China is no longer the problem it was, Korea is beginning to benefit from meaningful structural reforms (and could be the new Japan), and Vietnam’s high-growth narrative is starting to show signs of strain. This is the view of Pauline Ng, co-manager of the JPMorgan Asia Growth & Income trust.

In uncertain markets where investor sentiment can shift as quickly as returns, staying informed is essential to seizing opportunities rather than missing them.

This is particularly true in regions where the noise is at its loudest, such as China.

China has entered a new phase

Long viewed with scepticism due to its policies, unpredictability and the lingering drag from a troubled property market, China “has now entered a new phase”.

While geopolitical concerns are valid, “the macro risk in China is a bit of a muddle through,” Ng said, and dismissing the entire region because of it could mean leaving returns on the table.

“Internally, we do not expect any huge bazooka-like stimulus, but we’re not expecting a massive collapse anymore. More importantly, a lot of valuations have also reset to a more palatable level. Before this whole reset, it was really hard to find opportunities,” she said.

What’s changing isn’t just sentiment, but corporate behaviour. “Some of the bigger companies have been engaging a lot more on committing to a dividend policy, committing to share buybacks.”

Even in the battered property sector, which has weighed heavily on the market, Ng sees evidence of a floor.

“In tier-three and four properties, there’s still a lot of oversupply. However, tier-one property prices have already stabilised and that roughly makes up about 70% of the total market in China. We do not expect a systemic risk anymore, which is very important.”

The shift also extends to the political climate for China’s large private-sector firms. “A couple of years ago, the government was very strongly against the large private sector in China,” she says. “But in more recent months, we have seen that shift. Alibaba and Tencent have announced bigger capex plans to make sure that China continues to invest on artificial intelligence and not be left behind.”

Vietnam has no room to grow

In contrast, Vietnam – once a regional darling due to its central role in the ‘China plus one’ strategy, whereby companies diversify supply chains in emerging markets beyond China – is now being approached more cautiously by the trust.

“Vietnam is a country which, in terms of the impact of US tariffs, has less room to negotiate,” says Ng. “It will not be able to import enough US aircrafts, fighter jets or liquid gas to reduce the trade deficit with the US dramatically.”

That alone creates risk, especially in a more protectionist global environment, which will also affect Vietnam’s labour growth, wage growth and domestic consumption.

Korea financials erode value, but there is upside

Korea, by contrast, is where the trust has taken its most constructive stance, despite ongoing financial underperformance and widespread scepticism about the government-led ‘Corporate Value-Up’ programme, aimed at boosting shareholder returns and corporate governance.

Investors, Ng believes, are ignoring what could be a meaningful re-rating story.

“The market is not factoring in any corporate value improvement from Korea,” she said. “But we have to acknowledge that this is something that will play out over time. If you look at the experience of Japan, it didn’t happen in one year. It took many years.”

Korean financials in particular illustrate the upside.

“Today, the return on equity (ROE) of Korean financials is below the cost of capital,” Ng noted. “This tells you that every dollar actually destroys value. Now imagine if they are able to improve the capital return, which then directly improves the ROE – they would go from very challenged to perhaps more standard financial companies. In that process, the re-rating will be the upside that we believe in.”

Indonesian banks continue to increase market penetration

JPMorgan Asia Growth & Income is also overweight Indonesia and financials in particular – an industry with two key advantages. Firstly, there is “a lot of room for banks to increase their credit penetration”. Secondly, the top three or four banks continue to win market share from the rest of the banking sector.

“So you have this very unique situation whereby the addressable markets have a lot of room to grow and these players have also corrected a lot in the past six months,” Ng said.

India is worth looking at despite high valuations

Ng runs a small overweight in India, which remains an expensive market despite the recent de-rating.

“India remains a very attractive market when you think about the long-term ability for growth compounding. So we are not going to say that, because India is very expensive, people shouldn't go there,” she said.

“With India, this just doesn't make sense, because it's still one of the better growing markets within Asia. It has fantastic demographics and many companies that are very well run.”

Particularly in India (but also in China), the market is very deep and offers opportunities to stockpickers, the manager said.

“Our fund is not about being maximum bullish India, maximum underweight China or vice versa”. The trust also doesn’t take style bets on growth or value, which in Asia are particularly counterproductive, as she recently told Trustnet.

“Instead, we are bottom-up stockpickers who follow a balanced approach by looking for companies that they believe will outgrow the industry.”

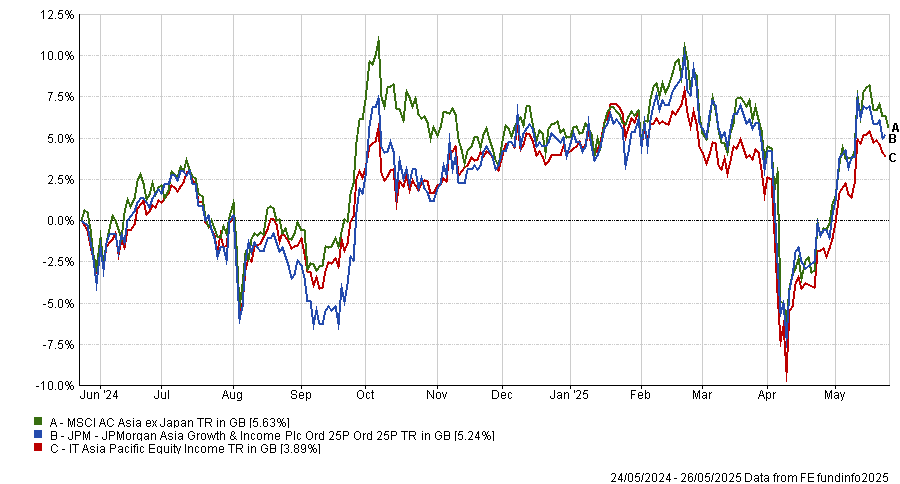

The JPMorgan Asia Growth & Income has beaten its benchmark, the MSCI AC Asia ex Japan index, over the past 10 and three years, falling slightly behind over five and one, as the chart below shows.

Performance of fund against index and sector over 1yr

Source: FE Analytics