Political uncertainty and slowing growth have made investors unwilling to pay a premium for US assets anymore, according to Boryana Perfanova, client investment specialist at Brown Shipley.

The US market is at the “epicentre” of uncertainty in financial markets this year and is struggling to sustain its former strong performance. For example, year to date, the S&P 500 is down by 5.7%, underperforming other developed market indices such as the FTSE All Share and MSCI Europe.

Dollar-denominated assets are also facing structural headwinds, such as the $1.83trn budget deficit, as well as unclear fiscal and trade policy from the White House. For years, the dollar had been overvalued due to the higher rate of growth in the US but if it is unable to sustain that growth, investors will find it increasingly difficult to justify these stretched valuations, she said.

This is forcing investors to pay much more attention to portfolio diversification than when the US was outperforming, according to Daniele Antonucci, chief investment officer at Quintet Bank (the parent organisation of Brown Shipley).

“We’re not saying the US is a bad region, what we’re saying is that going forward it is not going to be the only place to be and portfolios should reposition to reflect that,” he said.

As such, the wealth manager is underweight US equities, investment-grade bonds and treasuries. One area it has reallocated some of this capital towards is gold.

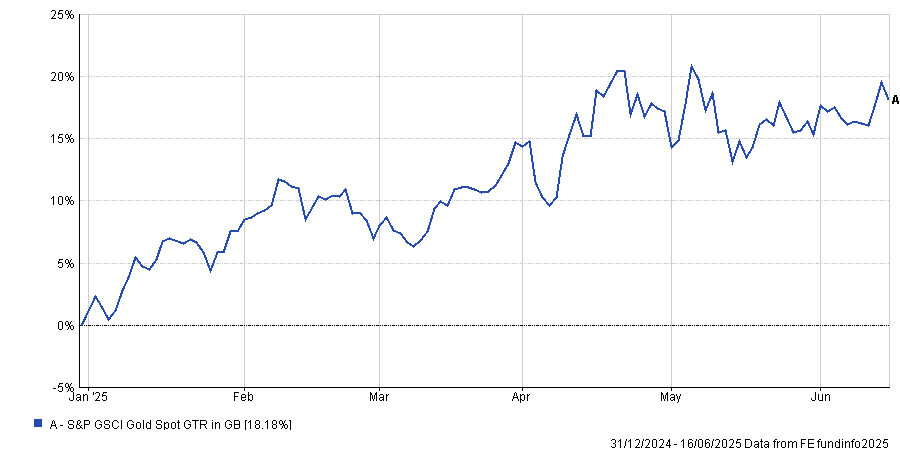

The S&P GSCI Gold Spot price index is up 18.2% year to date but Antonucci said this recent demand is structural and the yellow metal has room left to run.

Performance of the indices year-to-date

Source: FE Analytics

“As a risk mitigator, we think it benefits a lot from the fiscal and broad policy uncertainty emanating from the US right now,” he said. Uncertainty is causing central banks, particularly in emerging markets, to continue building their gold reserves. Central banks have bought so much gold that it is now the second-largest reserve asset in the world, surpassing the euro, he explained.

Additionally, it has become a favourite for investors “looking for comfort” in periods of high economic volatility. This is why gold funds are some of the top-performing strategies so far this year, according to recent Trustnet research.

The wealth manager has also increased its allocation to emerging markets, which it expects to benefit from dollar depreciation. Emerging market businesses are “often very export-heavy” and tend to price commodities in dollars, so when the dollar slides, prices go down and demand increases, he argued.

Additionally, the market is benefiting from new structural trends such as companies returning money to shareholders through buybacks. Coupled with “historically low valuations”, emerging markets look “very compelling”, particularly in a period where the supranormal performance of US assets cannot be guaranteed.

