to continue,” he said. “Don't be surprised if you see more and more of these technology companies initiating dividends. Tech is a sector that now is very much within income investors’ grasp.”

Until now, the options for income investors were limited to Microsoft, which has been paying dividends for a long time and “has a very mature dividend framework”.

Like with the others, it isn’t the nominal yield that’s interesting in Microsoft’s case, but the growth profile.

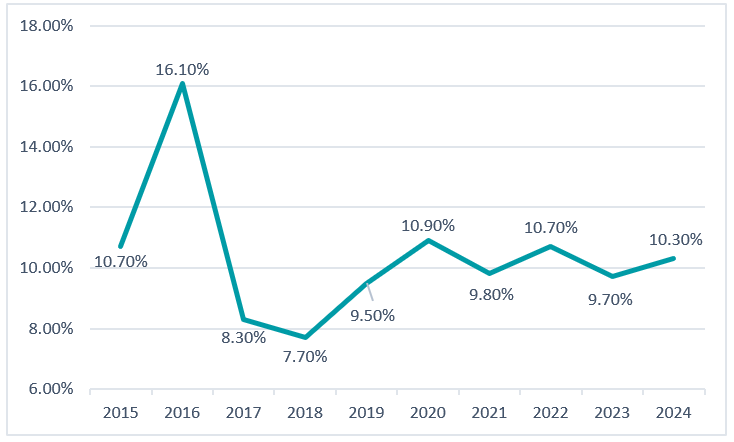

“The underlying growth of these companies is quite interesting. We expect their dividend to grow in line with the cash flows. For Microsoft it's been consistently double-digits,” Saldanha said.

Microsoft historical dividend growth

Source: Company filings

Whether there will be a large uptake of US tech within income portfolios is still to be seen and will depend on managers’ considerations around valuation and yield, but Saldanha has no doubt many funds will be increasingly looking at this sector.

“It's going to be interesting to see how that progresses. For us, it’s going to be a steady evolution,” he said.

The only large tech company currently in the Aviva Global Equity Income portfolio is Microsoft, but Alphabet is held in another fund managed by Saldanha, Aviva Global Equity Endurance and was described by the manager as the most convincing stock among the Magnificent Seven.

“Alphabet is a very strong company that is going to grow cash flows at a at a healthy rate, so it is certainly of interest now for the equity income fund too,” he said.

“For now, however, this fund gets its tech exposure via Microsoft and other routes in the supply chain. We've been very much invested in the semiconductor space, for example, where companies have much more mature dividend structures.”

Examples of these are the artificial intelligence chips suppliers Broadcom, which sells to Alphabet, and TSMC, which manufactures the chips for Nvidia.

“We're very pleased however to see this opportunity set continue to evolve and increase,” the manager concluded.

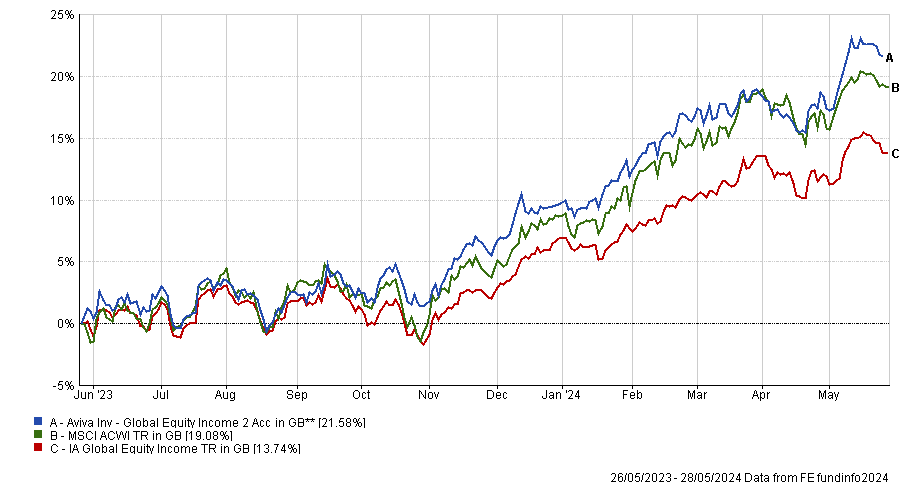

Performance of fund against sector and index over 1yr

Source: FE Analytics