The global financial crisis (GFC) occurred almost two decades ago, but for fund managers who ran money throughout this period, there are several pressing similarities between 2008 and today.

Back then, the best strategy for fixed income was to move into longer duration and higher quality assets, said Richard Woolnough, manager of the £1.3bn M&G Optimal Income fund. Although bond yields were much higher, investors were not getting sufficiently compensated for taking on credit risk.

History is now repeating itself with high rates, fears of an economic slowdown, not enough clarity on inflation and tight spreads. As a result, he has positioned his portfolio in the same way. “We are in a similar environment to the GFC,” the FE fundinfo Alpha Manager said.

“In 2007 and 2008 they had rates too high for too long to kill the property bubble; now rates are too high to kill the inflation bubble. It is all very similar,” he added.

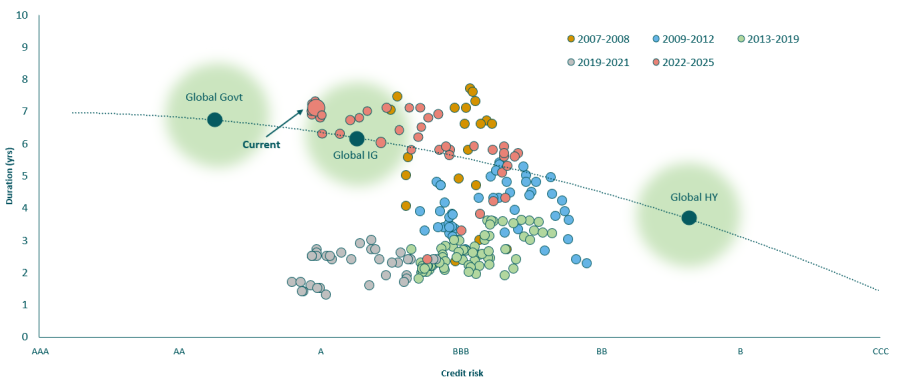

Positioning of fund since 2007

Source: M&G Investments

Below, Woolnough explains why he looks at credit and duration risk separately, and why bond markets are about avoiding losers not picking winners.

What is the Optimal Income fund’s investment process?

The fund is about finding value. We find that value by looking at duration risk (where interest rates and inflation are going to be) and by looking at credit risk (if we’re getting paid enough for lending to companies).

The biggest differentiator for us is that we split our duration view from our credit view. For example, at times we might have all our credit risk in euros and all our duration risk in dollars.

Why should investors own your fund?

Markets do get mispriced, they get to extremes, and they don’t focus on value. We see where markets become disjointed through fear and excessive borrowing, for example when telecom companies borrowed a lot of money in 2016, so their bonds became very cheap compared to their actual value.

The other thing is that when you commit money to something passive, you’ll buy anything under the assumption someone else has valued it correctly.

In the bond market, it’s all about avoiding the losers, whereas in the equity market it's about picking the winners. This means that in fixed income, actively managed funds have a better chance of competing with their passive counterparts.

You have more than 50% of the portfolio in government bonds. Why?

We think government bonds are trading cheaply compared to their value and that is partially because there is so much supply.

But it’s also worth noting that this allocation depends on the type of government bonds. Some of those bonds might be in riskier securities such as emerging markets, which are technically below investment grade. Other allocations include long-dated French government bonds, which are currently 5% of the portfolio and we think they are attractive versus German government bonds and corporate credit.

Government bonds are seen by the market as being risk-free, but they are not. They move relative to other risk-free rates and sometimes a government bond gets cheap versus that risk-free rate. That is when it looks great to buy.

Why do you believe interest rates have been too low for too long?

Normally, as the economy slows down, you’ve got two levers to pull – interest rates and government spending. Countries cannot rely on expanding their budget deficits to get the economy moving again, so interest rates must move much more to compensate.

The problem is that it takes about 18 months for interest rates to work. The economy we currently have is a consequence of the past year and a half of tight monetary policy. Similarly, regardless of what central banks do now, the economy will be facing a headwind for the next 18 months, meaning your risk/reward is now quite skewed.

Post Covid, interest rates were probably ‘lower for longer’ for too long. In the same way, in a few years’ time, we might look back on rates now and say ‘they were higher for longer for too long’.

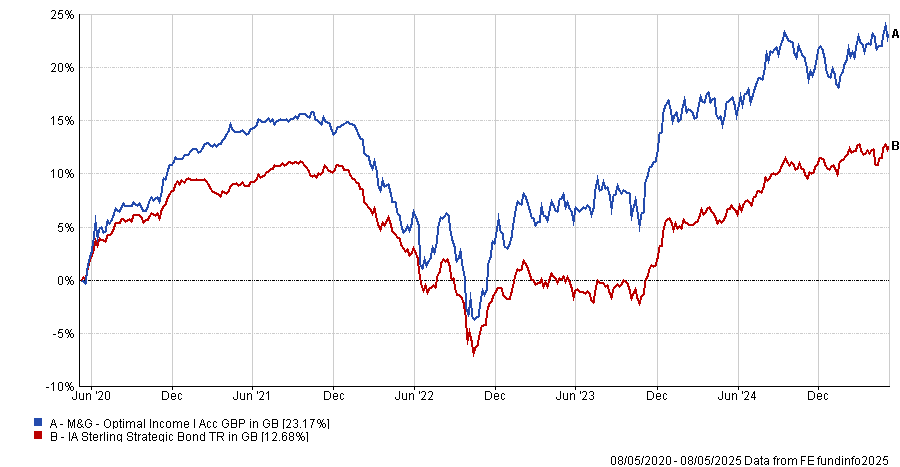

What were your best and worst calls over the past five years?

Our best was probably our duration in European and US government bonds. Over the past two or three years, there have been periods where Germany was a weak economy and the US was a strong economy and vice versa, meaning different bonds were appealing at different times.

The market tends to assume when one economy is plummeting the other is going through the roof. The ability to pivot has meaningfully contributed to recent performance and allowed us to find opportunities that other bond funds didn’t.

Our worst call was expecting a more fiscally reticent UK budget. We were of the view that the new Labour government would run a tight fiscal policy and blame the previous administration. They did half of that, but they also did quite a bit of fiscal loosening, which means they borrowed more, which hurt our allocation to UK gilts.

Performance of the fund vs the sector over 5yrs

Source: FE Analytics

What do you do outside of fund management?

I watch a lot of sport, particularly tennis.