The second quarter of 2025 saw both a sell-off sparked by US president Donald Trump’s ‘Liberation Day’ tariffs and markets reaching record highs, but which funds made the best returns?

The Trump administration sent risk assets into freefall in April when it hit trading partners with higher reciprocal tariffs than investors were expecting, only to announce a 90-day pause. Stocks rallied in relief and have been climbing since.

Chris Beauchamp, chief market analyst at IG, said: “Equity markets, and investors themselves, have been on a remarkable journey in Q2.

“From the terrifying lows of April to the dizzying heights of the past week, the rebound has caught many by surprise. As we head into Q3, investors are still fretting about inflation and a possible recession, but these threats seem much less imposing than they did three months ago.”

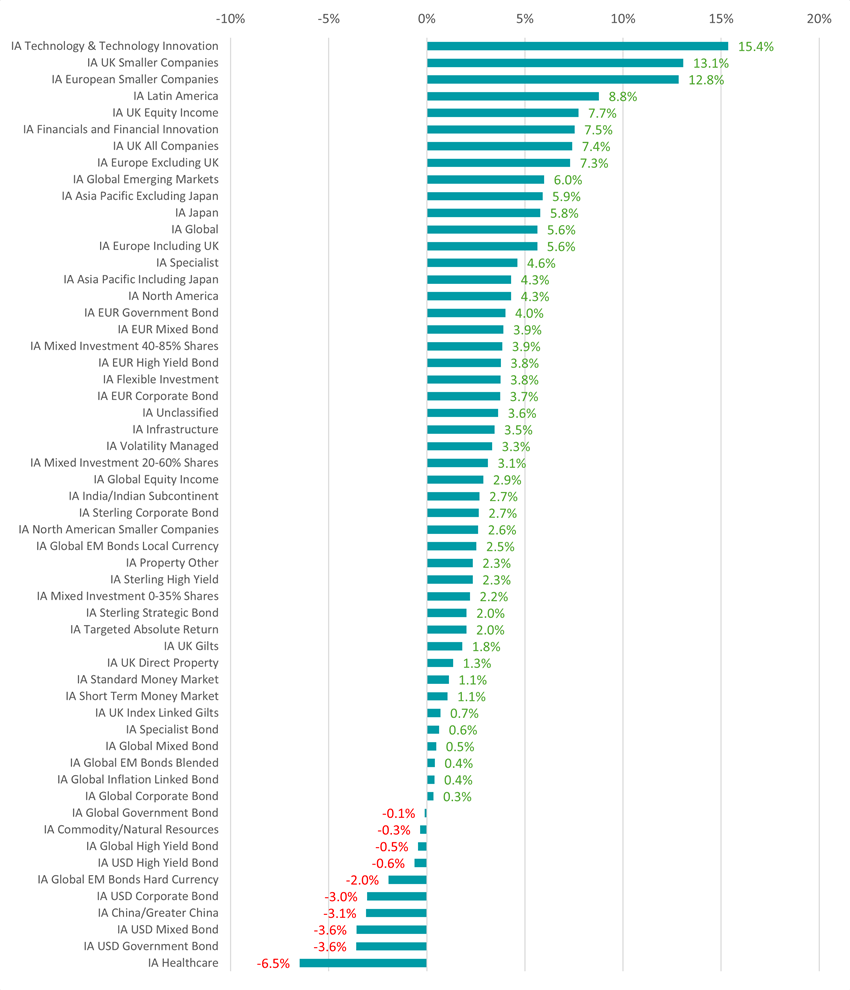

Performance of Investment Association sectors in Q2 2025

Source: FE Analytics

The chart above shows the average return of each Investment Association sector over the past three months, with IA Technology & Technology Innovation in the lead after making 15.4%. This did come, however, after an average loss of 11.1% in 2025’s first quarter.

Optimism returned after April’s tariff-induced dip as investors were encouraged by a combination of strong corporate results and easing trade tensions, which helped the Nasdaq rise to record highs.

The primary market catalyst remained AI and semiconductors. Market leaders like Nvidia and Microsoft delivered eye-catching returns, with Nvidia alone adding over 40% in the second quarter, driving large-cap tech performance.

Analysts also raised price targets on key chipmakers, citing expected continued demand for AI infrastructure.

UK funds had a resilient quarter, with the FTSE 100 hitting an all-time high of 8,884 on 12 June 2025.

Sterling had a strong quarter, climbing about 6% against the US dollar - its steepest quarterly gain since October 2022 - driven by optimism around a UK-US trade deal.

Mid-cap stocks also held up, with the FTSE 250 delivering its best quarterly return in more than four years. It gained 12.5% on robust domestic demand and fresh trade optimism.

At the bottom of the table is the IA Healthcare sector, where the average fund was down 6.5%. The peer group has struggled for some time, as recently examined by Trustnet, thanks to a mix of regulatory uncertainty, pricing pressures and persistent investor rotation.

