Investors across both the retail and institutional space are increasingly looking to private markets for investment opportunities, with private-equity assets under management projected to reach £7.4trn globally by 2029.

The trend is potentially beneficial to portfolios, according to Rob Morgan, chief investment analyst at Charles Stanley, who said that the world of private investments can be “a source of diversification and decent returns for investors”.

The £41bn 3i Group is the “behemoth” of the private-equity investment-trust world, noted Morgan, pointing to its strong growth record and FTSE 100 status.

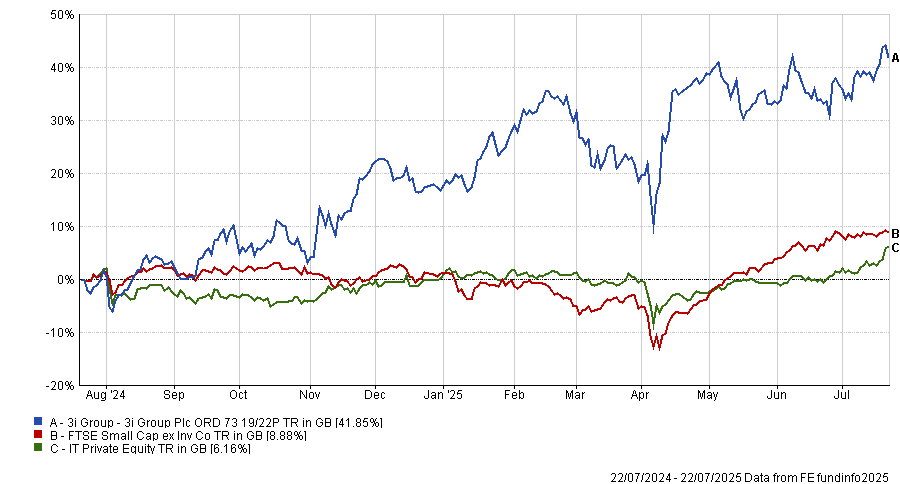

Performance of 3i Group against the benchmark and sector over 1yr

Source: Fe Analytics

However, it isn’t your typical private equity trust, with the vast majority (around 60%) of its entire asset base tied up in European supermarket retailer Action, which has driven a large part of 3i’s strong returns, especially in the past five years.

The large exposure to one company does bring about significant specific company risk versus a typical investment trust or fund, Morgan warned.

“In some ways, this is a shame as other elements of the portfolio are somewhat crowded out,” he said.

Fortunately, the growth story of Action and its impact on 3i performance thus far holds “considerable appeal”, with the fund boasting an almost 68% premium to net asset value (NAV) – paired with a 1.3% ongoing charges figure (OCF).

Trustnet asked three experts which funds they would hold alongside 3i Group to ensure investors interested in private markets can gain a more diverse exposure to private equity.

Alliance Witan

For James Carthew, head of investment companies at QuotedData, the priority is to ensure there is maximum diversity to complement 3i’s more targeted approach.

He suggested the Alliance Witan investment trust, noting that it offers exposure to the “best ideas of some of the world’s best fund managers”, with around 20 stocks per manager, or just over 200 holdings in total.

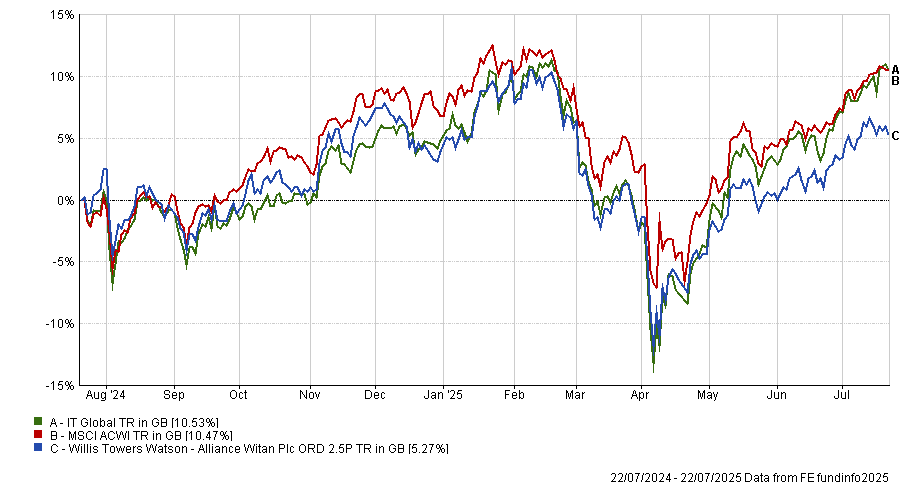

Performance of the trust against the benchmark and sector over 1yr

Source: FE Analytics

“It comes with a more attractive dividend yield than 3i (2.2% versus 1.7%) and is also a large, liquid FTSE 100 constituent with a market cap of £4.9bn,” he said.

