Alphabet, Meta and Amazon might not be the stocks that you expect to find in a value fund such as Nedgroup Contrarian Value, and yet they all belong to its top-10 holdings, making up 8.9%, 4.9% and 3.3% of the portfolio, respectively.

This has helped the strategy achieve a maximum FE fundinfo Crown rating of five, which is given on the back of relative three-year performance – a timeframe in which technology stocks, the largest sector exposure in the fund at the moment, soared.

The reason for holding these in a value portfolio is clear, according to manager Mark Landecker. No not be out of business.

“If you were to look at the portfolio and just saw a collection of deep-value names such as auto manufacturers, retailers and telecoms, we probably wouldn't be having this conversation today because we'd be out of business,” he said.

“We're not trying to bottom-fish and find companies that are valued in the lowest decile. We're trying to purchase high-quality companies when they very occasionally trade at a level that allows you to buy them as a price-disciplined investor with a margin of safety”.

So it all goes back to the time at the stocks were purchased. For Alphabet, it was in the 2010s, when the company was navigating regulatory scrutiny, antitrust investigations in the European Union, privacy concerns and market competition. For Meta, it was during the Cambridge Analytica scandal in 2018.

“These are long-held names in the portfolio, not indicative of us trying to jump on the artificial intelligence (AI) bandwagon,” he said. “We are fans of secular growth. Who isn’t? We just don’t like to pay for it.”

Top 10 Holdings as at 31 July 2024

Source: FE Analytics

Other names with a technology element in the portfolio include connector company TE Connectivity and semiconductor company Analog Devices. Microsoft was also a holding from 2010, when everybody “hated it and didn’t think it was going to go anywhere”, until 2020, when the valuation had become “hard to justify”.

Asked whether this was a concern for other names in the fund, Landecker said that he is “comfortable” owning companies as long as there is a “reasonable likelihood” that they can earn “equity-type rates” of return.

The latest example of a name that was cut for valuation concerns is Broadcom, as it has now pushed to a price-to-earnings ratio of 25x to 30x, whereas it was originally bought in 2018, as the manager recalled, at a 10x to 12x level.

According to Landecker, owning companies that investors are used to finding in funds with different styles doesn’t betray the price-disciplined process, but rather it’s “indicative of the strategy, the underwriting and the research working exactly as intended”.

“If we do our job well, we are in the right companies and we buy them at the right times, then the hardest thing is to convince ourselves not to sell them as the value appreciates.”

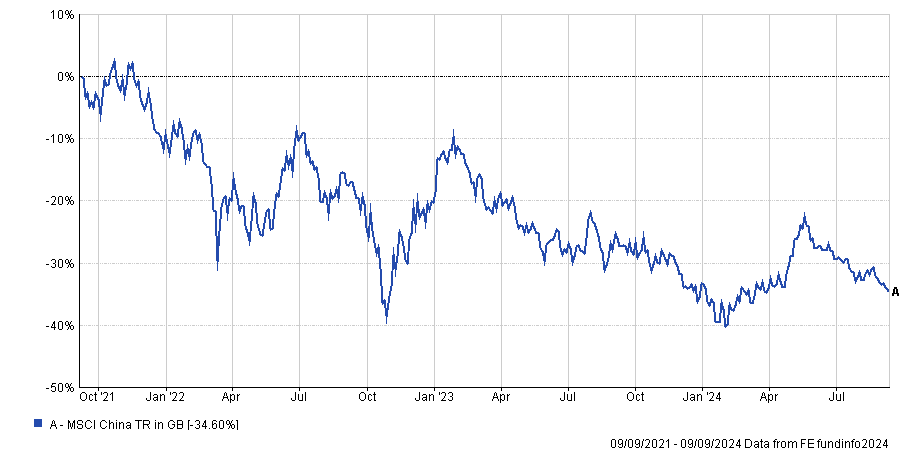

Another winning decision for the fund was to whittle down its exposure to Chinese companies on the back of geopolitical concerns. This has allowed it to avoid the abysmal returns of the past few years, illustrated in the chart below.

Performance of index over 3yrs

Source: FE Analytics

The manager had higher exposure to China in years past, but then the Chinese economy “moved towards more central-market planning rather than capitalist tendencies”, making it “a more unpredictable environment”.

“Relying on the decisions of a few people at the top, rather than the markets as a whole creates greater uncertainty and can potentially restrict your ability to compound capital over time,” Landecker said.

Admittedly, given the status of China as the world's second-largest economy, it is “almost impossible to escape it completely”, but today the NedGroup Contrarian Value is “virtually” China-free.

“Previously, if you were running a global equity portfolio focused on larger companies, you didn’t have to take geopolitical events into account as much, but unfortunately it looks like geopolitics will be part and parcel with investing in the next couple of decades,” he concluded.