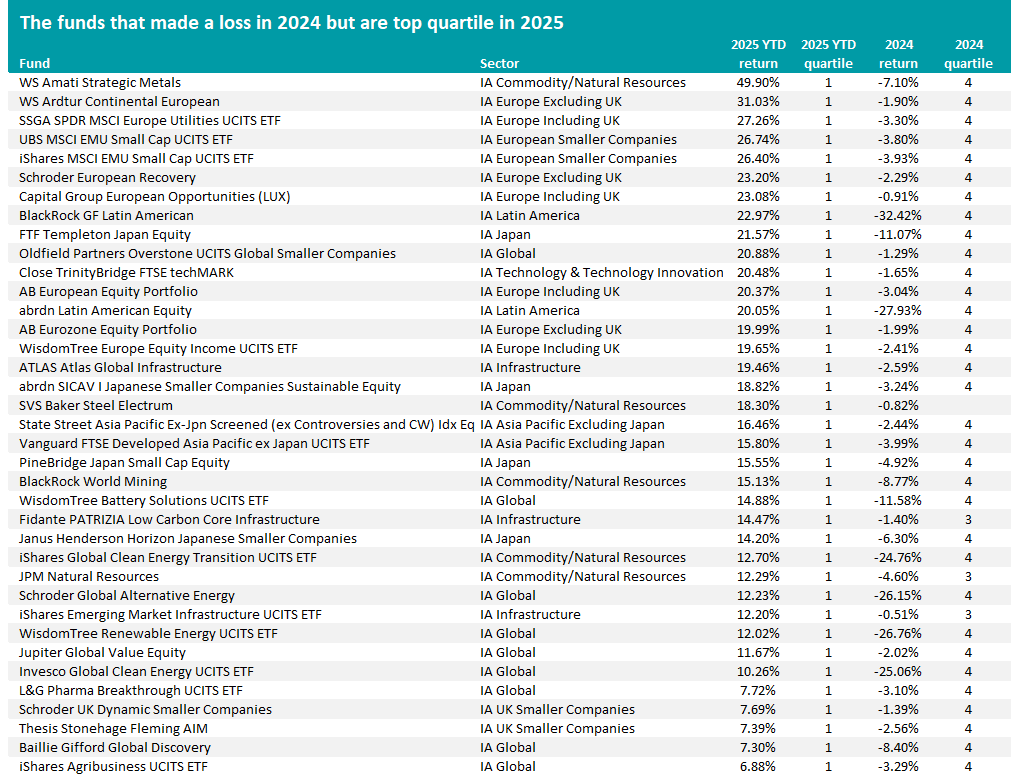

Close to 40 equity funds lost money in 2024 but are in their sector's top quartile over the year to date after markets reacted to the new US government, economic sentiment and geopolitics, Trustnet research shows.

Stock markets in 2024 were shaped by persistent inflation in services, diverging global interest rate paths and a loss of momentum in China’s post-Covid recovery. Investor sentiment swung between optimism over AI-led earnings growth and caution around central banks delaying rate cuts longer than expected.

By 2025, the outlook became more constructive as inflation fell steadily and investors eyed more rate cuts, supporting risk assets. Equities rallied globally on renewed hopes for a soft landing, though geopolitical risks and uneven growth in Europe continued to temper gains.

This shifting environment caused some funds to lose money last year, only to jump into the first quartile in 2025 – FE Analytics shows there are 38 funds from the Investment Association’s equity sectors that have done this. They can be seen in the table below, which is ranked by their year-to-date returns.

Source: FE Analytics. Total return in sterling

At the top of the table is WS Amati Strategic Metals. It lost 7.1% in 2024 and was in the IA Commodity/Natural Resources sector’s bottom quartile but is in the top quartile this year with a total return of just under 50%.

The £50m fund only invests in companies where revenues come from the sale of strategic metals, or metals such as gold, copper, nickel, silver and lithium, that have strategic importance to the global economy.

Analysts at FundCalibre said: “WS Amati Strategic Metals is a great portfolio diversifier that taps into unique investment opportunities, including the transition to a lower carbon world.”

