The Baillie Gifford US Growth trust has made changes to its investment process after portfolio swings during and after the Covid pandemic “exceeded expectations”, according to managers Gary Robinson and Kirsty Gibson.

In their annual report for the year to 31 May 2025, the managers said that, while “successful high-growth investing requires tolerance for volatility”, the extremes seen during and after the pandemic had prompted a rethink of some elements of the trust’s process.

A key change is an automatic retest of the upside potential for any listed holding that delivers a 2.5x return, regardless of the time taken. This review looks at valuation, competitive position and growth runway to decide whether to hold, trim or sell.

The managers are also monitoring the “overall shape” of the portfolio more closely, aiming for a deliberate mix of growth styles, maturity stages, and structural growth drivers, so that performance is less dependent on one type of company or theme.

For private companies – which now make up more than a third of assets – these adjustments are harder to apply because positions cannot be traded easily. However, the managers said any new private investment will be assessed in the context of the listed portfolio’s balance, to ensure it does not tilt the overall risk profile too far in one direction.

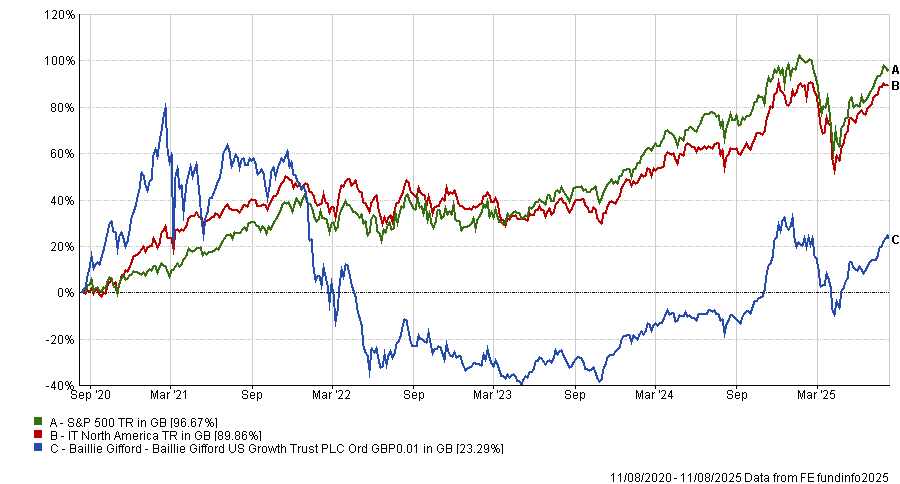

It remains to be seen whether these measures will temper future swings; so far, performance has rebounded strongly in the short term, with the share price and net asset value (NAV) returning 24.5% and 22.1% respectively over the year, compared with 7.2% from the S&P 500 in sterling terms.

However, Robinson and Gibson acknowledged that five-year relative performance “remains weak” due to the base effect from strong pandemic-era gains.

Performance of fund against index and sector over 5yrs

Source: FE Analytics

Portfolio activity

Turnover was 9.1% over the period, with eight new holdings – three private and five public – and four complete disposals.

The new private investments were Rippling, a workforce management system provider, Runway AI, a generative AI video platform, and Cosm, an immersive entertainment company. By year-end, the trust held 27 private investments representing 34.9% of assets.

Listed additions included DraftKings, Lineage, SharkNinja, Globant and The Ensign Group. Robinson and Gibson also added to Cloudflare, citing increased utility of its edge computing platform for artificial intelligence (AI) inference workloads.

The managers reduced holdings in Nvidia, Tesla and The Trade Desk. In Tesla’s case, they concluded that “the holding size no longer reflected our level of conviction” after a sharp post-election rally. The position in Nvidia was cut on risk-reward grounds, while The Trade Desk was reduced after a valuation review.

Complete sales included Sprout Social, 10X Genomics, Coursera and HashiCorp, the latter after its acquisition by IBM.

Investment stance

The managers reiterated their focus on “identifying resilient, adaptable companies which are underpinned by structural growth drivers and whose trajectories are largely price-indifferent”.

While acknowledging the difficulty of navigating unpredictable political and macroeconomic events, they said the priority was to “double down on the things we believe matter” such as falling costs in battery production, advances in artificial intelligence and new biological insights in healthcare.

Chair Tom Burnet said: “The year ahead presents significant opportunities for our investment strategy. Technology continues to reshape entire industries, creating opportunities for the visionary companies in our portfolio.”

The board also confirmed it views gearing as a long-term tool to enhance returns rather than a short-term market timing device and will continue to use it opportunistically within the agreed limits. At the year-end, the trust had net gearing of 13%, compared with 14% the previous year.

As for buybacks, the company repurchased 5.2m shares over the year, at an average discount of 11%, as part of its policy to provide liquidity and limit discount volatility.

The board said buybacks will remain an active part of its capital management strategy, subject to market conditions and the trust’s overall liquidity needs.