Artemis UK Select, Fidelity Smaller Companies and Baillie Gifford Pacific have all been given FundCalibre’s ‘Elite Rating’ along with seven others, in the investment research house’s latest update.

The title is awarded to funds based on quantitative and qualitative screenings and a peer group review and is generally awarded to only 10% of funds per sector.

Two funds were also put on the Elite Radar, which identifies funds that are on the team's watch list but lack some of the necessary criteria for a full rating.

UK equities

In the UK, Artemis UK Select and Fidelity UK Smaller Companies both achieved Elite Ratings. The former is managed by experienced fund managers Ed Leggett and Ambrose Faulks and stood out for its multi-cap portfolio and value bias.

The fund’s ability to short specific positions has allowed it to achieve significant long-term gains, even despite periods of market stress.

Darius McDermott, managing director at FundCalibre, said this made the fund a “strong option” for those seeking high returns, as long as they are comfortable with greater volatility.

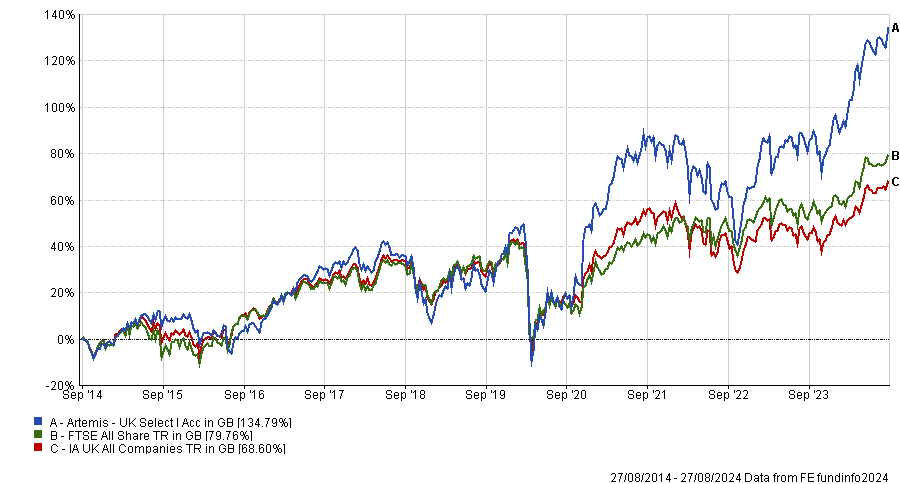

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Meanwhile, the Fidelity Smaller Companies fund, managed by Jonathan Winton, pursues a more contrarian approach, emphasising the overlooked areas of the small-cap market.

Despite a value-orientated approach, the fund has an extremely successful long-term record, even in periods when value investing has fallen out of favour, making it a highly attractive option for investors.

It has been the best performing fund in the IA UK Smaller Companies sector over three, five and 10 years, and is above the peer group average over the past 12 months.

Global equities

In the global equity space, two further funds were added: T.Rowe Price Global Select Equity and GQG Partners Global Equity.

Managed by Peter Bates, the T Rowe Price fund was credited for its clear investment process and dynamic stock selection, which McDermott felt positioned it strongly for long-term success.

