Value investing is a tried and tested investment strategy that has about one hundred years of history. At its core, it is a search for value: finding securities that are trading at a substantial discount to the intrinsic value of the underlying business.

Despite its long history, the effectiveness of value investing is influenced by a much more recent invention – passive investment products, such as exchange-traded funds (ETFs), which typically allocate money to indices according to the weight of their components.

Passive investing has grown very significantly over the past 20 years and now accounts for more than 50% of total equity investing in mutual funds and ETFs globally today.

Some of the largest index-tracking ETFs are now very big indeed. For instance, the SPDR S&P 500 ETF Trust has assets of $561.7bn, the iShares Core S&P 500 ETF has assets of $548.6bn and the Vanguard 500 Index Fund (VOO) has assets of $622.1bn.

There are a wide range of possible explanations for the popularity of passive investing. Low fees and diversified exposure are commonly cited. The long-term performance of major US indices is another attraction. But one thing that passive investors typically ignore is the valuations of the underlying assets.

We can say that passive investors are largely ‘value agnostic’. The sheer scale of the passive strategies means that value investors occupy a much smaller section of the market than they did in the past.

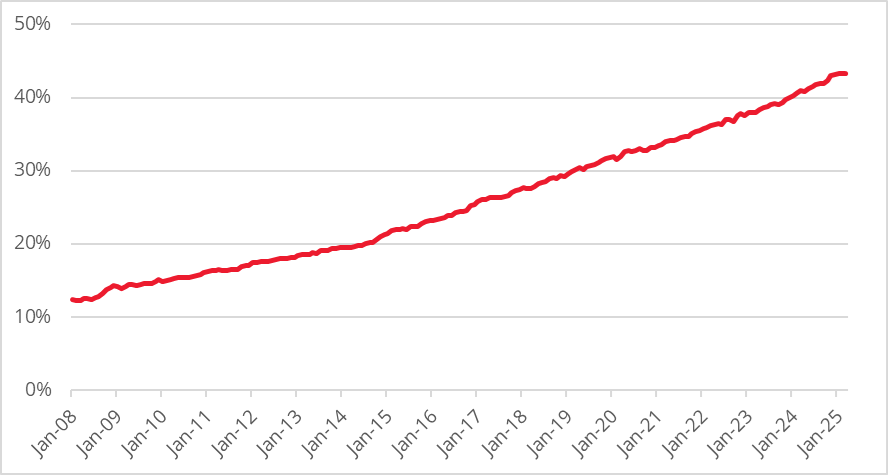

Passive investing makes up 43% of global equity mutual funds and ETFs

Source: Redwheel, April 2025. US dollars. Calculated using monthly total net assets of passive funds as a percentage of the Morningstar Global universe of mutual funds and ETFs, excluding money market funds and fund of funds.

Why do passive strategies increase market distortions? Put very simply: as the market share of participants who care about fundamentals and valuations shrinks and is replaced by investors who are indifferent to valuation, mispricing becomes a more common characteristic of the market.

Here is a more detailed explanation. Active managers, particularly those who employ a value-driven approach, are typically underweight the more expensive mega-cap stocks and overweight smaller but cheaper stocks. As they receive redemptions, these stocks are sold, and the passive managers allocate a greater proportion of the money they receive to larger, more expensive stocks.

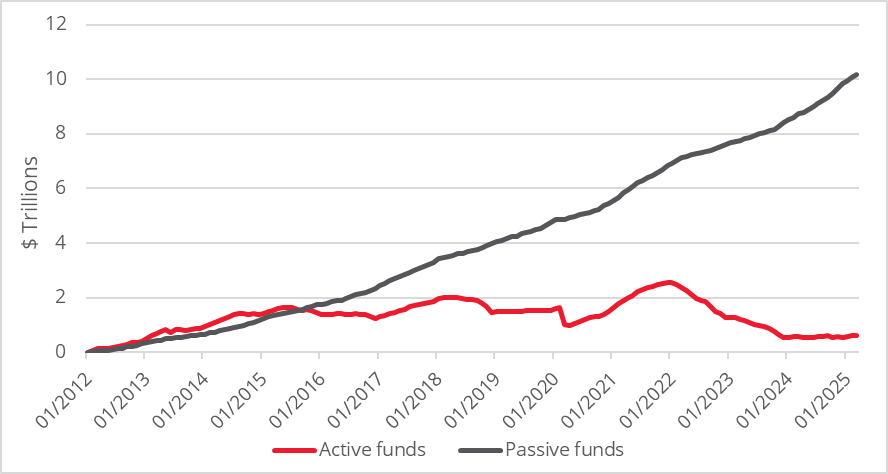

The chart below highlights the huge disparity in funds flowing into passive strategies compared to active strategies. While new money, such as pension contributions, can account for some of this, the magnitude of the disparity suggests that considerable sums are shifting from active to passive funds.

