Funds from Artemis, Jupiter and Schroders have delivered top-quartile returns over the past one, three, five and 10 years in the equity income sectors, Trustnet research found.

As part of an ongoing series, this week we examined the funds in the IA Global Equity Income and IA UK Equity Income sectors that have topped their peer groups over standard timeframes.

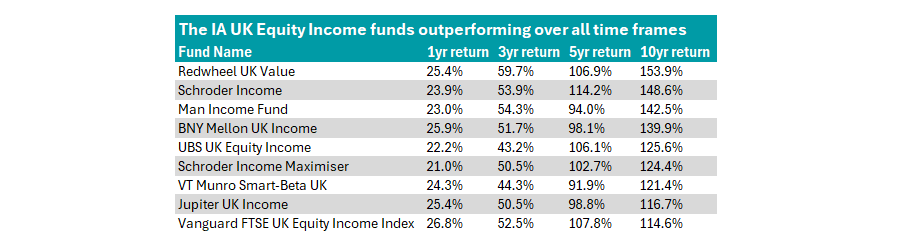

Starting in the IA UK Equity Income sector, Redwheel UK Value led the table for 10-year (up 153.9%) and three-year (59.7%) returns.

Source: FE Analytics. Data as of the end of November. Table sorted by 10-year returns.

Run by Ian Lance and Nick Purves, it is a concentrated portfolio of just 34 stocks, targeting companies that are cheap compared to their intrinsic value.

The value approach leads the fund to overweight stocks in sectors such as communication services, consumer discretionary, materials and energy when compared to the FTSE All-Share.

It has been in the top quartile of the peer group in seven of the past 10 calendar years. However, it faltered in 2017 and 2019, when it was one of the worst-performing funds in the IA UK Equity Income sector.

Schroder Income was the best performer over the past five years, with a 114.2% total return.

Managed by Andrew Lyddon and Tom Grady, the fund benefits from an experienced team of “committed and disciplined value investors”, according to analysts at Rayner Spencer Mills Research (RSMR).

The managers have a deep value approach to stock picking, founded on the belief that investors tend to ignore the potential for mean reversion and extrapolate based on short-term results, RSMR analysts said.

Its stablemate Schroder Income Maximiser, which follows a similar approach but uses derivatives to enhance the income, also appeared in the table. However, long-term Schroder managers Nick Kirrage and his co-manager Kevin Murphy, who are responsible for the fund’s track record, departed the team earlier this year and in 2024.

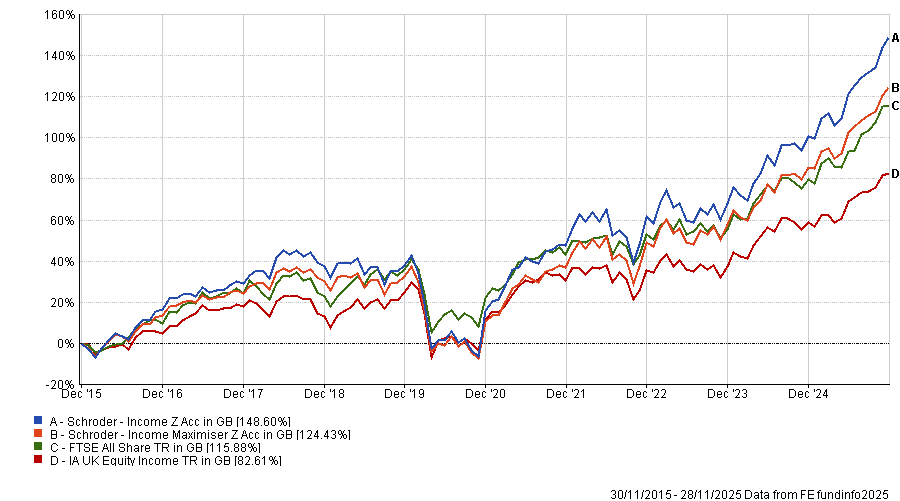

Performance of funds vs sector and benchmark over 10 years

Source: FE Analytics. Data as of the end of November.

Other UK equity income strategies which delivered top-quartile returns over standard timeframes were UBS UK Equity Income, Jupiter UK Income, BNY Mellon UK Income and Man Income.

Among passive solutions, the Vanguard FTSE UK Equity Income Index and the VT Munro Smart-Beta UK fund made the list.

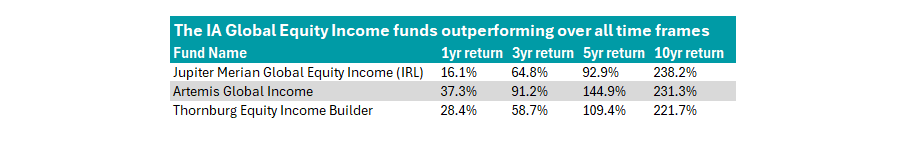

Shifting to the IA Global Equity Income sector, the Jupiter Merian Global Equity Income (IRL) fund topped the peer group over 10 years with a 238.2% total return. Across one, three, five and 10 years, it has consistently been in the top five of the sector in terms of performance.