It’s also cheaper, trading at a 5.27% discount to NAV with a 0.56% OCF.

Top holdings are dominated by US tech, including Microsoft, Amazon and Alphabet, alongside healthcare stocks such as Novo Nordisk.

NB Private Equity Partners

But there is also the option to double down on private equity.

Ben Yearsley, investment consultant at Fairview Investing, has been a “fan of private equity for many years”, and it forms a big part of his investment portfolios.

“Over the long term, the returns are excellent from private equity, and the beauty of it is companies are unique – you don’t find them in any index; therefore, they add genuine diversification to portfolios.”

He pointed to NB Private Equity Partners as a potential option to sit alongside 3i, noting it is well-diversified and has been investing progressively more into direct companies and away from private equity funds – “closer to the action and lower fees”.

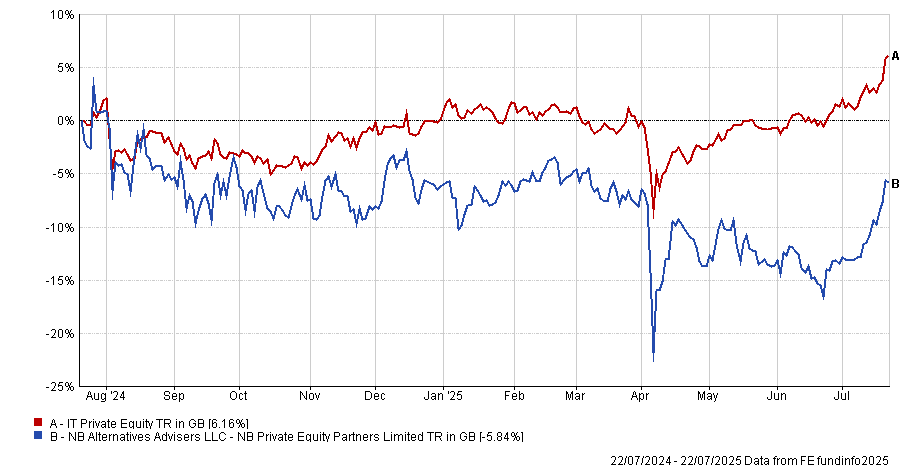

Performance of the trust against the sector over 1yr

Source: FE Analytics

NB Private Equity Partners is currently trading at a 28.8% discount to NAV. It is mostly investing in telecom, media and technology (44%), alongside industrials and financial services, at 17% and 14% respectively.

Given private markets carry a higher risk, Yearsley said he would look at an absolute maximum 10% stake in private equity overall, split between 3i Group and NB Private Equity Partners.

Pantheon International

Morgan from Charles Stanley suggested that broader private equity trusts, such as the £1.5bn Pantheon International, will provide a “varied approach to the asset class”.

The strategy combines stakes in leading third-party funds with co-investments in single assets, which Morgan said makes it an appealing “one-stop shop” for investors wanting diversified private equity exposure.

“There’s also a strong leaning towards cash-generative mature buyout and growth-capital investments rather than early-stage venture capital, so Pantheon is likely to be a less volatile option than those based towards the latter,” Morgan said.

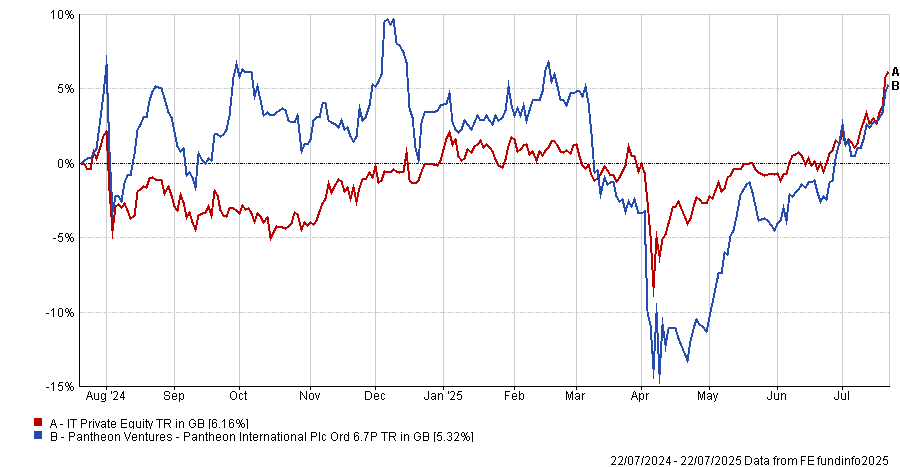

Performance of the trust against the sector over 1yr

Source: FE Analytics

Pantheon International shares presently trade at a 34.2% discount to NAV. “That’s significantly narrower than a year ago, thanks to some concerted efforts by the board to reduce it through share buybacks,” said Morgan.

He suggested that an 80/20 split in favour of Pantheon would be appropriate to have a more diverse core holding in the asset class, alongside a “punchier satellite position that is oriented towards a single business”.