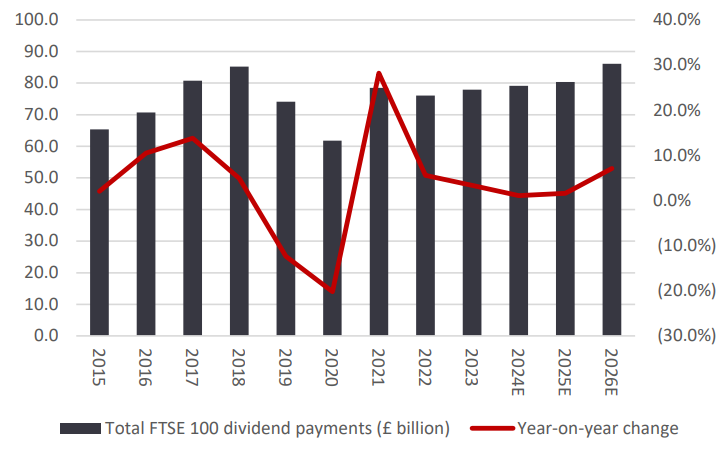

Forecasts for FTSE 100 dividends have weakened once more, suggesting investors hoping for a return to 2018’s record £85.2bn in payouts will have to wait until at least 2026.

City analysts have forecast £80.4bn in dividends from FTSE 100 members this year, down from their £83bn estimation three months ago. This represents an increase of just 2% on 2024’s payouts, putting the FTSE 100 on a forward dividend yield of 3.5% for 2025.

FTSE 100 dividend forecast

Source: AJ Bell, company accounts, Marketscreener, consensus analysts’ forecasts. Ordinary dividends only.

This is according to AJ Bell’s latest Dividend Dashboard, which aggregates forecasts for FTSE 100 companies from leading analysts on a quarterly basis to generate a dividend outlook for each company.

Russ Mould, investment director at AJ Bell, said: “Analysts seem to think that big increases will be a relative rarity in 2025, perhaps because buybacks are playing a big role in capital allocation plays – a board and chief executive are likely to draw less flak for a pause in a buyback than they are for a dividend cut.

“Investors also need to bear in mind the role of the pound, whose strength against the euro and particularly the dollar this year reduces the value in sterling terms of the dividends declared in those currencies by no fewer than 28 current members of the FTSE 100.”

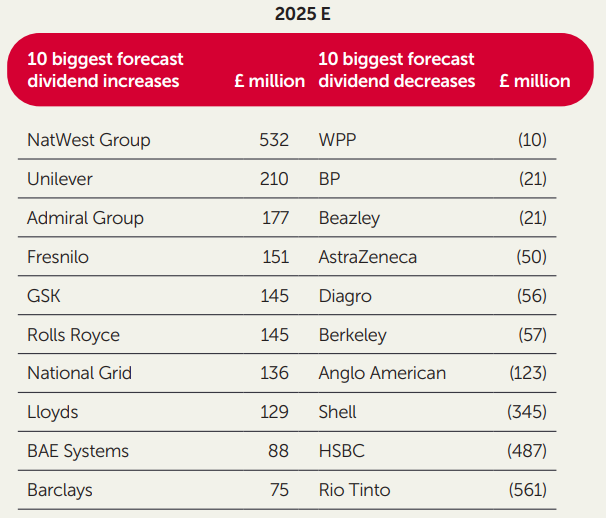

That said, Natwest is forecast to increase its dividend by £532m this year, followed by Unilever (£210m increase), Admiral (£177m increase) and Fresnilo (£151m increase). On the other hand, big cuts are expected from Rio Tinto, HSBC and Shell.

Forecast dividend increases and decreases

Source: AJ Bell, company accounts, Marketscreener, consensus analysts’ forecasts. Ordinary dividends only.

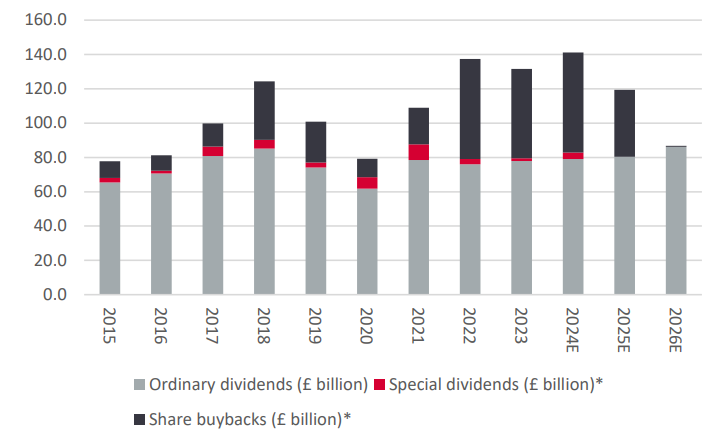

Unlike 2024, no firm has yet declared a special dividend for 2025. Last year, companies including HSBC, Berkeley Group and Admiral offered such payments to the collective tune of £3.7bn.

“Any similar distributions could further top up the cash pot, as could any merger and acquisition activity,” said Mould.

“A predator is yet to circle a FTSE 100 member in 2025, but buyers of UK assets have tabled bids worth a total of £20bn already this year, after £49bn worth of successful approaches in 2024. Takeover deals can therefore add to the total return from the UK equity market overall.”

Ordinary dividends, special dividends and share buybacks

Source: AJ Bell, company accounts, Marketscreener, consensus analysts’ forecasts. *Announced in aggregate as of 20 Jun 2025

While dividend growth remains anaemic, buybacks are playing an increasingly central role in shareholder returns.

FTSE 100 firms have so far announced plans for £39bn in share buybacks in the first quarter of 2025 – equivalent to more than half of 2024’s total – which takes the total expected payout from the headline index to £119.4bn. This equates to just shy of a 5.3% cash yield on the index’s £2.3trn market capitalisation.

“That cash yield beats inflation, the 10-year gilt yield and the Bank of England base rate which, on balance, still seems to go lower before it goes higher once more,” said Mould.

Hopes for a new all-time high in pre-tax profits from the FTSE 100 are also starting to wane, with analysts’ forecasts down 7% from three months ago to £231bn. Forecasts for 2026 have also fallen by 6%.

Mould said the potential for tariffs and trade wars to move those numbers remains, while events unfolding in the Middle East will also have an inevitable impact.

“Although the manner in which BP and Shell are expected to generate one-seventh of the FTSE 100’s total earnings between them in 2025 may mean that the UK market has some kind of hedge in place, should oil spike amid gathering tension between Jerusalem and Washington on the one hand and Tehran on the other,” he noted.

The research further pointed to the fact FTSE 100 earnings are highly concentrated, with just 10 companies forecast to pay out 53% (or £42.4bn) of the forecast total for 2025.

Ultimately, the UK may offer investors a “more propitious mix of sector earnings than tech-heavy America”, said Mould, highlighting the UK premier index’s 9.6% total return so far this year, versus S&P 500’s 2.1%.

He said investors in the UK market would have access to plentiful cyclical and cheap growth and perhaps “feel less obliged to pay top dollar (in every sense) for secular growth”.

In addition, the UK’s exposure to miners and commodities could persuade some investors that the market may serve as a haven in the face of ongoing inflation or worsening geopolitical tensions. Just over a third of the FTSE 100’s expected dividends are expected to come from more defensive sectors, such as healthcare and telecoms.

“Whether this trend [in UK versus US performance] continues or not remains to be seen, and the combination of a higher index and falling profit and dividend forecasts does take some of the shine off the appeal of the UK equity market, simply by dint of mathematics,” Mould said.