Source: FE Analytics. Data as of the end of November. Table sorted by 10-year returns.

FE fundinfo Alpha Manager Amadeo Alentorn invests 62.8% of the portfolio in North American stocks, with six members of the ‘Magnificent Seven’ (Nvidia, Apple, Microsoft, Tesla, Alphabet, Amazon, Meta) in the top 10 allocations.

This gives it one of the highest correlations to the S&P 500 in its peer group.

Meanwhile, the Artemis Global Income fund was the best performer on the table over the past one, three and five years, despite having a much lower allocation to the US.

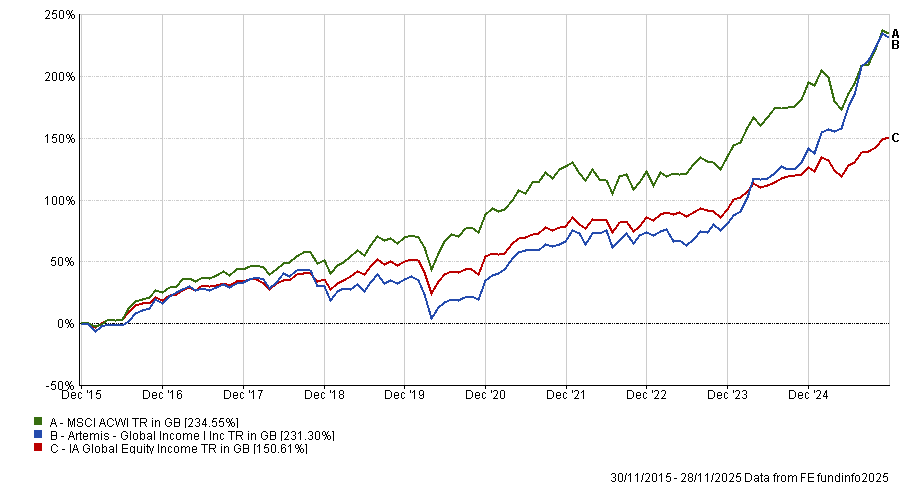

Performance of fund vs sector and benchmark over past 10 yrs

Source: FE Analytics. Data as of the end of November.

It holds just 27.2% in North American stocks compared to a 64.7% allocation in the MSCI ACWI. Instead, it currently favours stocks in Europe and emerging markets.

This is a result of managers Jacob de Tusch-Lec and James Davidson’s contrarian style, causing them to avoid the ‘usual suspects’ in their search for companies with high cash and reliable dividends.

This contrarian focus has made it a popular choice for AJ Bell investors this year, as some people’s enthusiasm for the US story began to wane.

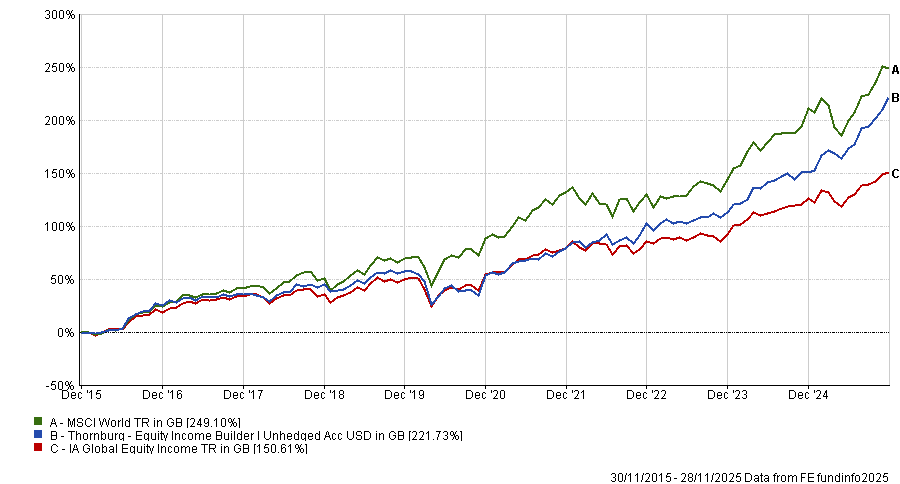

Finally, the Thornburg Equity Income Builder fund qualified in the global equity income peer group.

Performance of fund vs sector and benchmark over the past 10 yrs

Source: FE Analytics. Data as of the end of November.

Manager Brian McMahon and his team use bottom-up research to identify companies that can pay their dividends while maintaining financial stability. The team prioritises companies based on their current income but also considers the potential for long-term capital appreciation and income growth.

It is another contrarian strategy, with just 31.7% of the fund in the US, less than half of the benchmark and an overweight to France and the UK.

Previously in this series, we examined the funds that delivered top-quartile results over one, three, five, and 10 years in Europe, global markets, the US, the UK and Emerging Markets.