After a long bull run, India’s valuations began cooling off in the fourth quarter of last year then spiralled downwards in the first quarter of 2025.

An unlikely hero subsequently emerged to propel the Indian stock market back into an upward trajectory: Donald Trump. By kyboshing global trade and taking a knife to both the dollar and international stock markets, he almost single-handedly drove investors back into the arms of Indian equities.

India’s premium valuations, which investors had been questioning as excessive, seem worth paying after all for a structural growth story somewhat insulated from the vagaries of global trade and US tariffs, said Ewan Thompson, who runs Liontrust Asset Management’s India and emerging markets funds.

The plot thickened at the start of this week when China and the US climbed down from their escalating tariff spat, a development that lessens India’s relative appeal as a domestically driven economy relatively insulated from trade wars.

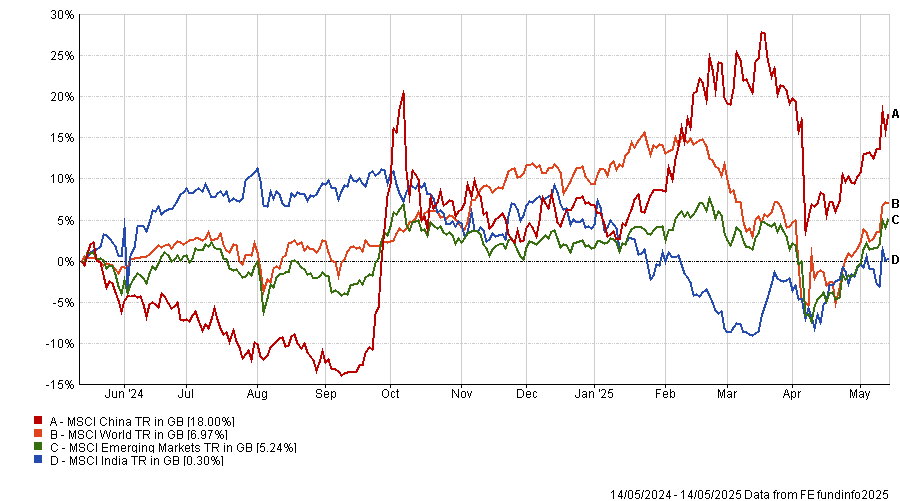

The MSCI India index is more or less flat over 12 months in sterling terms but that figure disguises a lot of volatility. For example, this year “India basically had a terrible two months and a really great two months and that washes out somewhere in the middle”, Thompson observed.

India vs China, emerging markets and global equities over 1yr

Source: FE Analytics

“What’s changed between those two periods has been the global perception of what tariffs are going to mean. India’s behaved in a counter-cyclical way so it was doing badly when everything else was okay and then it did extremely well when everything took a hit. That probably shows you the degree to which India is being perceived in the market as a more defensive place to be.”

What drove India’s sell-off?

In late 2024 and early 2025, India was hit by three things: a spike in food inflation; a budget in which the government curtailed its capital expenditure to single digits; and high valuations. India was on a 90% premium relative to the rest of Asia, said Kunal Desai, portfolio manager at GIB Asset Management.

“These three elements came together and created a 25-30% fall, particularly in the Indian mid-cap space, which had been the winner over the past two to three years, but that was really a healthy correction.”

In India, people spend a large amount of their disposable income on food and groceries so food inflation has been a significant issue, added Chetan Sehgal, manager of the Templeton Emerging Markets Investment Trust (TEMIT).

Investors are also concerned about whether artificial intelligence will erode demand for India’s IT services sector.

Waning enthusiasm for India coincided with China’s resurgence which attracted some capital flows, he added.

Mike Sell, head of global emerging market equities at Alquity, said “India is all about growth” and it just had a “growth scare”.

India’s weak quarterly GDP growth of 5.6% for the three months between July and September 2024 “scared people” because it was much lower than the growth rate of 6-7% or higher that investors had become used to seeing from India. However, he said the disappointing quarter was a “blip” and expects India’s economy to strengthen.

Buying the dip

GIB Asset Management increased the India exposure within its GIB AM Emerging Markets Active Engagement fund during late April and early May – buying the dip – and Desai plans to continue adding to India over the next six months.

“India is a market which moves from irrational exuberance towards excessive pessimism. It always has. And taking advantage of those periods of excessive pessimism, for us, makes perfect sense,” he explained.

TEMIT also took advantage of the recent sell-off, having previously been underweight India, according to Sehgal.

“With the correction of the Indian equity market, we have been able to seize opportunities both ways. While we have trimmed our positions in companies that have exhibited strong share price performance, for instance in Indian banks, we have also been able to relook at some companies,” he said.

“The valuation gap has narrowed and now we can get reasonable quality Indian companies at a reasonable price.”

What do fund managers expect going forward?

Despite a rocky few months, fund managers remain confident in India’s long-term prospects.

Gabriel Sacks, manager of abrdn Asia Focus, said: “As one of the largest and fastest-growing economies globally we think India remains one of the most attractive places to invest taking a long-term view and tariffs should help direct incremental investment to India at the expense of many of its peers in the region.

“The country is still well-placed geopolitically in a post ‘Liberation Day’ world and falling oil prices will help supress any pressure on the current account deficit and inflation expectations.”

India is Alquity’s largest active overweight within its Asia fund because it provides a much higher return on equity than other markets. India’s young, growing population is a long-term tailwind and Sell expects tax cuts this year to boost consumer spending. He has been gaining exposure to the Indian consumer by investing in retail, property, travel and leisure, for instance through a hotel chain.

Meanwhile, Desai believes India appeals for two main, interrelated reasons – strong domestic growth and insulation from trade wars.

India has the strongest GDP growth rate across the major emerging economies and benefits from a deep, integrated domestic market. And it is not dependent on exports; in fact, India’s exports to the US represent 2.3% of GDP – compared to 28% for Mexico and 15% for Taiwan, he said.

Additionally, people in India are moving their savings away from physical goods and into financial assets, tilting towards domestic equities. As a result, India’s stock market is “very dependent on domestic savings, which are far more structural and consistent, rather than foreign equity ownership, which pivots depending on the market news flow”, Desai said.

“Even though India traditionally has been seen as a risk-on, risk-off market, its stability is significantly higher because it is the domestic equity investor who’s really protecting the market from various gyrations that you see globally.”

Corporate fundamentals are also improving and companies are showing a higher degree of balance sheet restraint. Operating leverage should come through as a result, creating an attractive free cashflow profile going forward, he said.