Growth investing has been the dominant market force in the recent past, with value funds rarely able to keep pace. But the next five to 10 years are going to be very different and more evenly balanced between the two investment styles, according to Pictet Asset Management chief strategist Luca Paolini and senior multi asset strategist Arun Sai.

“Growth’s starting point is very challenged in terms of valuation and tailwinds such as digitalisation and AI [artificial intelligence] are largely priced in,” Sai said. “Now, however, structural policies such as reindustrialisation, as well as more spending on infrastructure and defence are supporting value as well. Purely from a policy perspective, the two are quite evenly balanced.”

Last week on Trustnet, experts argued both in favour of value (and suggested funds to take advantage of that) and growth (with fund selections here). Below, we highlight perfect fund pairings for investors who feel that both value and growth will have a place in a portfolio, with neither one dominating over the other quite so much.

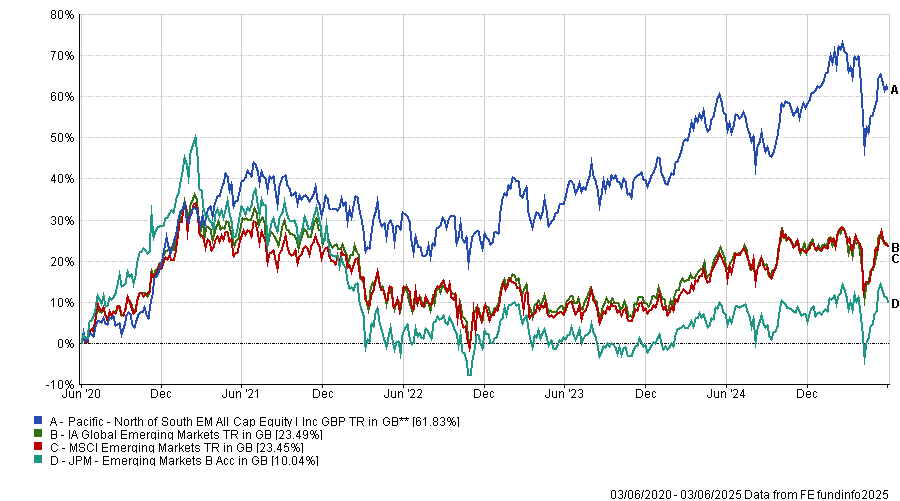

CT Global Focus and Artemis Global Income

We begin with a global perspective, where Andy O’Shea, investment director and head of fund solutions at Pharon Independent Advisors, chose CT Global Focus and Artemis Global Income.

O’Shea has held the former fund since it launched in 2018. “It's a big-enough fund to be stable but small enough to care”, he said.

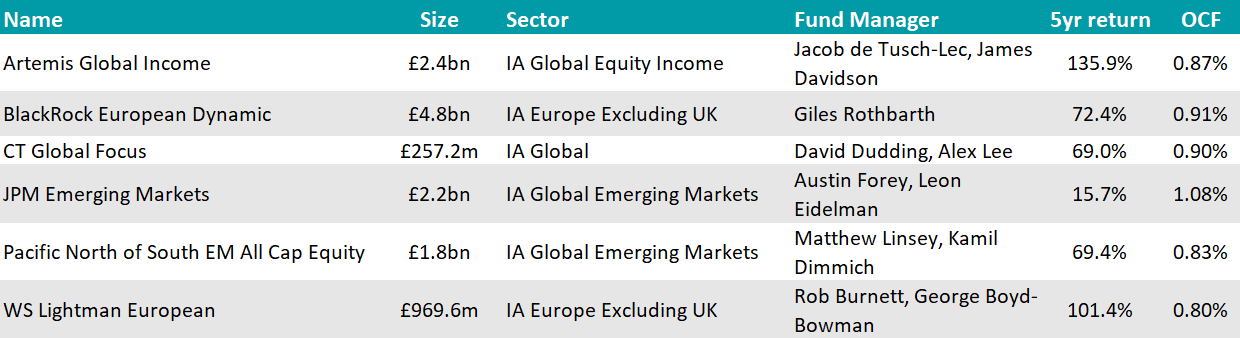

Managed by FE fundinfo Alpha Manager Dave Dudding, the £250m portfolio has delivered a top-quartile return of 39.6% over the past three years, beating the MSCI ACWI, as the chart below shows.

Performance of the fund vs sector and benchmark over 3yrs

Source: FE Analytics

Part of this performance is the result of a high allocation towards the US and technology, O'Shea noted, with the fund holding mega-cap tech stocks such as Nvidia and Microsoft in its top 10.

“Being a growth fund, it obviously has a bias towards America but that’s where the opportunities are.”

For a value pick to sit next to it, he pointed to Jacob de Tusch Lec’s Artemis Global Income – a “compelling” pairing due to their very different approaches, allocations and management strategies.

“While CT Global focus is overweight the US and tech, De Tusch Lec favours Europe and financials giving them significantly different holdings and drivers,” he explained.

Dudding is concerned more with how companies can reinvest their income, while De Tusch-Lec looks for companies that can pay out a significant dividend to shareholders. O’Shea suggested a 50/50 split between them.

BlackRock European Dynamic and WS Lightman European

Closer to home, Paul Angell, head of investment analysis at AJ Bell, favoured two European funds, BlackRock European Dynamic and WS Lightman European.