Passive flows are increasing while active flows are stagnating

Source: Redwheel, April 2025. Cumulative fund flows in US dollars from January 2012. Morningstar Global universe of mutual funds and ETFs, excluding money market funds and fund of funds.

This impact is exacerbated by the fact that liquidity does not scale in a linear fashion with market capitalisation. For example, Apple’s market cap is 187 times larger than Clorox but the difference in average daily traded volumes is only 35 times.

This means that as money flows into passive funds not only is more money being allocated to Apple than Clorox but each dollar will have a price impact that is greater than the differential in market cap.

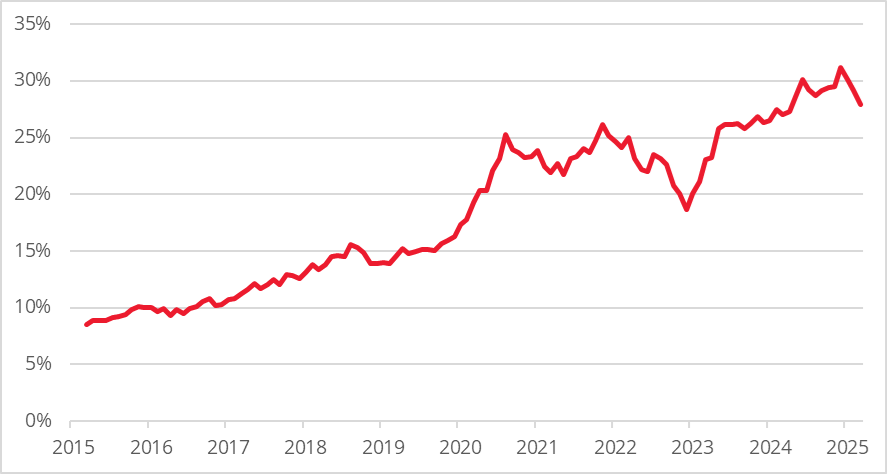

Passive has, in essence, become a giant momentum strategy. This undoubtedly has contributed to the highly distorted nature of the US stock market, whereby seven very large companies have just got bigger and bigger until they eventually make up almost a third of the index.

The fact that most passive funds buy more larger companies creates a reinforcing positive feedback loop: as companies get more expensive – and thus larger – the passive index buys more of them with each incremental dollar invested, further driving up the price, the company size, and the weight in the index, in a huge loop that rewards size and overvaluation.

The Magnificent Seven as percentage of S&P 500 index

Source: Bloomberg, Redwheel, 31 March 2025.

Much of the growth in passive investing has been driven by consistent inflows from working-age savers, primarily through pension contributions. As populations in developed markets age, the number of retirees drawing down from their investments could soon outweigh those making regular contributions.

That would reverse the net flows into passive funds and prompt a very different market reaction. If this occurs, who will step in to buy? With the active management industry shrinking and fewer investors willing to pick up bargains, markets could gap down with no natural buyers to provide support. This represents a dramatic shift from the 'passive era' where rising tides lifted all boats.

By contrast, active managers –particularly value-oriented ones – are well-positioned to allocate capital where the market is underpricing risk or overlooking opportunities. They can exploit valuation anomalies created by price-insensitive investors.

This isn’t a call to abandon passive investing, but a reminder that ignoring valuation carries risks. As we enter a new market cycle potentially influenced by inflation, higher interest rates and slower economic growth, the easy wins of the past decade may not repeat.

In this environment, valuation matters again. Retail investors and their advisers can reduce downside risk and capture long-term opportunities by focusing on fundamentals and adopting a more selective approach. While valuation may no longer matter to everyone, it should still matter to you.

Ian Lance is a partner and fund manager in the Redwheel Value & Income team. The views expressed above should not be taken as investment advice.