The UK market is praised for its dividend-paying champions, while the US is known for its high-growth technology companies. Investors know that and allocate money to one or the other expecting different patterns of returns, but this hasn’t been the case for some UK strategies, FE Analytics data has shown.

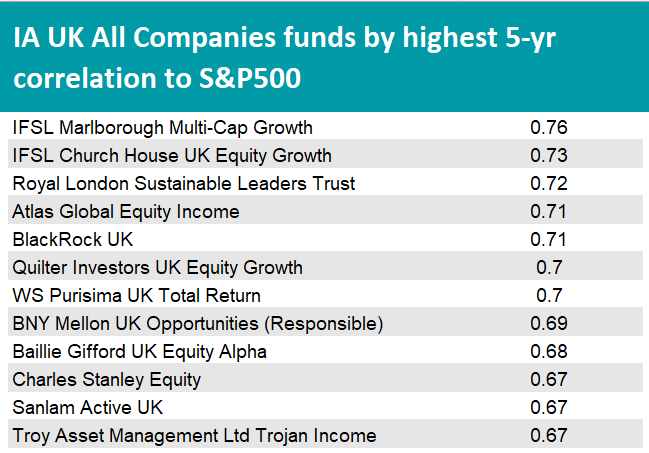

Trustnet looked at the five-year correlation between IA UK All Companies funds and the S&P 500, and while the average number across the sector was 0.59, there were seven outlier funds, which displayed high levels of correlation of 0.7 or above.

This means their performance moves reasonably in line with the powerhouse US index. Investors aiming at greater diversification should therefore pay attention when investing in these strategies, in particular if they are already investing in the US via an S&P 500 tracker.

Source: FE Analytics

The IFSL Marlborough Multi-Cap Growth fund topped the table with a correlation of 0.76, the highest in the sector. This £130m portfolio is run by FE fundinfo Alpha Manager Richard Hallett and concentrated in about 30 names.

Its top 10 holdings weigh heavily into UK financials – such as JTC (6.1%), Close Brothers (5.4%) and St James’s Place(4.5%) – and industrial companies – including Melrose Industries (4.8%) and Ashtead Group (3.6%).

The strategy received a FundCalibre Elite rating for its “fantastic track record when it comes to stock-picking skill”, with analysts stressing that this fund invests more in larger companies than most other Marlborough funds as “a deliberate move to pick up on the growth opportunities across the whole market spectrum”.

“The manager’s macroeconomic overlay helps to add context,” they added.

In second position, the £89m IFSL Church House UK Equity Growth fund had a 0.73 correlation.

It invests 62.5% of its assets under management in FTSE 100 companies, 15% approximately in UK small-and mid-caps, and 18.8% in overseas companies, with the latter figure being led by a 4.1% weighting to Microsoft.

Concluding the top three was the £2.6bn Royal London Sustainable Leaders Trust (0.72).

FE Investments analysts said its investment style “brings something different to UK equity funds”, as it combines sustainable principles with “in-depth company financial analysis” and makes “a very good candidate” for investors who want exposure to companies that are making a positive impact for society or operating in a sustainable manner.

“[Alpha Manager] Mike Fox is a very experienced manager and his track record highlights the benefits of his style,” they said. “Despite several periods of outperformance of cyclical sectors, the fund beat its peers and the wider market over the long term.”

Earlier this year, the fund appeared on Trustnet as one of the most consistent UK funds of the decade.

The £322m BlackRock UK fund and the Quilter Investors UK Equity Growth fund (also managed by BlackRock) made the list with a 0.71 and 0.7 correlation figure, respectively. The former has a large-cap focus, while the latter is benchmarked against the MSCI UK All Cap index.

The small WS Purisima UK Total Return also made the list.

Growth funds were a clear theme in the study. While many bemoan the lack of growth available in the UK, those funds that specialise in the investment style were highly correlated to the US market. These included BNY Mellon UK Opportunities (Responsible) (0.69), Baillie Gifford UK Equity Alpha (0.68) and Sanlam Active UK (0.67). However, the lower-risk and income-focused Troy Trojan Income also had a higher correlation of 0.67.

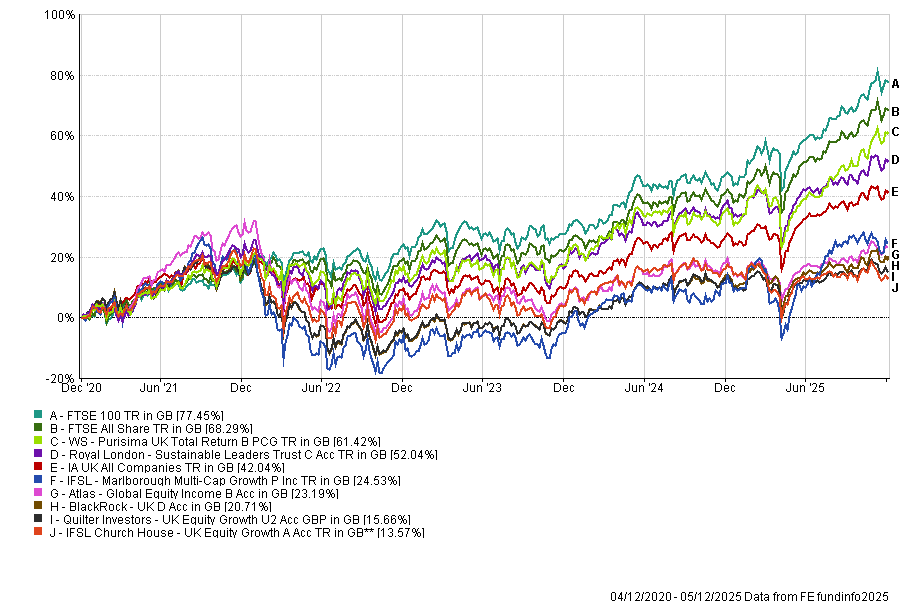

Performance of funds against indices and sector over 5yrs

Source: FE Analytics

The strategies at the opposite end of the table tended to be more heavily skewed towards value opportunities, although this wasn’t a rule.

TM Oberon UK Core and Thesis Stonehage Fleming Opportunities had the lowest S&P 500 correlation, both at 0.31.

The former is a small (£20m) portfolio, concentrated in sectors such as healthcare, tobacco, insurers and oil and gas; the latter (£79m) focuses on smaller companies and recovery names.

The popular Invesco UK Opportunities (UK) (1.8bn) concluded the bottom three, with a correlation of 0.32. It is run by Martin Walker with a bottom-up, high-conviction and valuation-focussed approach.

RSMR strategies favour it for being a “consistent large-cap strategy”, having produced “strong” and “consistent” risk-adjusted returns.

They said: “Bottom-up fundamental proprietary research leads to a high conviction fund that should outperform the peer group average over a full cycle.”

Other lowly correlated names included Redwheel UK Climate Engagement (0.35), Premier Miton UK Focus (0.36) and JOHCM UK Growth (0.37).

Previously in this series: the funds most and least tied to the S&P 500 in the IA Global Equity Income, IA Mixed Assets and IA Flexible Investment sectors, and the unexpected fund sectors with high and low correlations to the S&P 500.