The BlackRock fund, led by Alpha Manager Giles Rothbarth, typically invests in growing business with the “best cashflow and earnings stories”, but its manager is willing to be flexible, as demonstrated by the rotation into more cyclical names in the second half of 2020, Angell noted.

Rob Burnett’s WS Lightman European is a good option to pair it with, as it is “a more conventional value-orientated fund” looking for underappreciated businesses with high cashflow yields that are demonstrating operational improvements.

The two have “a substantially different set of holdings”, with 20% of the Lightman fund invested in consumer defensive stocks, compared to 0% in BlackRock European Dynamic, for example.

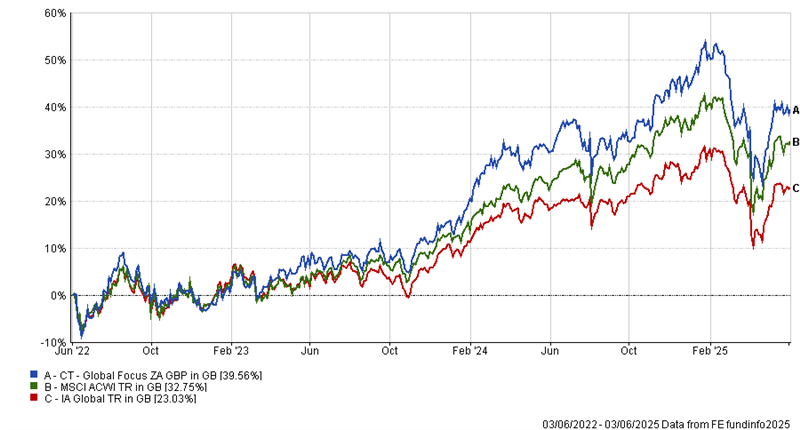

Over the past five years, both strategies have performed well. The BlackRock fund has posted a return of 68.9% since 2020, a second-quartile performance against its peers. Over the same period, Lightman European was up 92.4%, the fifth-best return in the IA Europe excluding UK sector.

Performance of funds vs sector and MSCI Europe ex UK over 5yrs

Source: FE Analytics

North of South EM All Cap and JPM Emerging Markets

Carly Moorhouse, fund research analyst at Quilter Cheviot, looked further afield, settling on a 50/50 split between North of South EM All Cap – a value strategy investing in companies within emerging markets across the market capitalisation spectrum – and JPM Emerging Markets, which concentrates on large- and mega-cap companies instead.

The two pair well together as they have different styles and approaches to market capitalisation. This means the overlap is “fairly low”, ensuring sufficient diversification.

“There have been some very strong style rotations within emerging markets over the past few years, and it is difficult to time when a specific style will outperform. Therefore a 50/50 split makes sense,” Moorhouse said.

Pacific North of South is “a well-diversified portfolio of high-quality companies that are more small and mid-sized, with fewer analysts covering them and therefore less well-known”.

The JP Morgan fund uses a low-turnover approach and “focuses on high-quality companies with strong competitive advantages and sustainable growth characteristics”.

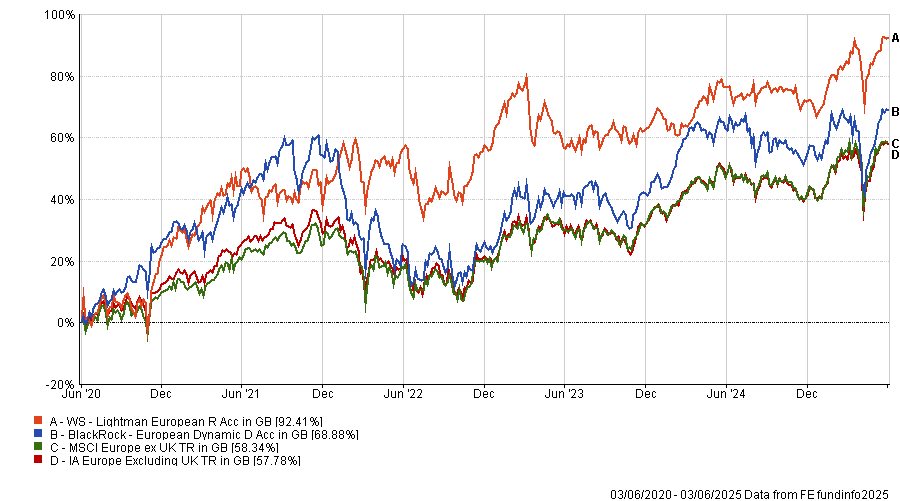

Their performances have been largely complementary, with Pacific North of South performing well between 2021 and 2024, while the JP Morgan counterpart experienced a broadly negative period; however, results were much closer in 2019 and 2020, as the chart below shows.

Performance of fund against index and sector over 5yrs

Source: FE Analytics

Finally, Moorhouse noted that, while market dynamics can alter significantly in emerging markets, the allocation to growth versus value does not necessarily change according to risk attitude.

“While value funds can have more exposure to dividend-paying companies and therefore appear more defensive, you also can have more exposure to traditional value areas such as energy, which are often perceived as lower quality and can be more volatile due to the impact of exogenous factors, including commodity prices,” she said.

“As such, choosing two funds that you have high conviction in to execute their philosophies and processes should lead to a better outcome over the long term.”