Factors such as looming patent expiries (known as ‘patent cliffs’) and ongoing debate over drug‑price reforms have weighed heavily on sentiment. US policies expanding Medicare’s negotiating power and imposing international price comparisons have intensified concerns about future revenue and margins.

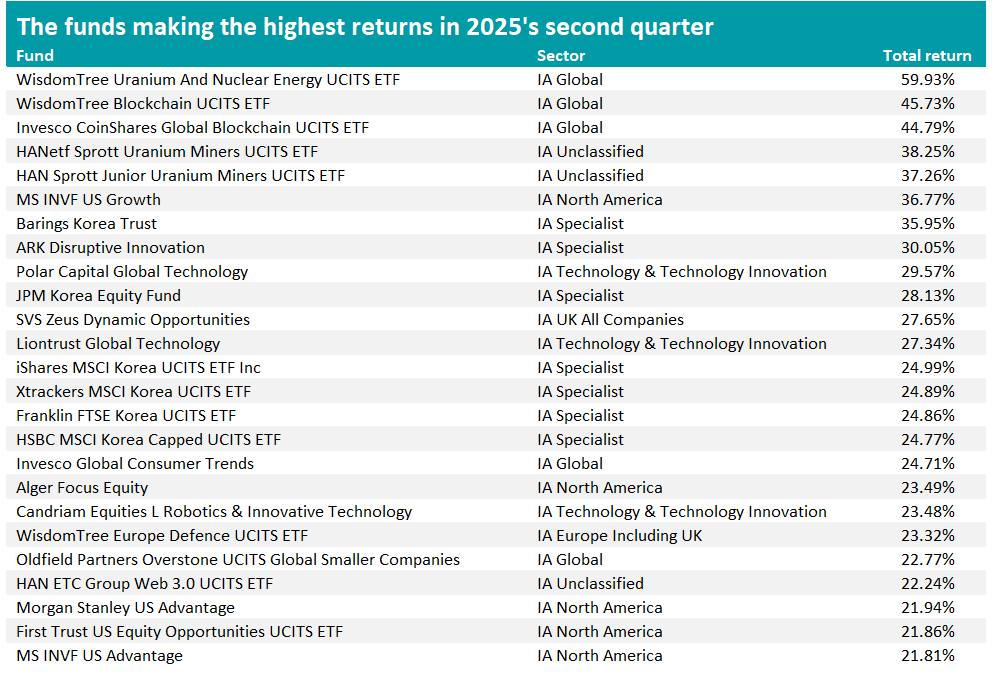

Source: FE Analytics

Turning to individual funds, the best performer was WisdomTree Uranium And Nuclear Energy UCITS ETF, up just under 60%, with HANetf Sprott Uranium Miners UCITS ETF and HAN Sprott Junior Uranium Miners UCITS ETF also appearing in the top five.

Uranium ETFs performed strongly as uranium prices climbed steadily through the quarter and equities linked to uranium production rebounded from earlier lows.

This rise was fuelled by a growing supply shortfall, with global uranium production unable to meet increasing demand from operating reactors. Output cuts by major producers further tightened the market.

Blockchain-themed ETFs such as WisdomTree Blockchain UCITS ETF and Invesco CoinShares Global Blockchain UCITS ETF delivered strong performance in Q2 2025 as the crypto market rebounded and investor appetite for blockchain technology gained momentum.

The rally in Bitcoin and other major cryptocurrencies (Bitcoin rose nearly 30% during the quarter) boosted confidence and buoyed ETFs focused on blockchain infrastructure and related equities.

South Korean equities – and funds like Barings Korea Trust - posted solid gains as foreign investors returned amid easing US trade tensions.

The rally gained further support from sweeping market reforms under president Lee Jae‑myung, including improved corporate governance, higher dividend incentives and the removal of a short-selling ban. These measures reduced South Korea’s ‘Korea Discount’ and raised optimism about the country being upgraded to developed-market status by MSCI.

Other themes include a strong showing from active US growth funds, outside of dedicated tech and blockchain strategies.

Funds like MS INVF US Growth, Alger Focus Equity and First Trust US Equity Opportunities gained over 20%, reflecting that large-cap US growth rebounded strongly. This aligns with Nasdaq’s record-breaking quarter and a rotation back into high-growth names after April's pullback.

European defence is another strong market theme at present. The WisdomTree Europe Defence UCITS ETF made 23.3% in the second quarter while growing to $3bn in assets in just three months after launch.

Core European defence stocks, such as firms like Rheinmetall, Thales and Leonardo, have benefited from rising order books and government spending commitments. Market sentiment was further boosted by the German and EU-wide budgetary shifts, particularly Germany’s massive procurement spending and the EU’s Readiness 2030 plan proposing up to €800bn in collective defence investment.

Broader structural support came from policy moves including NATO’s new pledge to raise European defence spending to 5% of GDP by 2035, Germany’s easing of debt rules and the European Commission’s industrial strategy to rearm Europe.