It has been hard for active global funds to excel in recent years. Even harder still when avoiding some of the ‘Magnificent Seven’ US tech stocks that have dominated in the artificial intelligence (AI) boom.

Yet the little-known VT Holland Advisors Equity fund has achieved just this. The fund was launched in 2011 but was converted to a UCITs fund in 2021 – when Trustnet first started collating data on the portfolio.

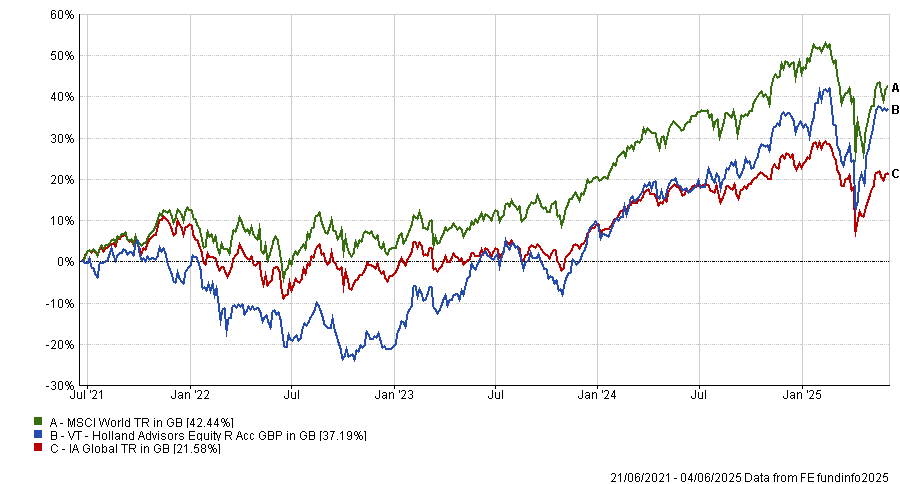

Since this time, it has been a top-quartile performer in the IA Global sector over one, three and six months, as well as over one and three years. It also is among the 25% best funds in the peer group since 2021, as the chart below shows.

Although it has failed to beat the MSCI World over this period, it has proven to be one of the top portfolios in the sector. And it has achieved all of this with a US weighting of 39% - around a third less than the MSCI World index, and a whopping 42% in Europe including the UK.

Performance of fund vs sector and MSCI World since 2021

Source: FE Analytics

Yet with assets under management of just £36.2m, it could be falling through the net for many investors.

Below, manager Andrew Hollingworth explains how we draws inspiration from Charlie Munger and Warren Buffett, why he made a mistake selling Apple for portfolio construction reasons and why he has a UK bias.

What is your investment process?

I’m very focused on a small set of global businesses that aren’t in a specific sector or country but have certain special traits. Those are generally disruptor businesses that have very low unit costs, are trying to upset an industry and are run by passionate and aligned owner-managers.

Today 95% of my portfolio falls into that categorisation. I am not interested in country allocations, sector allocations, or growth and value labelling.

Why do you have so little (comparatively) in the US and so much in the UK?

I try to be intellectually honest about how I allocate my capital. Do I find amazing businesses in America? Yes, because the US is a fantastic, deep capital market. But the other reality is I am English and was brought up in the UK and live near London.

So if I am not going to have more conviction in businesses that are close to home I’m probably deluding myself.

It might look a bit odd against a global index that has ‘X%’ in the US and ‘Y%’ in Europe. But this is an honest outcome of the way I do the job and the conviction I get from having done the work on a company.

Do you look at the portfolio based on weightings and allocations?

If anyone ever asks me about currency exposure or top-down exposure I use the example of Apple. I purchased Apple shares at a similar time to Warren Buffett and they are up six or seven times since then.

But I am a fool because I sold them around a year later because I was worried about my dollar and US exposure at the time.

That shows you that overlays sometimes have terrible consequences because, in my case, they led me to be foolish enough to sell a great company at what was a great price.

I want my portfolio to be free to not do things like that and if that means I have to accept a bit of currency volatility now and again, then that is a price worth paying.

Where do you find new ideas?

They can come from anywhere. Charlie Munger once said there are three ways to find an investment idea. One is to look at big companies spinning out smaller ones. I don’t tend do that. I have done in the past but it is a bit of a specialist area.

The other two are to look at the cannibals, and by that he meant people who are buying their own shares, such as Next. And lastly look at what the good investors are doing.

The last two aren’t bad places to be.

Occasionally, I will look at what other managers have bought – although not that often in the UK – and wonder why they’ve bought that.

But for me it is mainly about pattern recognition. For example, seeing a business model I know repeat in a different country or sector.

Why don’t you have a strict process or big research team?

The industry likes to have a process that it can demonstrate is diligent and detailed and resource-heavy. At the margin, those things do help.

If you want to research a stock in Hong Kong and you are Fidelity, the fact that you have an analyst on the ground is going to help a bit.

But I am inspired by some of the great investors of the past and quite a few of them were much freer with their time and weren’t constrained by sector or country biases. They could use the skills they had learned in US retailing, let’s say, in Chinese e-commerce.

You have to be nimble and bring the skills from one part of the investment world to another. And that is hard to do if you have a lot of resource and that resource is very silo focused.

All I’m trying to do is move between the silos and get excited when something is significantly mispriced for the growth it offers.

What have been the best and worst performers in recent years?

My worst-performing stock was Ryman Healthcare. It was about a 6% holding a year ago. It is a wonderful company in New Zealand that looks after really good elderly care facilities.

But the business was not run with the financial discipline that it needed to be and I made some mistakes. I gave it a bit of a pass on the owner-manager who left the business five years before. I thought the culture was still intact but I was probably wrong.

It fell 20% in the year. I sold it just before year end and it’s down another 50% since.

The best was Netflix. It made 86% in 2024 and is up another 38% in 2025. Then there is Carvana, up 350% in 2024 and a further 54% in 2025. Finally Jet2 was up 30% in 2024 and 18% in 2025.

Jet2 is interesting. I think it is a compounder dressed as a cyclical. It is a business that is consistently growing over time around 15-20% per annum.

It is doing this without any leverage, in a sector where there is really poor quality competitors, but the stock market has been slow to recognise that.

The stock has gone from a P/E [price-to-earnings ratio] of 6x to a P/E of 10x in the past six months or so as people have finally started to pay a bit more attention to it.

What do you do outside of fund management?

My wife and I are big gardeners. I also play a bit of golf. We have a golf course about five miles away so I leave work at 6pm and take the dog with me for a few holes to keep sane.