The UK is not usually considered a tech powerhouse. Just 4.3% of the FTSE All Share is made up of technology companies.

For some, such as Steve Clayton, head of equity funds at Hargreaves Lansdown, technology does not matter in the UK, as it is such a dwindling part of the market that investors have little to get excited about.

“Its sector weight is so low that, as far as the stock market is concerned, technology is something that happens outside of the island,” he said.

It is perhaps why those looking to add technology to their portfolios have looked primarily towards the US, where Silicon Valley tech giants have benefited from the rise of artificial intelligence (AI).

But for Nick Shenton and Andy Marsh, co-managers of the Artemis Income fund, there is a “golden thread of technology” that links some of the best businesses in the UK.

They explained how they have tried to find businesses where technology adds to their existing value, rather than those that sell technology as their product.

“The UK may not have SaaS [software as a service] businesses, but it does have a significant number of tech-like businesses that are using technology to create more value for their customers. In that way, we think the UK is quite good at tech,” they explained.

Marsh argued that this often goes underappreciated because of the “incredibly misleading” nature of sector allocations in the index. For example, consumer staples can have very tech-heavy value chains, even if they are not classified as technology companies.

“While for years investors have been looking to the US for technology investments, they were hiding in plain sight in the UK across a range of sectors and at more attractive valuations,” Shenton said.

As a result, despite the Artemis Income fund’s low 5.7% allocation towards technology at the time of writing, the managers explained that “tech-like” businesses are some of the biggest holdings in their portfolio.

“These companies use technology to protect from competitive encroachment, but also use it as an opportunity to grow as a business,” said Shenton.

Tesco is a great example of one of these tech-like businesses. As one of the largest supermarkets in the UK, it is usually perceived as a consumer business, but it has the “best consumer data set in the UK bar none”, he said.

The Tesco Clubcard is almost three decades old and holds important data for “personalised promotions” that differentiates it significantly from its competitors.

Shenton added that, compared to other supermarkets, it has been much more focused on improving this data set further, which gives it real long-term growth potential.

They are not the only experts to take note of this. Garry White, chief investment commentator at Charles Stanley, added that the Clubcard has “helped it [Tesco] retain cost-conscious shoppers amidst ongoing inflationary pressures”.

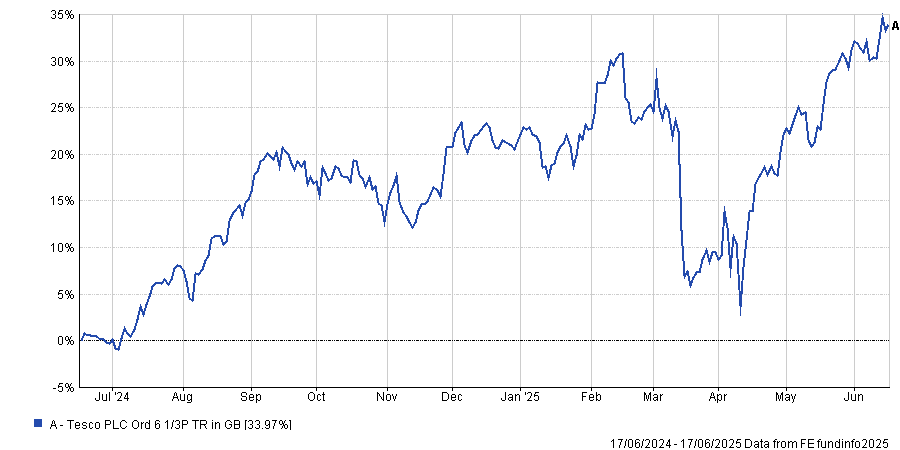

Share price performance over the past year

Source: FE Analytics.

The stock has performed well over the past 12 months despite competitors launching new initiatives, such as ASDA announcing a programme of price cuts, which led to a short-term sell-off for the shares.