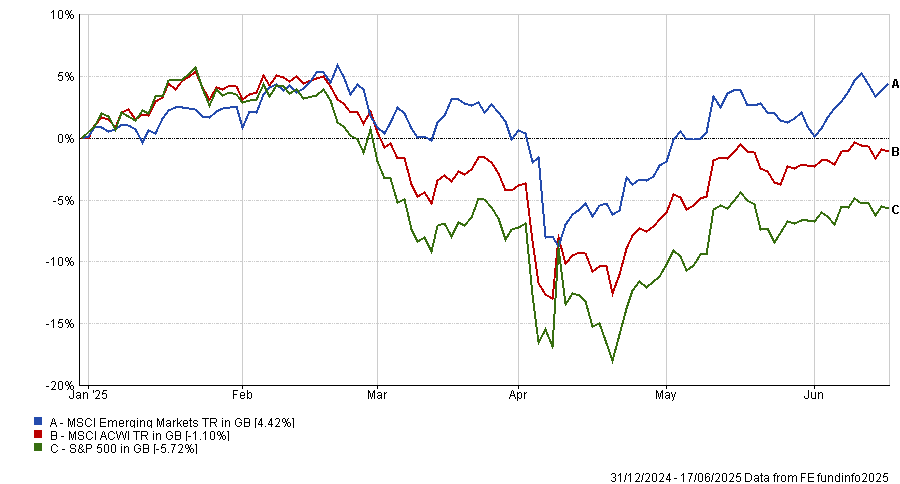

Year-to-date, the MSCI Emerging Markets is up 4.4%, outperforming both the S&P 500 (down 5.7%) and MSCI ACWI (down 1.1%).

Performance of the indices year-to-date

Source: FE Analytics

One of their other major shifts is towards Japanese equities. On the valuation side, Japan is another extremely cheap market and “buybacks are at some of their highest levels in multiple years”.

Japanese equities often have “very low correlation to other developed market equities and are driven by extremely different factors”, he noted.

Structurally, the region is also looking much better. While the yen remains incredibly cheap, Antonucci is encouraged that the Bank of Japan will soon enter a rate-cutting cycle to get the economy moving again. This will cause a “moderate appreciation for the yen, which shouldn’t cause much harm to Japanese exporters or earnings growth”.

Additionally, Japanese equities are benefiting from an ongoing set of governance and corporate reforms, which should provide another tailwind for the region, he said.

Increased allocation towards Japan is also a momentum play. While domestic investors have been pouring money into global assets for years, as volatility continues more Japanese investors will buy domestic assets. This provides another tailwind that the wealth manager hopes to benefit from.

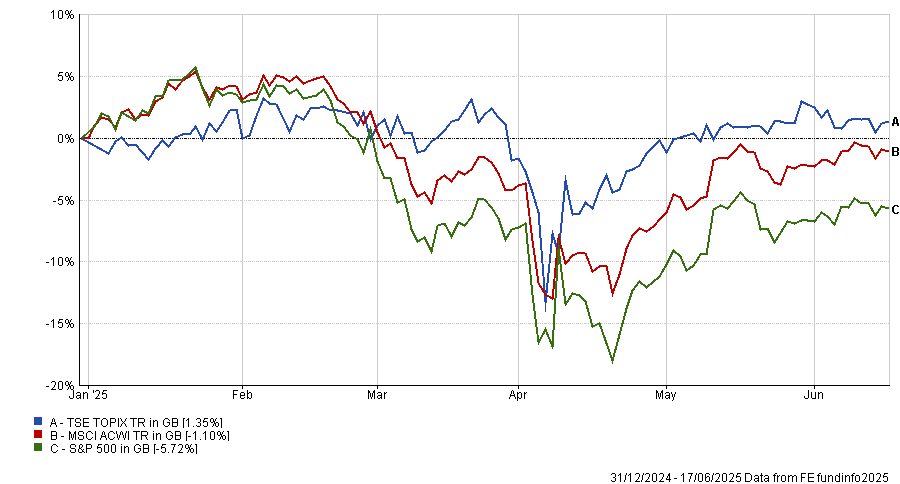

Some of these tailwinds are already starting to come through, with the TSE Topix up by 1.4% year to date, beating both the MSCI ACWI and the S&P 500, as demonstrated in the chart below.

Performance of the indices year-to-date

Source: FE Analytics