While the price of gold has surged in recent years, miners in general have had more mixed fortunes. The MSCI AC World Metals & Mining index fell 11.2% in 2024 on lacklustre earnings prospects, weaker industrial metals demand and investor caution.

However, the index is up 17.3% in 2025 so far. This rebound was driven by gold miners, which have outperformed on the back of record gold prices, but base metal-linked miners have benefited from a more constructive outlook, particularly for copper and lithium, as the energy transition narrative regained traction.

Reflecting this turnaround in the metals and mining space, another four IA Commodity/Natural Resources can be found in the list of funds that made losses last year but have jumped to the top of the peer group in 2025: SVS Baker Steel Electrum, BlackRock World Mining, iShares Global Clean Energy Transition UCITS ETF and JPM Natural Resources.

However, the most common peer group in the table is IA Global, which has nine members making it onto this research’s shortlist.

Some of these global funds fit into the energy transition theme – or the global shift from fossil fuels to low-carbon energy sources such as renewables, electrification and energy storage – noted above. These include WisdomTree Battery Solutions UCITS ETF, Schroder Global Alternative Energy, WisdomTree Renewable Energy UCITS ETF and Invesco Global Clean Energy UCITS ETF, the latter three of which fell around 25% in 2024.

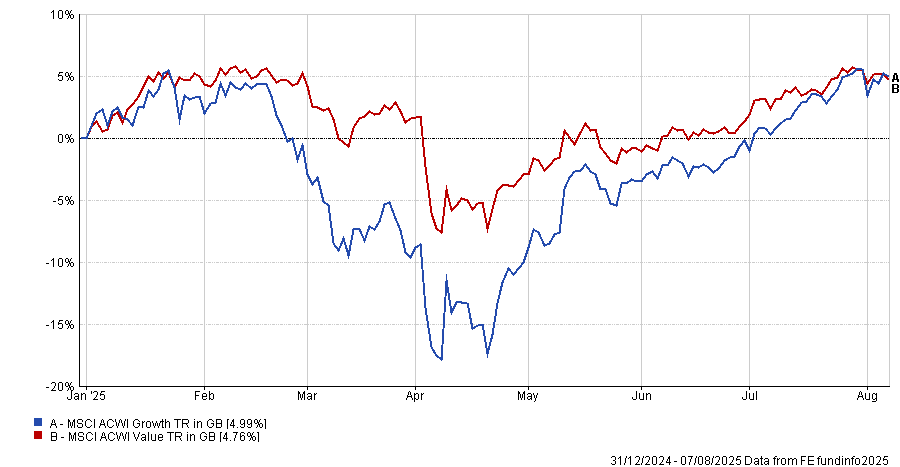

Brian McCormick’s Jupiter Global Value Equity fund is a more conventional strategy that has been highlighted by this research. Value investing lagged behind the growth style by a significant margin in 2024 but, as the chart below shows, this gap narrowed in 2025 – in part due to the underperformance of the expensive US market – although growth has been rallying hard more recently.

Performance of value and growth investing in 2025

Source: FE Analytics. Total return in sterling

As would be expected, Jupiter Global Value Equity is underweight the US while holding more in European stocks than the benchmark. European equities have surged this year, thanks to the cracking of the ‘US exceptionalism narrative’, higher fiscal spending on the continent and improving economic sentiment.

At the start of the year, McCormick noted that valuation levels for the US market are at levels that have only been witnessed during historic bubbles. “By every metric we can think of the US looks very expensive in both absolute and relative terms. It is baking in tremendous optimism and stands in sharp contrast to many markets around the world,” he said.

“Many narratives have been provided to justify a US market that continues to soar above longer-term valuation levels, but as students of financial history will know, the most expensive four words in investment remain ‘this time is different’.”

The presence of Oldfield Partners Overstone UCITS Global Smaller Companies and Baillie Gifford Global Discovery in the above table reflects how smaller companies struggled relative to mega-caps last year but have started to bounce back in some areas as the top end of the US market came under pressure.