Healthcare stocks have been in the mire for the best part of a decade and are facing an ‘annus horribilis’ over the past 12 months. Despite hopes of a turnaround, Garry White, chief investment commentator at Charles Stanley, said investors are wise to be cautious.

This year, global healthcare stocks have tumbled 7.2% (as represented by the MSCI World/Health Care index), some 6 percentage points lower than the broader MSCI World.

But this is not a new phenomenon. From 2015 to 2024, the healthcare sector has outperformed the wider market in just three years (2022, 2018 and 2015).

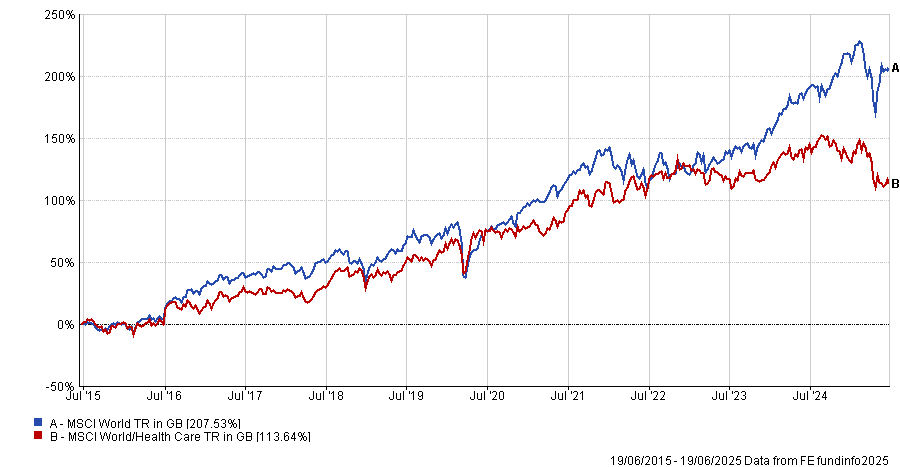

It may have left investors sorely disappointed, as over the past decade healthcare stocks have made half the returns of the wider market, as the below chart shows.

Performance of indices over 10yrs

Source: FE Analytics

Yet it is a sector of great importance, not only for the wellbeing of the world but also in particular for UK investors, with pharmaceutical giants GSK and AstraZeneca among the six stocks that make up some 12.7% of the FTSE 100 index.

So why has the sector so badly struggled recently?

The most recent bout of poor performance has been driven by a mix of regulatory uncertainty, pricing pressures and investor rotation into higher-growth sectors such as technology and artificial intelligence (AI), said White.

“One of the key drags on performance has been concerns over drug pricing reforms and patent cliffs. The Biden-era Inflation Reduction Act (IRA) allowed Medicare to negotiate prices on select drugs,” he said.

“Signed into law in 2022, the IRA granted Medicare – for the first time – the authority to negotiate prices for certain high-cost prescription drugs. This long-contested provision aims to curb federal spending and reduce out-of-pocket costs for millions of Americans.”

In response, pharmaceutical giants, such as AstraZeneca, launched legal battles against the policies but a May 2025 landmark ruling in the court of appeals upheld the law and dismissed the claims.

Additionally, president Donald Trump signed an executive order in April that expanded Medicare’s negotiating power and introduced a controversial ‘most favoured nation’ pricing model, meaning drugmakers selling into the US would be pushed to match the lowest price paid by other countries.

“Industry groups argue that pegging US prices to international benchmarks could stifle innovation and lead to drug shortages if companies pull out of less profitable markets. Still, the Trump administration appears undeterred,” said White.

Janus Henderson research analyst Luyi Guo said last month the “sheer lack of detail” makes it “difficult to assess the immediate impact”.

“For example, the order cites no obvious legal authority to mandate lower drug prices, so it remains to be seen how effectively the Trump administration would be able to enforce the new policy. And it is unclear which insurance programs would be targeted and to what extent,” she said.

Then there are the ‘Liberation Day’ tariffs, which would impact the profits made by international pharmaceutical companies that export drugs to the US.

“The administration argues that foreign price manipulation and supply chain vulnerabilities have left the US exposed, especially in times of crisis,” said White.

“However, the move has sparked concern among healthcare providers and policy experts. Critics warn that tariffs could exacerbate drug shortages, raise costs for patients and disrupt access to essential medicines.”

While some are lobbying for exemptions, none have been forthcoming at present.

Despite all of this, “analysts remain cautiously optimistic about the long-term fundamentals of the healthcare sector”, said White, citing ageing populations, rising chronic disease burdens and technological innovation as likely to underpin demand.

Although there are short-term price pressures from the policies above, biotech innovation – particularly in gene therapy, oncology, and AI-driven drug discovery – is a long-term theme that could boost the industry, he added.

“M&A activity is also expected to pick up, as large companies seek to replenish pipelines and diversify revenue streams. A wave of strategic acquisitions is likely,” the Charles Stanley chief investment commentator said.

This is in addition to the rapid rise of weight-loss drugs such as Ozempic, which David Goodman, fund manager in the Liontrust Global Equities team, described earlier this year as “pioneering treatments”.

He pointed to data from Scott Galloway, professor of marketing at the NYU Stern Business School, which suggested the health phenomenon could have a bigger economic impact on the US than AI.

“These drugs have the potential to be a transformative force for good in healthcare, the economy and society as a whole,” he concluded.

So what should investors do now?

In the short-to-medium term, the outlook is mixed, said White, with the healthcare sector “at a crossroads”.

“Share-price underperformance, policy uncertainty and the threat of tariffs have created a challenging environment for investors and operators alike. Yet the sector’s long-term drivers – demographics, innovation and global demand – remain intact,” he said.

“As the Trump administration’s trade and healthcare policies take shape, the coming months will be critical in determining whether this is a temporary setback or a structural shift. For now, caution – and close attention to Washington – remain the order of the day.”

Guo agreed, suggesting healthcare stocks may “continue to be prone to volatility”, but added that we could be “slowly nearing the end of the regulatory uncertainty”.

For those who do want to invest, she suggested investors should “stay focused on the attractive fundamentals” and those companies with both defensive characteristics and future growth opportunities.

And there could be a good reason to get in now, with Janus Henderson’s Guo noting the sector is trading at a nearly 20% discount to the benchmark versus the long-term average of a 4% premium.

“The entry point for long-term investors has rarely been this attractive. Starting from such low valuations, we believe healthcare stocks are primed for gains when there’s positive news,” she concluded.