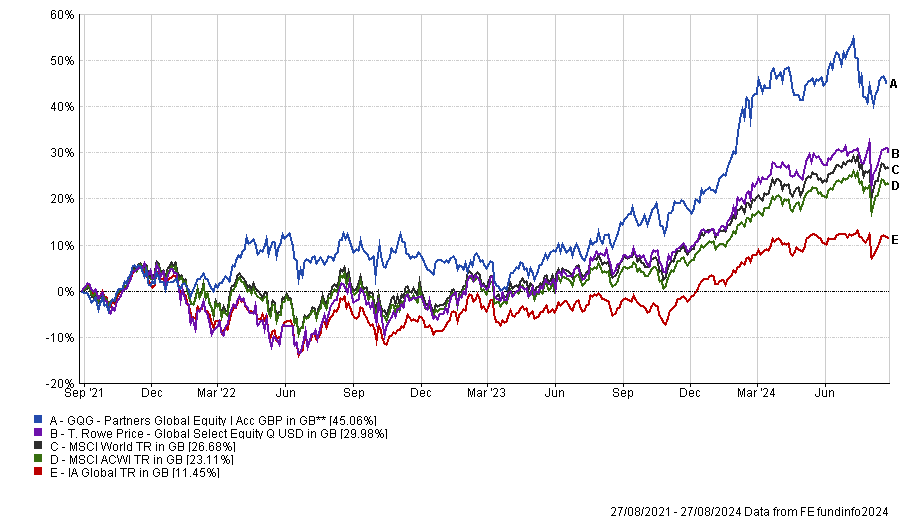

Launched in 2020, the fund has had a strong three years, as the below chart shows, relative to its MSCI World benchmark.

“It is a high-quality choice for investors seeking a well-rounded global equity portfolio,” he said

Performance of funds vs sector and benchmarks over 3yrs

Source: FE Analytics

GQG Partners Global Equity was similarly credited for its “nimble and dynamic approach”, which has enabled it to respond to market opportunities quickly and consistently outperform many of its peer groups.

Indeed, the fund, which was launched in 2019, has consistently ranked within the first quartile of the wider IA global sector in the past three and five years.

Emerging markets and Asia

Elsewhere, three funds were added in Asia and the emerging markets. The Baillie Gifford Pacific fund has established itself as a long-term growth fund focused on the Asia Pacific region, which has targeted durable growth companies.

This means that, while the fund can experience some volatility, it is a consistently strong performer, with McDermott adding that it “shows pragmatism by rotating into cyclical sectors when needed”.

Meanwhile, the M&G Global Emerging Market fund, managed by Michael Boruke since 2018, takes more of a contrarian approach, targeting businesses with strong capital returns and attractive valuations.

“Its low turnover and thorough process make it a standout option for investors seeking a differentiated approach to emerging markets,” McDermott said.

Concentrating more specifically on Japan, the M&G Japan Smaller Companies fund, led by Carl Vine, is another top performer, beating out the other 67 peers in the IA Japan sector to take the top spot over the past decade.

“Even in recent challenging market conditions, this fund has delivered steady performance, making it an interesting option for investors seeking exposure to Japanese smaller companies,” McDermott said.

Bonds and other asset classes

In the fixed-income space, the Bluebay Global Investment Grade Corporate Bond portfolio has achieved an elite rating.

Primarily focused on investment grade bonds, the fund also has the ability to allocate to high-yield bonds. McDermott credited the portfolio with a steady track record and well-disciplined approach.

“This is a solid core option for portfolios with bond allocations,” he said.

Multi-asset fund WS Canlife Diversified Monthly Income also achieved an Elite Rating in the summer shake-up. With a diverse portfolio of global shares, international bonds and property, the fund has aimed to provide a steady yield of at least 4%, using a balanced approach to asset allocation to manage risk.

“This fund has delivered solid performance since its launch, making it a reliable choice for income-focused investors,” said McDermott.

Another on the list was FTF Clearbridge Global Infrastructure Income. This fund combines regulated utilities with demand-based infrastructure such as railways and roads, with a targeted yield of around 5%, and offers inflation protection, making it compelling for periods where interest rates decline.

“The seasoned investment team has a good track record of strong performance and dividend growth, making it a compelling option for income-seeking investors – particularly if interest rates decline,” McDermott said.

Other movements:

In the latest review, GQG Partners US Equity and Invesco Tactical Bond portfolios were re-classified from the firm’s Radar to Elite Rating.

Meanwhile, two new funds were added to the elite radar: Bluebay Investment Grade Global Government Bond and the Invesco Emerging Markets Ex-China funds.