SpaceX has become Scottish Mortgage’s biggest contributor over the past year, with manager Lawrence Burns describing it as “one of the most important geopolitical assets in the world”.

Its contribution over the past 12 months has more than offset the losses from the bankruptcy of former private holding NorthVolt, as Burns explains below, while also discussing new holdings and the main risks for Scottish Mortgage shareholders.

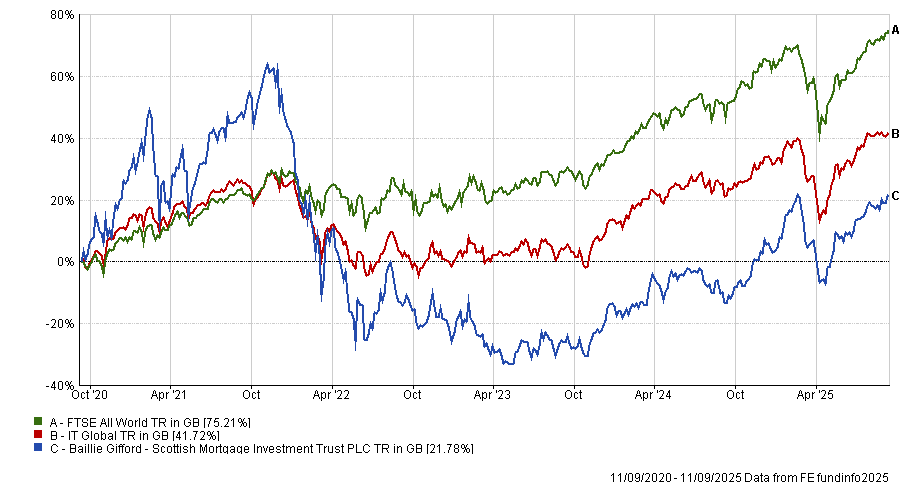

Performance of trust against index and sector over 5yrs

Source: FE Analytics

What’s the trust’s process?

We are looking for the world's most exceptional companies from anywhere in the world, whether they're public or private. We try and own them for five or 10 years, sometimes more, to fully benefit from the upside.

Having a stake in the future comes with a degree of uncertainty and volatility, so you need a five- to 10-year time horizon. That said, everyone should have a stake in the future in their portfolio, but it's about the size of the position.

When does the trust tend to do well and when not?

Our portfolio generally delivers over the long run, but there will be some periods where it does less well, for example, when digitisation slows down, as it did at the end of the Covid lockdowns. Higher interest rates and risk-off markets also don't favour the trust.

However, outlier companies can deliver exceptional returns even in the most difficult of macroeconomic and political backdrops. We have seen that time and time again with [Latin American e-commerce] Mercado Libre. Latin America has not been a pretty place to invest over the past 10 or 15 years from a macro perspective, but Mercado Libre has been able to generate huge amounts of shareholder value.

What do you see as the biggest risk in the portfolio right now?

You could point out different macro factors that would be less helpful to us, for example, if you had a massive historic rise in interest rates like we did a few years ago.

But if the development of AI turned out to be massively disappointing, that would also impact the trust. If you look at the technical capabilities of large language models today, you don't need to develop them further – you've got years of the current ones percolating through companies and improving them. If that was to end overnight, it would be difficult.

Are tariffs a risk?

They are a risk for the global economy, and all of our companies operate within the global economy. So far, however, our companies seem to be navigating that a lot better than even we would have hoped. Shopify’s success in recent quarters probably speaks to that, and it was thought to be one of those companies that might be particularly vulnerable.

We don't have a lot of exposure to companies that make things in one country and export it to another, so that reduces the immediate risk profile. When that is the case, for example for companies such as Ferrari and Hermes, they have incredible pricing power, and to buyers of their products, the idea of paying 30% extra for the Ferrari they've waited more than a year for is less of a problem than most people might imagine.

What was the best call of the past year?

The top contributor in the past 12 months to the end of August was SpaceX, which contributed 4.43 percentage points to net asset value (NAV).

The stat that always stuns me is that about 78% of the active satellites in orbit are SpaceX’s Starlink satellites. That's the degree of domination it's got in terms of access to space.

