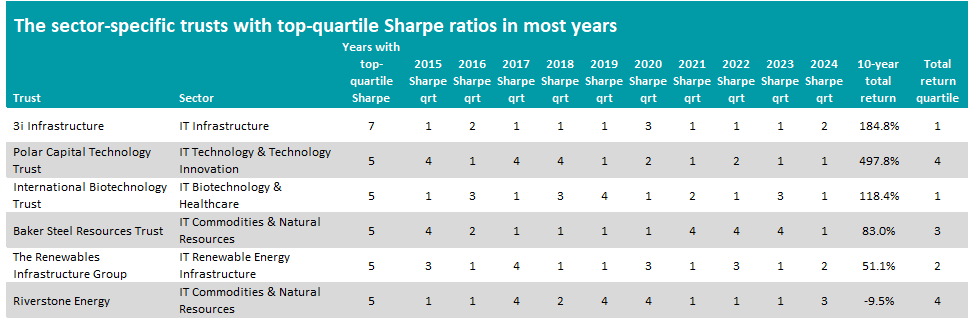

Investment trusts managed by Polar Capital, 3i and Schroders have made some of the highest Sharpe ratios year in, year out in the peer groups that focus on a specific industry, research by Trustnet shows.

The Sharpe ratio reveals how much return has been generated relative to the risk taken, by comparing its return above the risk-free rate to its volatility. A higher Sharpe ratio means an investment has delivered more return for each unit of risk, making it a valuable measure of performance efficiency.

In this research, Trustnet is looking for investment trusts that have made a top-quartile Sharpe ratio in at least five of the full calendar years of the past decade – focusing this time around on the sector-specific peer groups: IT Biotechnology & Healthcare, IT Commodities & Natural Resources, IT Environmental, IT Financials & Financial Innovation, IT Infrastructure, IT Infrastructure Securities, IT Renewable Energy Infrastructure and IT Technology & Technology Innovation.

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

There are 50 trusts residing in these eight Association of Investment Companies peer groups but only six have consistently been in the top quartile for risk-adjusted returns over the past 10 years.

They are shown in the table above, which is ranked firstly by the number of years in the top quartile for Sharpe ratio then by their total returns over the period under consideration (a blank indicates that the trust does not have a 10-year track record).

3i Infrastructure sits at the top, having been in the IT Infrastructure sector’s top quartile for Sharpe ratio in seven years. It made a first-quartile return of 184.8% over the decade to the end of 2024.

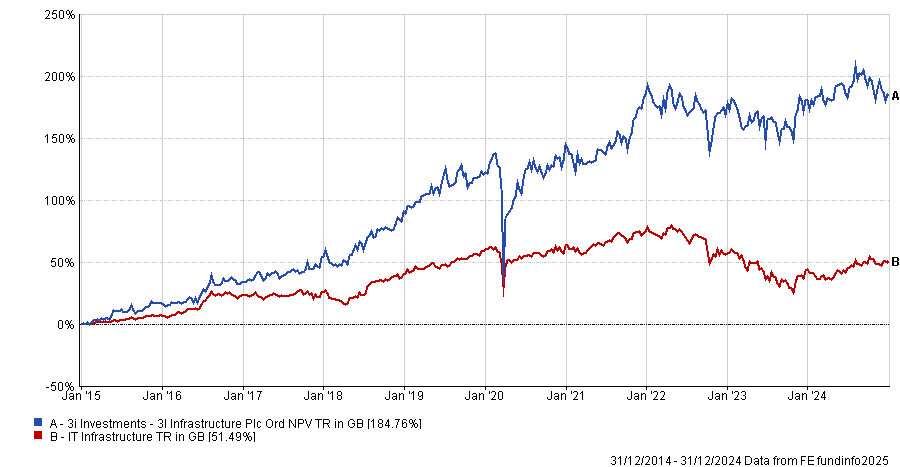

Performance of 3i Infrastructure vs sector over 10yrs

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

The trust invests in companies that provide economic infrastructure in Europe, largely targeting operating companies rather than the PPP contracts and toll roads held by core infrastructure trusts. Analysts at Kepler pointed out that this makes 3i Infrastructure more like a private equity portfolio.

