Having at least $2,000 in an emergency fund drastically increases a person’s financial wellbeing, according to Paulo Costa, senior behavioural economist at Vanguard.

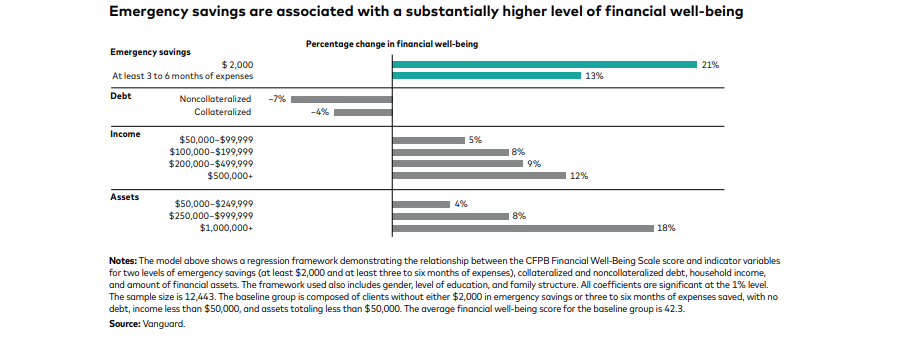

The firm’s study of US investors found that this “magic number” sat in cash was responsible for a 21% increase in people’s wellbeing, regardless of their income or overall wealth.

It is the biggest single factor that improves people’s mood around their finances, more so than the difference between having $1m in assets and not.

Such a large amount of money is likely to be tied in retirement accounts or investments for the long term, or even held in property, meaning it does little to alleviate short-term stress, although of course it is helpful.

“So we joke: ‘When is $2,000 worth more than $1m? When it comes to financial wellbeing’,” he said. “What that is doing is putting a buffer between you and whatever may come your way.”

It has real-world implications too. For example, Vanguard clients without emergency savings spend 7.3 hours per week thinking about (and dealing) with their finances, the report found, compared with 3.7 hours for clients with at least $2,000 in emergency savings.

Additionally, investors without emergency savings are three times more likely to report an increase in stress than in the previous year.

The Vanguard senior behavioural economist said the ‘magic number’ was more important than keeping three to six months' expenditure in an emergency fund – a common rule of thumb given by UK financial advisers, who recommend people aim to accumulate this larger figure in cash as quickly as they can.

However, this only increases financial wellbeing by 13% and could even be a mistake, said Costa. While he advocates for $2,000 to be held in cash, any savings above this should be invested.

“We would prefer to keep that money invested instead of just sitting in cash, because it is useful in case you lose a job or there is some income reduction, both of which are less likely to happen than those emergencies that pop up at any time.”

So, his advice was to “leave that money invested at an appropriate asset allocation for you.”

Savers should also not panic about getting this much-higher sum together in one go and should build up this pot “alongside other goals”, such as saving for a house deposit or new car.

“Three to six months' expenditure takes a long time to build. We want to make sure the advice is achievable. Save as much as you reasonably can. Do your best. Each person has a different journey when it comes to their finances,” he said.

The third factor that improves wellbeing is reducing debt, particularly non-collateralised debt such as credit cards and payday loans. However, this had a more muted response from those surveyed, improving wellbeing by around 7%.

While this study was based on US investors, he said the same would apply for those in the UK as well.

“The best behaviours when it comes to finances are pretty similar across financial wellness. Have a budget, pay down high-interest debt and prepare for the unexpected,” said Costa.

He coupled this latest research with a report from 2023, in which Vanguard found people who tend to be accumulators – those under 50 – are more likely to be financially stressed and this stress is highly correlated with their level of income.

Retirees have grown their wealth and therefore tend to have fewer concerns about their finances, while younger investors are more stressed as they have less money, he noted.

Despite more than half of respondents admitting to feeling financially stressed, few seek to alleviate this by seeking financial advice – something Costa said advisers can use to their advantage.

Vanguard believes there are four sources of value that financial advisers provide. The first is portfolio management and the second is financial planning. These are the work of financial advisers, but there are two side benefits that they do not promote enough.

One is that they give their clients back time, as they no longer have to run their own portfolios or spend hours future-proofing their finances.

The second is to relieve stress.

“The emotional side in particular is severely undervalued because people do not realise advisers can help deliver significant emotional balance,” he said. “I think this is an opportunity for financial advisers to be able to connect with clients.

“As a financial industry, we should not only focus on what we are doing – the portfolio management and financial planning – but also how we are doing it and what the benefits are to people. Reducing financial stress is one of them and something people should be talking more about.”