Despite US president Donald Trump retreating from a more extreme position on tariffs, investors became more selective with their capital in May, according to recent data from Calastone.

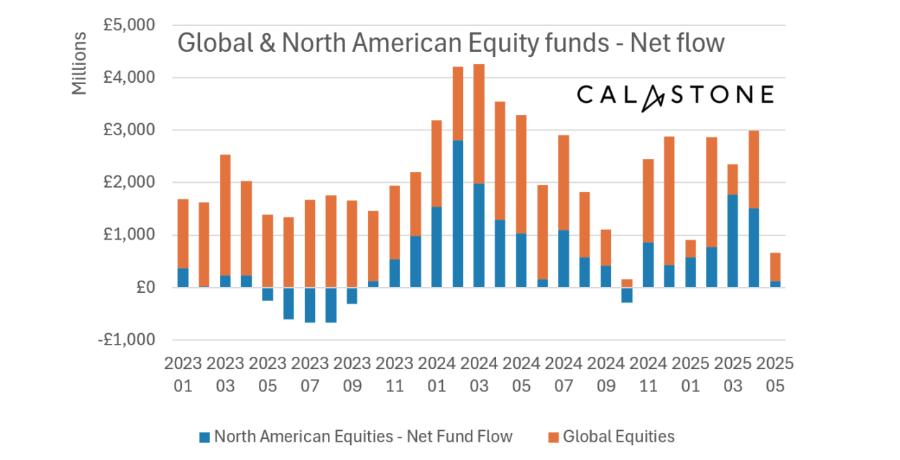

Investors added a net £525m to equity funds last month down from £1.5bn of inflows in April. Some £546m was added to global funds, a third of their monthly average, while US equities experienced their worst month of inflows since September 2023, with just £115m added.

European equities were the big winners as investors poured £369m into the market, the best monthly performance since June 2024.

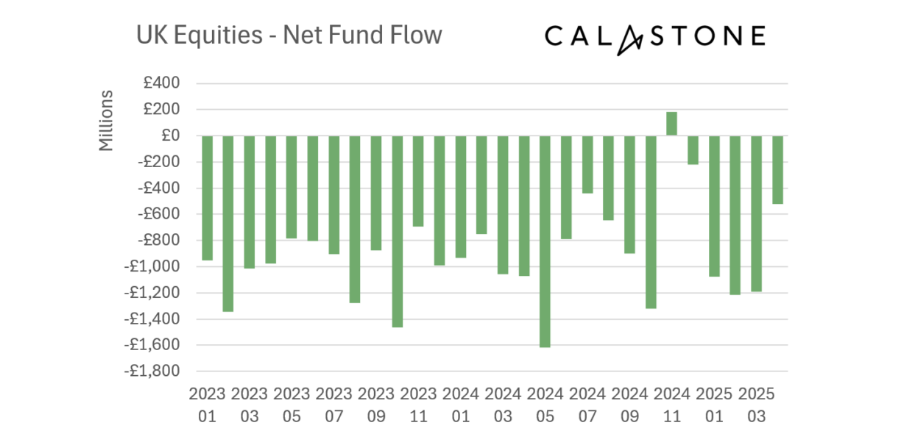

But these were offset by the UK, where investors withdrew another £449m in May from domestic funds. The positive news here is that this figure was half the monthly average for the past three years and marked the second month of declining outflows from UK equity funds, while the amount of buying orders has remained the same, indicating a reduction in selling activity.

While it is too early to call an end to the trend of UK equity outflows, Edward Glyn, head of global markets at Calastone, said “less negative narrative is a necessary first step” to getting investors back to the domestic market.

Although the stock market is “flirting with the all-time high it reached in February” this has not yet been enough to encourage net inflows, however.

Source: Calastone Fund Flow Index – May 2025

Overall Glyn said investors remained cautious last month as they “bought into the rally but not with any great confidence”.

“With so much uncertainty over inflation, interest rates, geopolitics and trade wars, it seems rational for investors to be cautious. Certainly, investors are being selective with where they put their capital,” he said.

Source: Calastone Fund Flow Index – May 2025

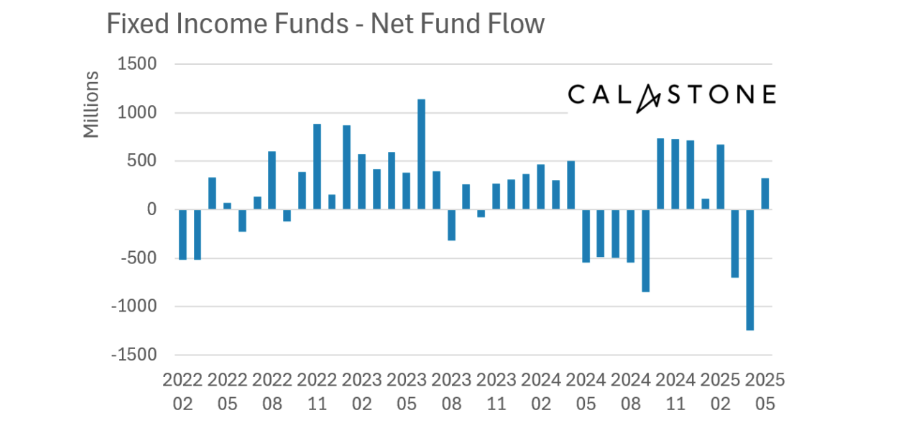

In the fixed-income market, investors added £328m to funds, a reverse of trends in April and March when £1.94bn was pulled from funds investing in the asset class.

“Bond yields climbed strongly during May, suppressing bond prices, as concerns over government solvency and inflation took their toll, but they clearly reached levels tempting enough to spur investors to lock new capital into high yields,” said Glyn.

Source: Calastone Fund Flow Index – May 2025

Elsewhere, the Investment Association (IA) released its official fund flows for April. Despite high geopolitical uncertainty, retail investors placed £1.1bn into funds, the strongest inflows of the year.

This was attributed partially to the new tax year, as investors tried to make the most of the £20,000 ISA allowance.

Equity funds were the big winners in April, with investors pouring £948m into North American Equities and £872m in global equities. Miranda Seath, director of market insights and fund sectors at the IA said some investors opted to “buy the dip”, but noted that others were more cautious and favoured “diversification away from US stocks”.

European equities enjoyed their second month of inflows in April, while investors poured £728m into multi-asset funds, the best performance for these portfolios since August 2021.

Investors were also moving money into “lower risk vehicles” with money market funds experiencing another month of strong inflows, with investors putting £2.4bn into the asset class across April and March.

Bond funds were by far the biggest losers, with investors pulling a net £1.8bn out in April. This reflects tariff concerns, which could reduce the scope for future interest rate cuts by central banks.

Seath said: “Looking ahead, the outlook for global markets will remain unclear as long as uncertainty hangs over the economy and tariff policy remains changeable. If tariff threats do push up prices, central banks may delay cutting interest rates. That kind of scenario could mean that market turbulence persists.”