Building a portfolio using relative measures is widespread practice in fixed income, whether comparing a bond’s valuation to similar securities or trying to outperform a benchmark by owning its better constituents. But to Jonathan Golan, manager of the Man Dynamic Income fund, both approaches are flawed.

“If you base your investment on an asset that is greatly overvalued, and then say another one is cheap in comparison, you're not actually ensuring any margin of safety,” he said. “Relative value is a fool’s game.”

Buying something simply because it appears cheaper than a worse alternative does not provide protection, only the illusion of it. “We never invest based on what’s cheap versus the rest of the market,” he said, but rather focus on cheapness in absolute terms.

He applied the same criticism to benchmark-relative investing, which he argued leads to arbitrary and dangerous positioning. “If you use the benchmark to allocate assets, you’re using a completely arbitrary metric to decide where you want to invest,” he said. “You’re using the size of a company’s debt as a proxy for expected return. There is no logical or mathematical reason why larger issuers should produce better risk-adjusted outcomes.”

Yet that is exactly how much of the fixed income world operates, according to Golan. Managers typically attempt to own the better parts of the benchmark while avoiding the worst – a style that is “the antithesis of margin of safety”.

“It's why many investors end up doing the opposite of what they should: taking on risk when spreads are tight and panicking out when prices are attractive,” he said.

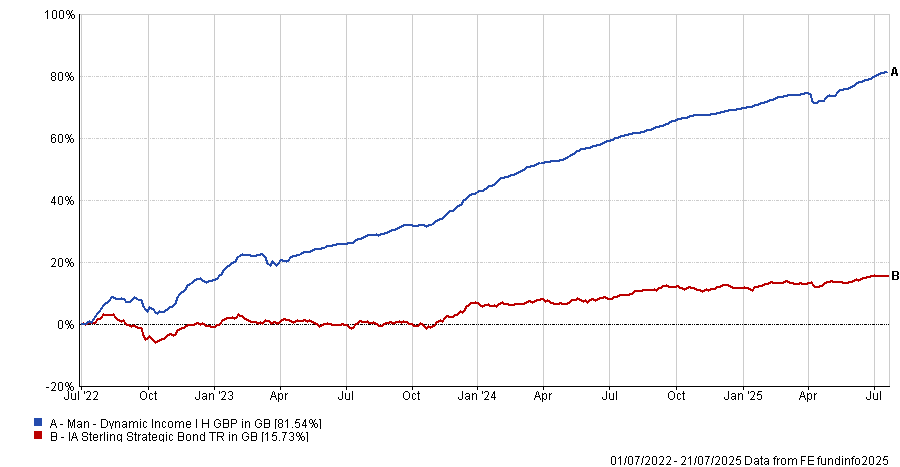

It’s also why his own fund – launched in 2022 and already topping the IA Sterling Strategic Bond sector over three years with a return of 80.1% – is explicitly benchmark-unaware.

Rather than carve up the world based on regions or ratings, Golan breaks the market into segments clustered by rating, seniority and sector, and assesses each bond against its own historical valuation range, as he recently explained to Trustnet.

The result is a portfolio that tends to diverge heavily from peers. Man Dynamic Income has been heavily tilted toward financials and European service companies this year, two areas Golan described as offering the best margin of safety after the collapse of Credit Suisse and renewed risk appetite following Liberation Day.

But more important than the sectors themselves is the mentality behind them. “Everyone is cyclical at heart,” he said. “It’s human nature. People get aggressive when the market is expensive and defensive when the market is cheap.”

To avoid falling into that trap, Golan insists on two things: an absolute valuation anchor and a broad enough opportunity set to go where the value is. That often means lending where others won’t – not because the risk is higher, but because the perception of it is.

In 2022, when European real estate was trading at levels below the eurozone crisis and Covid, he saw a buying opportunity.

“That’s not a once-in-a-cycle event, that’s a once-in-multiple-cycle event. If the worst-case scenario is priced in seven times over, of course we’ll go in.”

It’s in these dislocations that his process – though systematic and data-driven – still relies on judgement. Every bond flagged as cheap by the firm’s quantitative screen is then subject to fundamental analysis to rule out value traps.

“Nineteen times out of 20, those names are value traps,” he said. “It’s only the 20th that gives us the return.”

And while he insists there is no “perfect” model, Golan noted that no single issuer in the fund has detracted more than 20 basis points from performance in two years.

That makes his fund a core offering in his view – albeit not one suited to benchmark-thinkers. “This is for investors who want a properly diversified portfolio with deep-value opportunities,” he said. “It’s not about chasing yield. It’s about getting risk-free return, not return-free risk.”

The numbers so far support him. Since launch, the fund has not only outperformed the sector, as illustrated below, but done so with strong downside protection and what Golan calls “mostly upside volatility”.

“Volatility only matters if it’s downside,” he added. “If it’s upside, you want as much of it as possible.”

Performance of fund against index and sector since launch

Source: FE Analytics

However he does not compare himself to his peers. “It’s hard enough to do this job well,” he said. “If I start worrying about the competition, it would be doubly hard.”