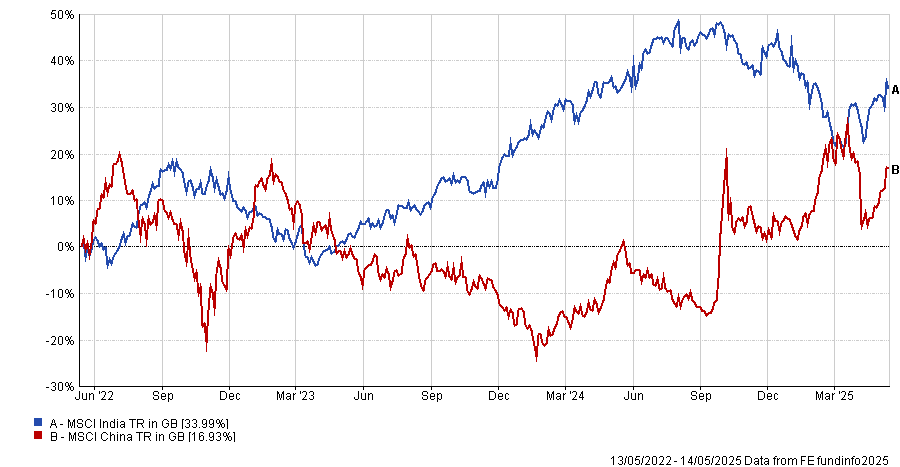

China and India have been mirror images of each other for the past three years, with a correlation of -0.15%, yet several emerging market managers believe that trend is unlikely to continue as the two markets have very different tailwinds that could propel them both upwards at the same time.

If they are right, this could be a golden era for emerging market equities, given that India and China together constitute half of the MSCI Emerging Markets Index (China had a 29.6% weight and India was 19.2% as of 30 April 2025).

India vs China over 3yrs

Source: FE Analytics

Gabriel Sacks, manager of abrdn Asia Focus, said: “Should we see a more structural shift in capital flows out of the US and a weakening US dollar, then it may well be the case that both markets rise simultaneously.

“The domestic investor also has an important role to play here, with investors in India optimistic about the future and helping to prop up the market, while consumer confidence in China has been extremely weak. If policymakers are able to revive ‘animal spirits’ in China – a real possibility in the coming 12-18 months – then this will be good for Chinese equities and should have no impact on the optimism felt by locals on the ground in India.”

Liontrust portfolio manager Ewan Thompson also believes India and China have potential and is overweight both countries in his emerging markets fund. Because these markets have such different drivers, they complement each other well and provide diversification, he said. India is a structural growth story whereas China is recovering from low valuations.

A key attraction of India is that its stock market and corporate earnings are highly correlated to domestic GDP growth – which is relatively unusual for emerging markets, he added.

Kunal Desai, portfolio manager at GIB Asset Management, also believes India and China could prosper in tandem for different reasons. “India is probably one of the most powerful secular and scalable investment opportunities globally but China is one of the investment opportunities that has the highest degree of self-help levers at play,” he said.

China’s key problem is a deflationary cycle which has led to risk aversion. People don’t spend because they expect prices to be cheaper tomorrow. About 50% of consumer balance sheets are tied up in the property market, which continues to fall.

But there is light at the end of the tunnel. China’s high savings rate, amounting to 45% of its GDP, is the dry powder that could spark a stock market revival. “Once the Chinese consumer has an appetite to deploy their savings, this could be one of the greatest consumption stories the world has ever seen,” Desai said.

People will start to spend more if inflation makes a comeback, the property market stabilises and people’s investments make a positive return, he said.

However there are dissenting voices. Mike Sell, Alquity’s head of global emerging market equities, said China and India are “polar opposites”.

“One is a very free market, democratic, with a rapidly growing economy, which is India. China has had increasing political interference in the economy, has a horribly ageing population and doesn’t have the same sources of growth.

“Now that doesn’t mean there’s nothing to invest in, in China, over the medium term. It just means it’s different.”

China has the firepower to stimulate its economy which could provide a short-term boost to share prices, he said, but on a five to 10-year view he has a clear preference for India.

Other macro factors are supportive of emerging markets as a whole, Thompson said. Emerging markets usually perform well when the dollar weakens – which he expects to happen – and when bond yields are falling.

Looking further ahead, emerging market equities also perform well when the US is recovering from a recession, so as and when the US economy emerges from a tariff-related slowdown, emerging market equities should do well on the other side.

There are ample opportunities beyond China and India, Thompson continued. Eastern Europe should benefit from Germany’s increased spending commitments and a potential end to the war in Ukraine. “Latin America is flying this year,” he added, with Brazil and Mexico performing especially well. “Flowers are blossoming across the board,” he concluded.