Fund pickers are divided on whether Artemis UK Select or Fidelity Special Situations – two popular UK equity funds – is the best choice for investors' exposure.

The FTSE All Share is rallying this year as investors have pivoted away from the US following concerns over unclear trade policy and a weaker dollar. This has led to a rise in investor interest in other areas, particularly the resurgent UK market.

Two funds thriving during this rally have been the £4.9bn Artemis UK Select fund and the £3.8bn Fidelity Special Situations fund, which have the fourth and eighth best total returns in the IA UK All Companies sector year to date (YTD).

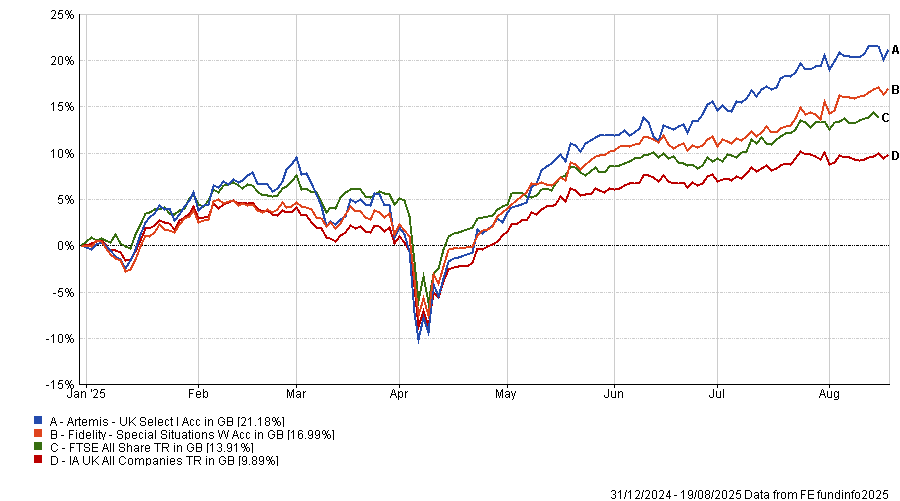

Performance of funds vs sector and benchmark YTD

Source: FE Analytics.

Both are led by experienced FE fundinfo Alpha Managers (Alex Wright for Fidelity, Ed Legget for Artemis) and have strong long-term track records, making it challenging for investors to identify a clear winner.

The case for Fidelity Special Situations

For Joseph Hill, senior investment analyst at Hargreaves Lansdown, although both are “shining examples” of UK investors' skill, Fidelity Special Situations had the edge.

He attributed this to Wright’s willingness to stick to his “naturally contrarian value investment style through thick and thin”. While he conceded that being a successful contrarian investor can be challenging, with the support of Fidelity’s analysis team and experience of working under retired star manager Anthony Bolton, “Wright is set up for future success”.

With a diversified stock portfolio of around 100 stocks, the Fidelity Special Situations fund “plugs investors into different drivers of growth and sectors”, reducing the risk of a single position causing large slides in performance.

This is part of the reason the fund has been able to beat the index over the very long-term, he continued.

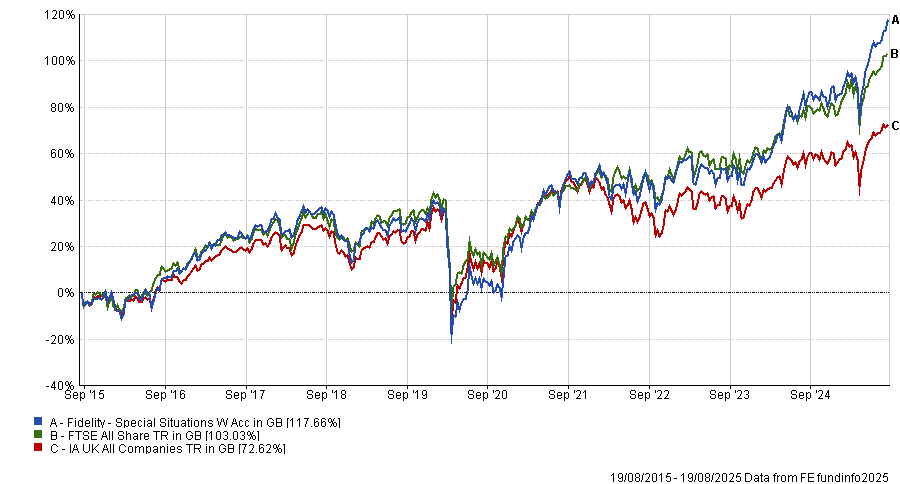

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics.

