The FTSE 100 has outperformed more than half of the stocks in the S&P 500 over the past two years – including doubling the returns of tech giant Apple, research by IG has found.

One of the major stories of 2025 has been the underperformance of US stocks – after an extended period of extreme dominance – as the ‘US exceptionalism’ narrative started to crack under high valuations, a weaker dollar and trade tensions caused by US president Donald Trump.

IG’s research has looked at the performance of the FTSE 100 index and the constituents of the S&P 500 since 3 July 2023, when Apple’s market cap surpassed the entire FTSE 100.

Since then, the UK blue-chip index has risen 28% but Apple has gained just 11%.

What’s more, the FTSE 100 has outperformed 53% of S&P 500 companies over this period, beating well-known US stocks such as Tesla (18% return), McDonald’s (6% return) and Starbucks (down 1%).

Share price performance of FTSE 100 vs well-known US companies

|

Index/stock |

Two-year performance |

|

FTSE 100 |

28% |

|

Apple |

11% |

|

Tesla |

18% |

|

McDonald's |

6% |

|

Airbnb |

5% |

|

Paypal |

8.9% |

|

Salesforce |

25% |

|

Chevron |

4% |

|

Starbucks |

-1% |

Source: IG. Period starts 3 July 2023 when Apple’s market capitalisation overtook FTSE 100. Data taken 21 Jul 2025 from Reuters. Rounded up to nearest %

The FTSE 100’s strong performance was driven primarily by financials, defence stocks and ‘old economy’ sectors such as energy and industrials.

UK-listed banks have benefited from higher interest rates since the Covid pandemic and a more stable regulatory system for lending, leading to strong gains. Barclays shares are up 144%, Standard Chartered’s 106% and Lloyds’ 96%.

Defence stocks have also surged as European countries pledged to increase defence spending amid rising geopolitical risks and pressure from the US administration. BAE Systems is up 121% in two years and Babcock rose 280%, but Rolls Royce has shot the lights out with a 560% gain.

Top 10 FTSE 100 performers since 3 Jul 2023

|

Index/stock |

Two-year performance |

|

FTSE 100 |

28% |

|

Rolls-Royce |

560% |

|

Babcock |

280% |

|

Fresnillo |

147% |

|

Barclays |

144% |

|

IAG |

139% |

|

3i |

135% |

|

NatWest |

128% |

|

BAE Systems |

121% |

|

Standard Chartered |

106% |

|

Lloyds |

96% |

Source: IG. Period starts 3 July 2023 when Apple’s market capitalisation overtook FTSE 100. Data taken 21 Jul 2025 from Reuters. Rounded up to nearest %

Chris Beauchamp, chief market analyst at IG Group, said: “The UK stock market faces serious challenges - with more companies currently leaving than joining. But that hasn’t stopped the blue-chip index from delivering the goods over the last couple of years.

“With tariff risks still present and US valuations looking stretched, it makes sense that investors should look for alternative developed markets in which to park their money. UK equities remain undervalued and under-owned despite their strong performance.

“The UK market offers exposure to global earnings, solid balance sheets and valuations that remain relatively low by international standards - suggesting there is still value to be unlocked. Its exemption from the more aggressive elements of Trump’s proposed tariff regime has added to the case for the FTSE, particularly at a time when US exceptionalism appears to be fading and market leadership is beginning to broaden.”

A recent survey of 1,800 UK-based IG clients found that investor confidence in the US market as a leading source of growth has dropped to its lowest point in over two years.

Just 15% of respondents expect the S&P to be the market most likely to experience the highest growth in the coming six months, down from 29% in December 2024.

But despite the strong performance from the FTSE, sentiment towards the UK market remains subdued.

The latest data from the Investment Association shows the IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies sectors have each been hit with net outflows for at least 13 months in a row.

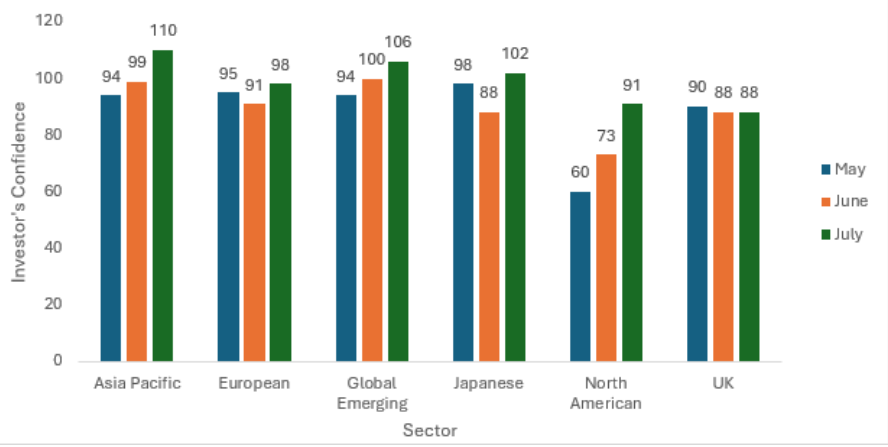

Meanwhile, Hargreaves Lansdown’s Investor Confidence index – which is compiled by surveying the platform’s clients each month – found that investor confidence rose for every region except the UK in July.

Kate Marshall, lead investment analyst at Hargreaves Lansdown, said: “This isn’t a huge surprise given economic and political stability has been called into question – UK GDP has slowed, business costs are mounting and policy reversals from the Labour party have dented its fiscal credibility.

“Investors are also questioning the potential for further interest rate cuts in the UK, across the short, medium and long term.”

HL Investor Confidence Index

Source: Hargreaves Lansdown