Funds managed by Artemis, Ninety One and Schroders made the highest returns in the 12 months since Labour won the 2024 general election, Trustnet research shows.

After 14 years in opposition, the party’s 2024 manifesto promised economic stability through unlocking markets, investing in infrastructure and leading the green revolution. But unlike Tony Blair’s government in 1997, prime minister Keir Starmer has faced a sluggish economy, geopolitical uncertainty and strained US relations.

The UK’s economic growth has been far from impressive, with the fiscal situation further strained by a disappointing first Autumn Budget and a debt-ridden public purse.

According to Andy Marsh, co-manager of Artemis Income, while there have been “several false dawns” in recent years when investors thought the UK might come back into favour, there are some notable differences following a year operating under a Labour government.

“The companies that are here now are much stronger, as the weak ones have either disappeared or been taken over,” he said.

Several of the companies still standing are global in nature, Marsh pointed out, meaning they are not too dependent on the fate of the UK economy.

In particular, the UK is home to companies with the defensive qualities that investors look for during periods of uncertainty.

“Most other developed economies have similar challenges – they may not be as bad and they may be different, but I don’t think we’re alone in facing problems,” Marsh said.

But how have UK fund managers fared this year? Trustnet dug into the data to find out.

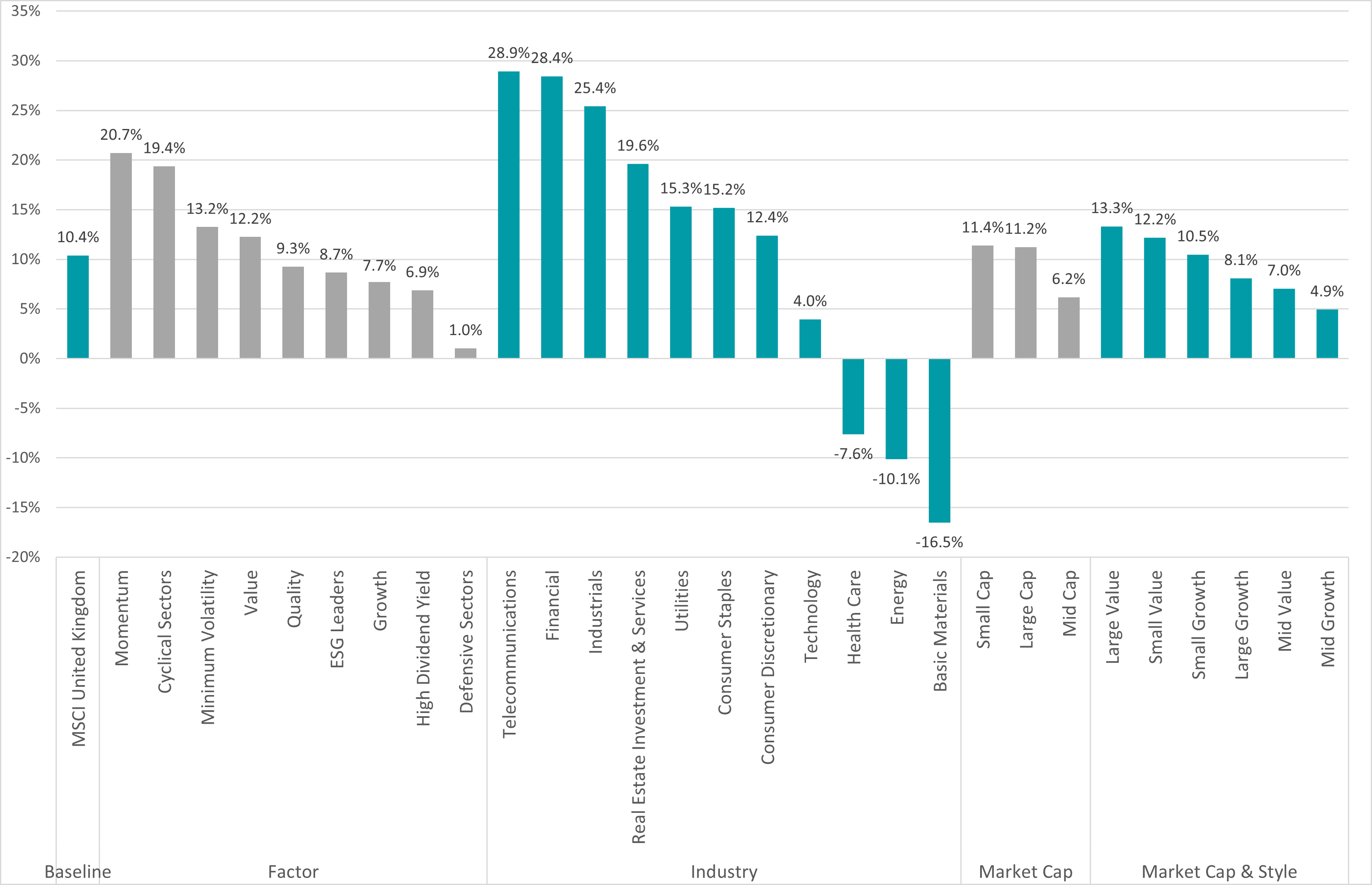

Performance of UK market over 12 months

Source: FinXL

As demonstrated by the table above, momentum proved to be the most lucrative investment factor over the past 12 months, delivering a 20.7% total return.

At the industry level, telecommunications and financials emerged as clear winners, posting robust gains of 28.9% and 28.4% respectively.

Meanwhile, value continued its resurgence, beating growth across every market cap segment. Large-cap value and small-gap value returned 12.2% and 13.3% respectively, ahead of their growth counterparts at 10.5% and 8.1%. Even in the mid-cap space, value (7%) had the edge over growth (4.9%).