Additionally, 60% of the portfolio is currently invested outside the FTSE 100, which will benefit more from any further interest rate cuts, Hill continued.

John Monaghan, research director at Square Mile, said he thought Wright’s fund is particularly suited for first-time investors.

Despite underperforming Artemis on a five-year view, it has still “comfortably” outperformed the index and peers with a “far lower level of risk, as measured by standard deviation”, which can be appealing to novice investors.

However, he said investors must still be prepared for the fund to occasionally underperform. For example, it only delivered a 6.3% return in 2023, while the FTSE All Share was up 7.9%.

“Nevertheless, there is a lot to like here, especially the fact that the manager has remained consistently true to his investment style,” he concluded.

The case for Artemis UK Select

However, experts from Chelsea Financial Services and FE Fundinfo favoured Artemis UK Select instead.

Darius McDermott, managing director at Chelsea Financial Services, described Artemis UK Select as one of the “premier UK equity funds”, particularly for investors with a higher risk tolerance.

Firstly, he pointed to its style-neutral approach, which gives it flexibility in terms of stock selection, although he conceded it tends to favour value due to the composition of this index.

One of the fund's key differentiators is the ability to short up to 10% of the portfolio, which serves as an “extra lever to generate” returns. He explained that Legget and his co-manager, Ambrose Faulks, have used this very effectively to help drive performance over the long term.

However, McDermott acknowledged that shorting makes it one of the riskier options in the sector. Indeed, the fund is in the bottom quartile for volatility in the IA UK All Companies sector.

Jack Driscoll, fund analyst at FE Fundinfo, also narrowly favoured Artemis UK Select. He explained this is due to familiarity with the management team and process. “I’m just very impressed with Ed Legget’s decisions, track record and how it’s all worked out.”

Over the past 10 years, since Faulks joined the team, the fund has delivered the second-best total return in the peer group.

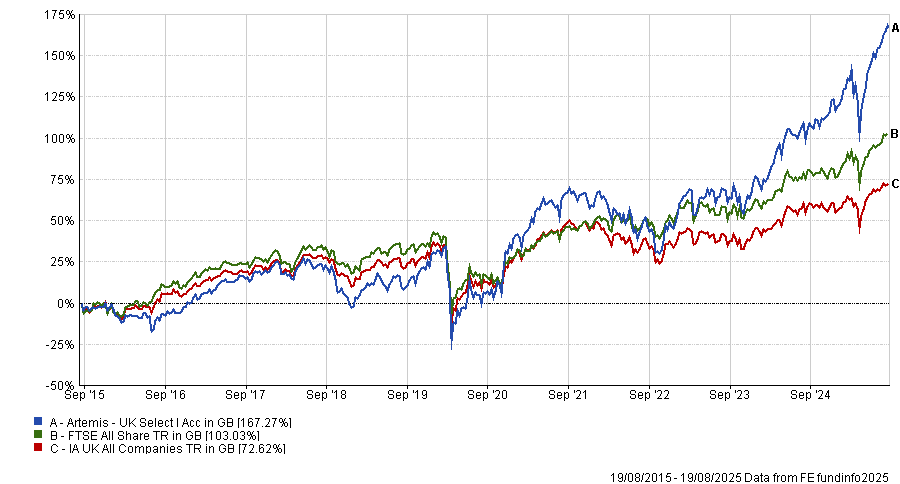

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics.

While Fidelity also has a strong management team, Artemis UK Select’s is “a better representation of the UK market as a whole”. This is because its 79% exposure to the FTSE 100 is a more accurate reflection of the dominant role of UK large-caps, Driscoll explained.

“It’s still underweighted the market by comparison, because the 10 largest positions in the FTSE All Share represent nearly 50% of the market cap. But for a first-time investor, I think they’d be better served by Artemis's higher exposure to large-caps,” he continued.

Indeed, this would have paid off for investors this year as the FTSE 100 passed an all-time high and is currently outperforming the FTSE 250 and Deutsche Numis Smaller Companies indices.

Driscoll concluded that while Artemis' ability to short stocks “can be a challenge for first-time investors”, he ultimately preferred it as a source of UK equity exposure.