The potential is huge, because every day, you can read articles about what people think it might be able to do in space, from science experiments to computing in orbit with data centres. I suspect SpaceX is probably one of, if not the most important geopolitical asset in the world.

The US government has realised that SpaceX is an important partner for America's security interests, whether they like it or not. There is a degree of irreplaceability.

Why did you sell Tesla?

It was more around valuation. After the November election, the share price of Tesla had around $500bn of market cap added to it within the space of a month or so.

We owned Tesla for the potential in electric vehicles, but we also thought it could leverage its advantage in autonomy into robotics, particularly humanoid robotics. We maintain a small remaining holding because this is a company trying to do big and ambitious things, and frankly, if we see more evidence of it working, particularly on the broader robotics side, we could end up building that holding up again in the future.

What was the worst contributor over 12 months?

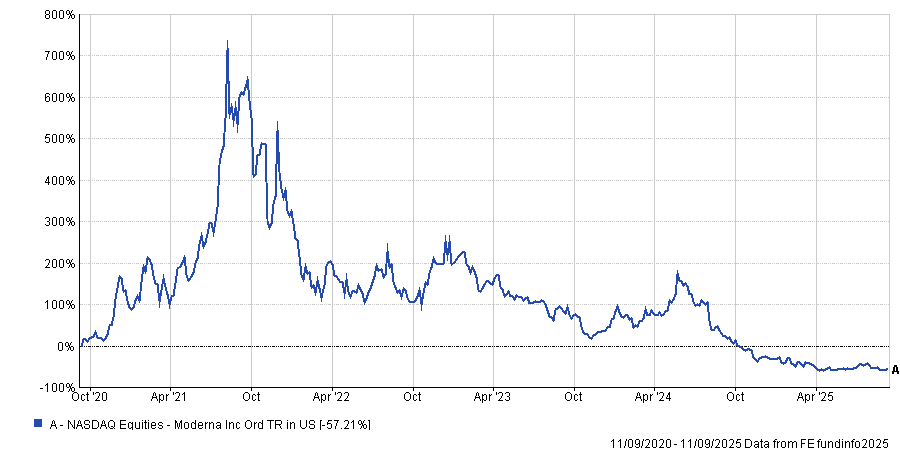

Moderna, which detracted 3.45 percentage points. It has been a very difficult holding for us for a while. We still believe that there is a huge amount of potential in its mRNA technology, and the cancer vaccine has had very good trial results, but the sizing of the markets and the commercial execution haven't come through as we would have hoped.

We look back on that, and it's right that it might still have potential from here, but we've been wrong to hold it so far.

Performance of stock over 5yrs

Source: FE Analytics

What about Northvolt?

Northvolt was trying to build a battery supply chain for Europe and a few things went wrong. The execution of building up the capacity did not go as well as we would have hoped: there was a slight degree of overstretching. Also, the degree to which the various stakeholders that were willing to support it made it more difficult than we would have anticipated.

What matters more, however, is the things you get right than the things you get wrong. Over the past 12 months, the valuation of SpaceX has made more money for Scottish Mortgage shareholders than the downward valuation of Northvolt.

We absolutely need to learn from Northvolt and improve on it and recognise the mistakes that we made in analysing it. But at the same time, the nature of growth investing is you will invest in some companies that deliver a very high multiple return and work very well, and you will deliver some that can't. The real job we have is to improve the odds of that each time we go through with new holdings.

New holdings like the Chinese CATL, another battery manufacturer?

Yes. The big picture is the same – the huge opportunity for demand for batteries as the world transitions from combustion to electric. The difference to Northvolt is that CATL is a radically different company in terms of maturity, with around 40% market share globally. That's the attraction.

What held us back historically was whether the market opportunity within batteries was large enough that, even with a dominant share, you could make a very large multiple from this starting point.

A combination of increasing conviction in the competitive edge of CATL and the view that you can start with car batteries and then move to ships, makes it a multi-decade structural growth story where CATL is uniquely well positioned. In some ways, the failing of Northvolt only adds to that strength.

What do you do outside of fund management?

Read, travel, and I have two young children, so the combination of those three takes up most of it. Travelling with children gives you an excuse to go and do things that you want to do, but might otherwise feel too old to do.