The average woman in the UK is set to retire with far less in their pension pot than men, with experts urging women to take matters into their own hands to close the savings gap.

To catch up, women can increase the amount they save in the years they are working, by exploring their investment options and risk appetite and maximising auto-enrolment contributions.

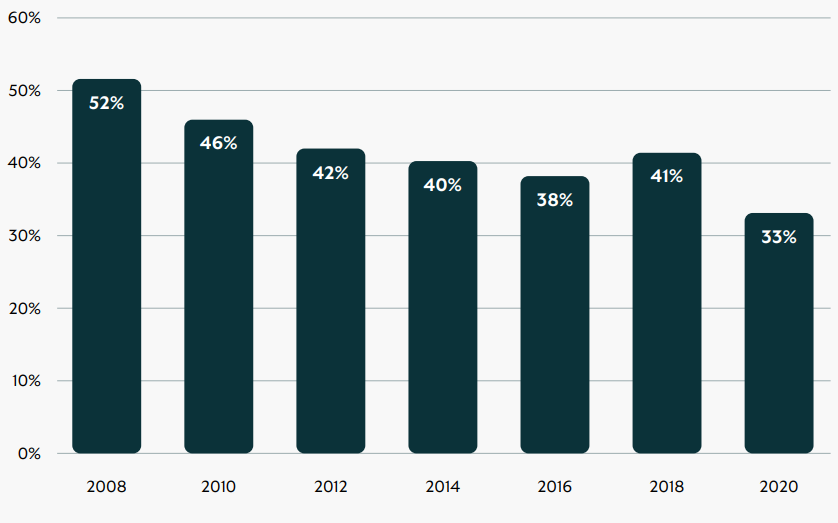

Recent research by the Department for Work and Pensions (DWP) found that the difference between the private pension wealth of men and women aged 55-59 was 48% between 2020 and 2022. The gender pension gap was smaller for younger people (22% for ages 25-29) but increased over time.

Separate 2024 research by Scottish Widows projected a 30% gender gap in retirement income overall, with 42% of women at risk of poverty in retirement compared to 35% of men.

Gap in private pension assets between men and women

Source: Scottish Widows, Frontier Economics analysis of the Wealth and Assets Survey, ONS

The cause of this disparity can be boiled down to two simple facts: women are, on average, paid less than men and they work fewer hours across their working life, due to factors such as having children or being more likely to adopt the role of carer for family members.

Lisa Picardo, chief business officer UK at PensionBee, said: “The DWP’s latest figures reinforce what we already know: a significant disparity persists in women’s retirement outcomes.”

Although experts acknowledged that high-level policy changes are required, they have also outlined steps women can take to bridge the gap.

Take more risk

With decades until retirement, women need to adopt a higher risk appetite, Picardo explained.

“Higher-risk investments with potential for higher returns, such as equities, tend to generate more growth over the long term”, she said. “For women in their 40s and 50s, this period is crucial for optimising pension savings and making strategic plans for retirement.”

This extends to auto-enrolment pension schemes.

Sarah Pennells, consumer finance specialist at Royal London, urged women to check where their workplace pension is invested.

Many workplace pension providers automatically “lifestyle” a pension saver’s investment mix as they approach retirement age, gradually shifting money from higher-risk, growth-focused investments like equities to lower-risk, more stable investments like bonds and cash.

But this doesn’t necessarily work for a woman looking to build her pension pot. “Many women are in default funds that might not suit their goals,” Pennells explained. “A quick review could help their money work harder.”

Rachel Vahey, head of public policy at AJ Bell, said this doesn’t mean women have to put their entire savings into global equity or private equity, however.

“They may choose to keep some more cautiously in that default fund, but a percentage of their money can and should be used to get better results,” she said.

Maxing out auto-enrolment contributions

One crucial change a young woman can make upon entering the workforce is to immediately maximise pension contributions.

“The magic of compound growth works wonders over longer periods, making early contributions incredibly impactful,” Picardo said. “Even a small increase can have a significant impact on your future pension pot.”

Always check if an employer offers matched contributions, she added. “This is essentially ‘free money’ for an individual’s pension and can help grow savings much faster.”

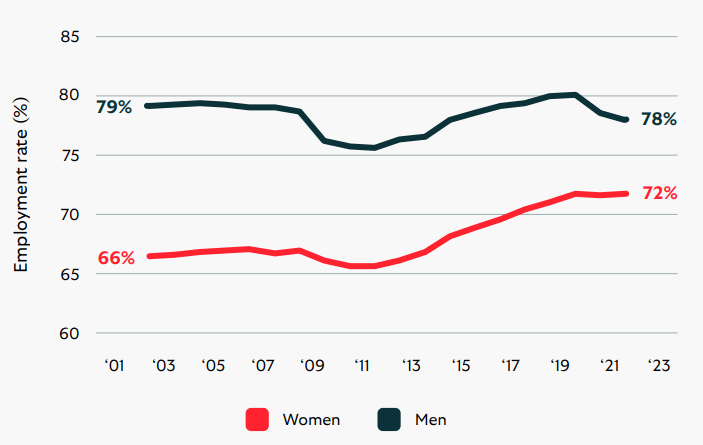

Employment rate for women 2003 to 2023

Source: Scottish Widows, ONS, LMS

Susan Hope, business development director at Scottish Widows, highlighted modelling research conducted by the pension provider based on an extra 1.15% extra pension contribution across a woman’s working life.

“This would fully negate a woman taking a five-year break from work,” she said. “So paying as little as 1% more when in full-time work will give women that breathing space to pause their career [when having children or for other reasons].”

Getting to grips with the pension pot

To understand how big their individual pension savings gap is, it’s crucial that women map out what they currently have and how much they will need, experts agreed.

This includes a state pension forecast to identify any potential gaps in their national insurance record, as you need to have worked 35 years to receive the full amount.

“The sooner women can plug any gaps, the better,” said Camilla Esmund, senior manager focused on consumer campaigns, financial education and retail investment analysis at interactive investor (ii).

In addition, Picardo pointed to the importance of checking child benefits.

“If a woman takes time out of work to care for children, even if they don’t claim child benefit due to earning above the threshold, they can ensure they are registered to receive national insurance credits until their youngest child turns 12,” Picardo said.

“This protects their state pension entitlement, ensuring they can accumulate necessary qualifying years.”

Women must also think about the impact of annuities when doing their financial planning for retirement, according to Hope.

“We know that over 80% of annuities bought are single life male,” she said. “We then often have a situation where the male partner dies and the female partner had no idea that part of her income would then stop, because it hasn’t been treated in a joint financial planning arena.”

High level change

Ultimately, bringing about true gender equality across pension savings falls on the shoulders of the government.

The experts called for the extension of auto-enrolment to younger workers and those in multiple part-time jobs, the recognition of unpaid caregiving by building greater awareness of the ability to claim national insurance credits, the introduction of flexible contributions that support people taking career breaks or returning to work, and better financial education for people at different life stages.

“We can’t keep putting the onus on individuals to fix a system that doesn’t work for everyone,” said Pennells. “The gender pension gap is real and it’s significant.”