Kepler also highlighted its strong performance when core infrastructure trusts were struggling amid higher interest rates. Analysts said: “[It] has always been transparently a portfolio of operational companies with strong infrastructure characteristics but with more equity upside than most infrastructure trusts, meaning it has the ability to generate higher returns and to adapt to different environments.”

The highest 10-year return of the six trusts above has come from Polar Capital Technology Trust, which made 497.8% over the 10 years to the end of 2024. It was in the top quartile for Sharpe ratio in five of these years and appears second in the table.

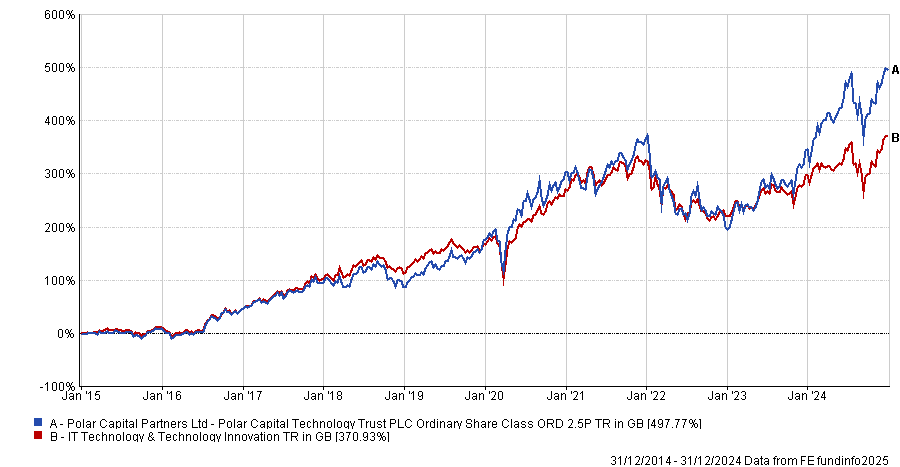

Performance of Polar Capital Technology Trust vs sector over 10yrs

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

Analysts at Square Mile Investment Consulting & Research said Polar Capital Technology Trust is an “attractive strategy” for investors seeking long-term exposure to rapidly growing technology companies.

“The trust is managed by experienced investors who are skilled in identifying changing industry trends and the companies that are poised to benefit as a result. Technology is constantly evolving and continued vigilance is required by the managers [Ben Rogoff and Alastair Unwin] to keep informed of developments. Polar Capital's large team of technology investment specialists provides them with a distinct advantage in this regard,” they said.

“Another plus for the trust is the experience of the managers, who have witnessed first-hand a plethora of seemingly promising businesses that have fallen by the wayside alongside the gains that can be generated through companies that succeed in sustaining the growth of their business.”

In third place is International Biotechnology Trust, which is managed by Schroders’ Ailsa Craig and Marek Poszepczynski. The trust invests in around 100 of the most innovative, high-quality companies across the entire spectrum of the biotech and other life sciences sectors.

Biotechnology is a growth sector that has the potential to generate strong returns, owing to the fact that biotech firms are working on developing treatments with the potential to deliver both medical breakthroughs and financial rewards, although it has been a volatile area for investors. The managers take a risk-conscious approach to portfolio management, such as investing in baskets of companies in different therapeutic areas and reducing holdings prior to events with binary outcomes, such as trial results.

Analysts at Kepler said: “Ailsa and Marek have shown the value of their risk-aware approach over the past four years, having outperformed in falling and then rising markets. We think this strategy, the use of gearing, the wide discount, and the exposure to private companies, all add to the attractions of International Biotechnology Trust as a way to gain exposure to biotech.”