Many fund managers have been warning for months, if not years, that US equities were too expensive but it took the shock of Donald Trump’s extreme ‘reciprocal tariffs’ last month for that to become something of a consensus view.

The tables have turned on relative regional equity market performance this year and investors are now faced with the question of whether less steeply valued equity markets outside of the US offer better prospects.

Below, fund managers explain where they are finding value and how they interpret current stock market valuations.

Redwheel: It’s as if tariffs never happened

Nick Clay, head of Redwheel’s global equity income team, believes US equity valuations and earnings growth expectations are still far too high. “Given how stretched the valuation gap had widened to by the end of 2024, the most recent moves in markets have done little to close the valuation gap,” he said.

Furthermore, stock markets have “done a round trip” since 2 April and are acting “as if tariffs never happened”.

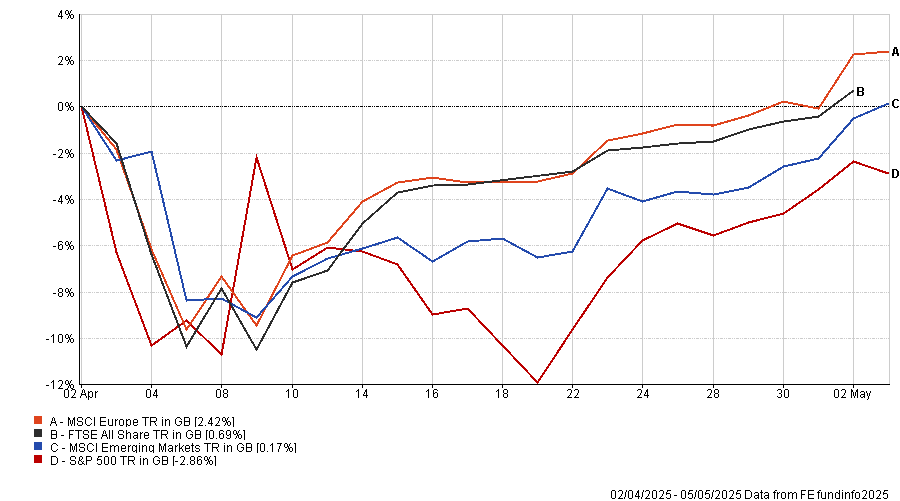

Performance of regional stock markets since 2 April

Source: FE Analytics

“Given that the markets worldwide have recovered their ‘Liberation Day’ wobbles, it would seem that consensus believes nothing much has happened to upset the trends hoped for at the start of the year – continued American exceptionalism,” he observed.

“We believe that is wishful thinking. Therefore, in the TM Redwheel Global Equity Income team, we continue to favour investments outside of the US, in Europe including the UK and Asia, where we think valuations are more forgiving and expectations not so high.”

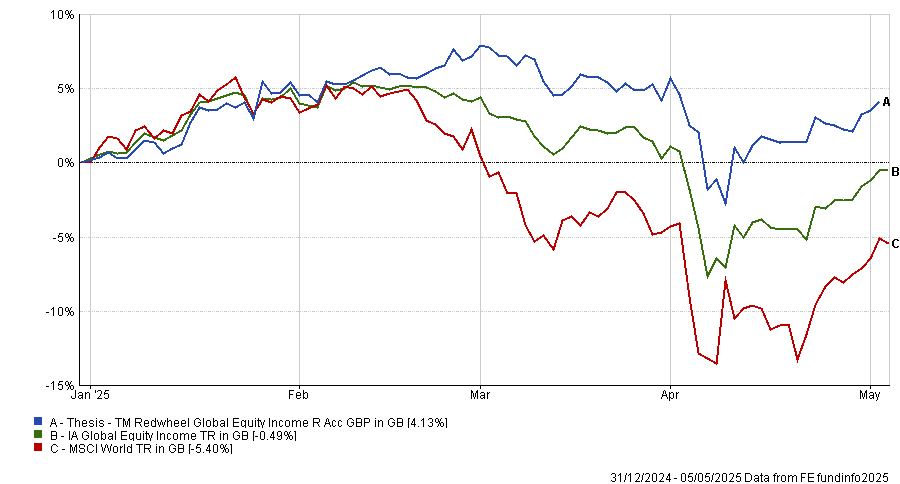

The TM Redwheel Global Equity Income fund had 32.6% in the US as of 31 March – an underweight that has contributed to the fund’s significant outperformance this year.

Performance of fund vs sector and benchmark YTD

Source: FE Analytics

JP Morgan Asset Management: Opportunities exist not in cheapness but in mispricing

Given that valuations reflect consensus expectations about an equity market’s prospects, the main thing to watch out for is not attractive valuations per se, but “where our expectations diverge from this consensus”, said Natasha May, global market analyst at JP Morgan Asset Management.

For instance, at the start of this year, the MSCI Europe index’s price-to-forward-earnings ratio was a little below its own long-run average and every European sector traded at a larger-than-average discount to its US counterpart. These valuations reflected investors’ expectations that Europe’s underwhelming economic performance would continue, she observed.

“We believed European policymakers would rise to the challenge of a less friendly US and therefore expected fiscal, monetary and regulatory policy to turn more supportive than investors anticipated. As this policy shift has begun to play out, European equity valuations have risen,” May explained.

“The scale of the rise has been limited by trade-related uncertainty but we believe the magnitude of Europe’s policy shift should provide further support to European equity valuations going forward.”

Forvis Mazars: US earnings growth is still worth paying for

At the other end of the spectrum, some asset allocators are taking a fresh look at the US, now that stock market falls have taken the sting out of toppy valuations.

Forvis Mazars went from underweight to a neutral position in US equities during its 18 April rebalance, said chief investment officer, Ben Seager-Scott. “The dramatic moves over the first three-and-a-half months of 2025 saw valuations fall and markets potentially overweighting the most extreme tariff scenarios, meaning we saw a tactical opportunity of a potential overreaction.”

By most measures, US equity valuations still look expensive but they have “come down from extreme levels”, he observed. Meanwhile, fundamental earnings growth is still strong and “worth paying for”.

“Earnings expectations for this year have fallen: but from a punchy 14% to a ‘mere’ 8%. Bearing in mind the UK and Japan are expected to see earnings fall 3% this year and Europe to grow just 1%, the US can still justify a bit of a premium – and growth for next year is expected to be around 12%,” he explained.

If tariffs plunge the world into a global recession, the US is better placed to weather the storm due to the relatively closed nature of its economy, he continued.

“Much of the US economy is driven by services which aren’t impacted directly by tariffs, wages are growing faster than inflation and employment is still tight, even if hiring levels are dipping. That, coupled with the likely successful implementation of tax cuts means that the outlook is actually pretty reasonable.”

The US equity exposure within Forvis Mazars’ balanced model, which has 54% in stocks, has increased from 15.8% to 18.6%; within the overall equity allocation, the US has gone from 29% to 34%.