While small-cap stocks as a whole returned 11.4%, slightly above a 11.2% gain for large-caps, as is shown in the ranking table, this trend didn’t translate to fund performance. Notably, none of the top 25 performing UK funds over the past year had a dedicated small-cap mandate.

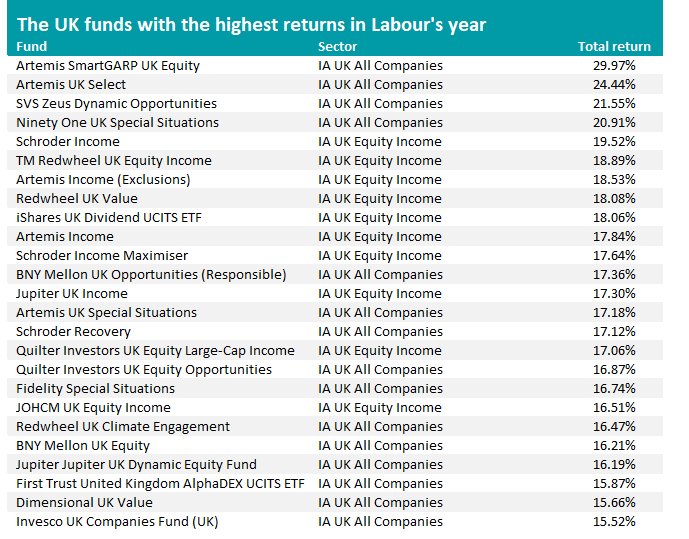

Source: FE Analytics

Of the 25 best-performing UK equity funds over the past 12 months, 15 of the top funds hailed from the IA UK All Companies sector, while the remaining 10 came from the IA Equity Income peer group.

A common thread among the top-performing funds is a clear tilt toward value strategies. In contrast, growth-oriented and small-cap approaches have been notably absent from the top tier of returns during the first year of the Labour government.

Top of the table is Artemis SmartGARP UK Equity, which posted a near-30% total return during the first year of the Labour government – stretching to 144.4% over five years. The fund has almost £880m in assets and a FE fundinfo Crown Rating of five.

Managed by Philip Wolstencroft, the value-focused fund has allocated 23.2% to banks, 9.4% to financial services and 8.9% to oil and gas. Top holdings include Barclays, GSK and Shell.

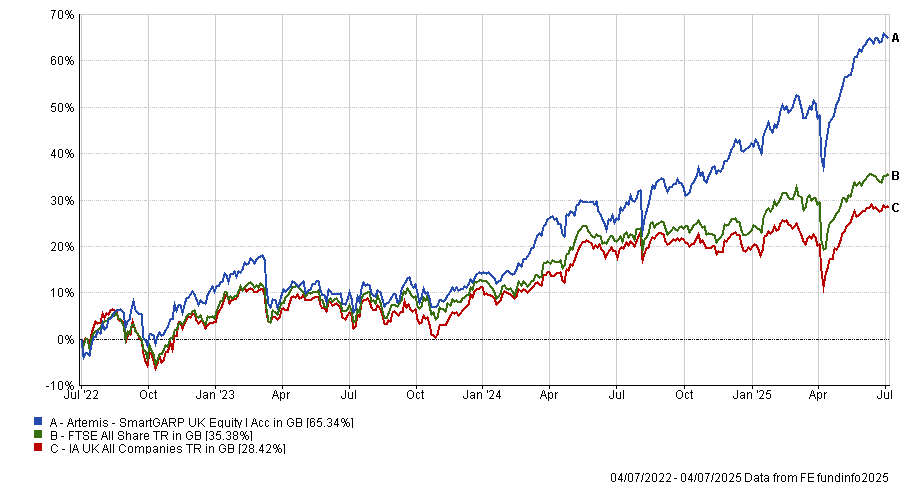

It has also delivered an annualised alpha of 10.8 over the past three years, with a beta of 0.77, suggesting it has consistently outperformed the market while taking on lower volatility.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Also in the top five was Ninety One UK Special Situations, managed by Alessandro Dicorrado, with a 20.9% return over the same period.

Artemis Income, managed by Marsh and Adrian Frost, delivered a 17.8% total return between 4 July 2024 and 4 July 2025, securing a spot in the top 10 performers.

Just missing out on the top 25 in 26th place in the rankings was the first non-equity entrant – VT Redlands Property Portfolio. Targeting long-term capital growth, it returned 15.4% over 12 months and 12% over five years. Top holdings include TR Property Investment Trust and Legal & General Global Infrastructure Index.

The highest-ranking UK small-cap fund was WS Raynar UK Smaller Companies, which came in 53rd overall with a 12-month return of 11.9%.

Justin Oneukwusi, chief investment officer at St. James’s Place, said Labour’s “clear, pro-growth tone and a willingness to engage with business” has brought stability for both markets and investors.

Looking forward, he said: “Regulatory clarity from a growth-oriented government is essential as it gives businesses and consumers confidence, and encourages long-term investing. Leveraging regulation to support better investment decisions, particularly in the UK market, could unlock capital that fuels sustainable growth.

“However, markets also value fiscal credibility. Any move away from fiscal rules risks unsettling bond investors, especially at a time when global debt is rising and uncertainty is weighing on bond markets. Staying the course on fiscal discipline will help reinforce market confidence.

“Investors want predictability on regulation, on tax, and on the broader economic direction. Striking the right balance between reassurance and realism will be crucial. Recognising the role of the private sector in delivering growth will give the Government more levers to pull. In a volatile global landscape, the UK has a real opportunity to lead by creating the certainty that investors and businesses need to plan and grow.”