Financial markets clearly want to push higher as the shock of Trump 2.0 recedes. In precious metals, that means investors are looking beyond 'safe haven' gold towards silver, platinum and palladium as pro-growth alternatives.

Known as the 'white' precious metals, these industrial assets have leapt in price to multi-year highs on a sudden recognition of both their solid productive uses and, more urgently, their current supply-demand deficits. Indeed, the lack of readily available platinum in London's bullion market sent one-month borrowing costs soaring from 5% annualised at New Year as high as 45% in mid-July.

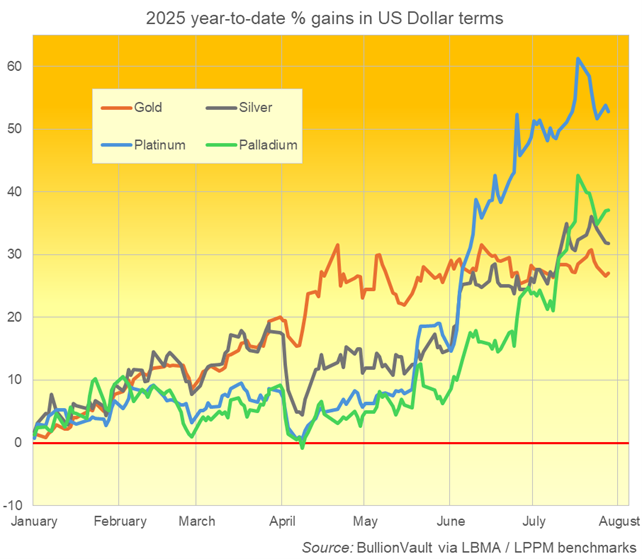

On a historical basis however, and despite now overtaking gold's percentage price gains year-to-date, the whites remain under-valued versus the yellow metal. Silver priced against gold now costs 20% less than its 21st century average; platinum is trading $2,000 per ounce below the gold price having consistently shown a premium until 2015; palladium's dollar-per-ounce discount to gold has tripled in the past two years.

These relative discounts to gold have helped spur heavy catch-up bets in futures contracts, physical bullion and exchange-traded funds; they are also driving substitution by some household and industrial consumers. Together, that should widen the white metals' supply-demand deficits, supporting the investment narrative still further after the explosive price gains of June and July.

Source: BullionVault. Year-to-date US dollar % price performance of gold, silver, platinum, palladium

Net of scrap supply and recycled jewellery, silver finds over 50% of its demand from industrial and other productive uses rather than investment or adornment. More than five times the proportion for gold, that figure rises to 65% for platinum and 96% in palladium.

The white metals therefore carry an obvious appeal as 'hard asset' growth plays. And the more that gold is remonetised by central banks hoarding it as a geostrategic asset, the less affordable it becomes for jewellery consumers in particular.

As the second-largest market, India's gold jewellery demand is highly price sensitive. It is now making a sizeable shift towards silver, even though the white metal itself hit an all-time high in rupee terms in June.

Gold-plated silver in particular is enjoying strong demand for pre- and post-wedding events, according to specialist analysts Metals Focus, making bridal jewellery sets accessible to more income groups and "amplified by the sheer scale of India’s wedding market", where the number of marriages nearly doubled last year compared to 2021, reaching almost five million.

Platinum is enjoying a sudden return to favour among jewellery manufacturers and retailers in No.1 gold consumer China, sucking in metal to stock inventory. That's because the safe haven's run of record high prices, having forced hundreds of outlets to close last year, continues to crush demand. Already in 2025, fabricators have launched 10 platinum-jewellery showrooms in manufacturing hub Shenzhen's wholesale district of Shuibei, tripling the number now open.

Electronics demand for palladium meanwhile remains a small part of its total market, but hard drive shipments will rise again in 2025 amid the boom in data centres according to analysis from Johnson Matthey. Palladium is also gaining appeal as a substitute for gold in printed circuit boards. Again boosted by AI applications, that sector − in which precious metal electroplating accounts for a sizeable chunk of total material cost − aided a 9% rise in total electronics demand for gold in 2024, up to a three-year high, according to the mining industry's World Gold Council.

Palladium's largest use, however, remains in autocatalysts to reduce emissions from gasoline engines, which accounts for over 90% of end-use. Despite ever-tighter standards implying higher loadings per unit, the rise of battery electric vehicles has hurt global demand and crushed sentiment towards the metal's long-term outlook. As a result, speculators have now held an unbroken bearish view in US palladium futures and options since October 2022. But that net short has shrunk by more than 75% so far this year, while palladium ETFs have swollen to a record size.

Also finding its single largest use in autocats at around 40%, platinum appears to be overcoming electrification's hit to sentiment, rising back to prices not seen since the 'dieselgate' emissions-cheating scandal of 2015. Platinum ETFs have also grown by size and are approaching a record value thanks to the metal's price jump. But with speculative positioning in futures and options still below historic peaks, platinum's sudden re-pricing appears more clearly driven by trading in the physical market, as this spring's surge in Chinese imports coincided with an accelerating decline in output from No.1 miner South Africa, down as much as 24% year-on-year.

Like palladium, the end-use market in platinum is set for a third annual deficit of supply versus demand in 2025. But its shortfall is twice as large at nearly 10% of mining output, and it will run until at least 2029 on analysis from the mining industry's World Platinum Investment Council. Silver meantime faces a structural deficit now in its fifth consecutive year as record-high industrial use meets price-inelastic mine output (two-thirds comes as byproduct from base-metal projects).

All this said, an investor considering the white metals should note that, despite their very different supply and demand dynamics, they rarely move separately to gold. Silver most of all remains in the yellow metal's orbit, with its price moving in the same direction as gold's 77% of the time day-to-day, week-to-week and also year-to-year across the past half-century. But these smaller markets are necessarily more volatile (silver's is around 1/10th the size of gold's by value, with platinum and palladium each around 1/10th of that). That's likely to help attract speculative as well as longer-term inflows for as geopolitics and fears over the size of government deficits keep gold front and centre.

Adrian Ash is director of research at BullionVault. The views expressed above should not be taken as investment advice.