Shenton and Marsh also pointed to Informa. Its event business is one of the “best collections of assets in the whole world”, with face-to-face events such as the Miami Boat Show or Dubai Air Show regularly bringing hundreds of thousands of attendees.

However, the managers argued it is often underestimated by investors, as seen by its declining share price year to date. This was attributed to its high exposure to the US in the wake of tariff announcements.

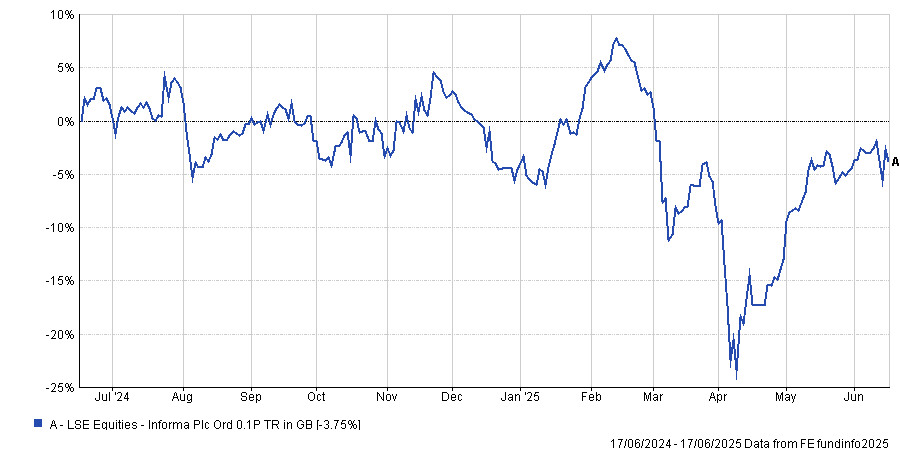

Share price performance over the past year

Source: FE Analytics.

They believe this is not indicative of any structural weakness and argued that over the long term the business has delivered due to its efforts to improve its data sets. “It’s got a really unique set of first-party data and we think it can do plenty more with it over the long term,” they said.

Despite having a very large tech component, it’s seen as more of a publishing and events business.

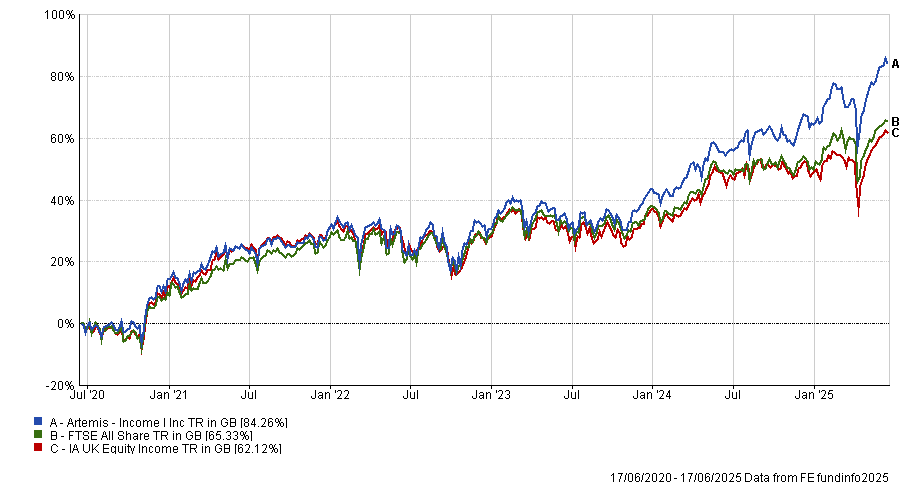

The data suggests this approach has paid off for the team in recent years. By identifying and backing these tech-like companies, the Artemis Income fund is up 84.3% over the past five years, a top-quartile result in the IA UK Equity Income sector.

Performance of fund vs sector and index over five years

Source: Fe Analytics

It has also delivered top-quartile results over the past one, three and 10 years.