Long/short strategies, Personal Assets Trust, gold and infrastructure would all slot into a traditional 60/40 portfolio and provide diversification during these volatile times, according to experts.

Earlier this month, BlackRock urged investors to rethink their portfolio construction and move away from the traditional 60/40 split between stocks and bonds.

The asset manager’s argument was that the world has moved on from the old investing regime of 2010-2020, when inflation was low and central banks supported markets with low rates and quantitative easing.

The new reality is increased economic, financial and geopolitical volatility, meaning the same 60/40 portfolio that delivered strong returns over the past decade may be underperforming today.

Kate Marshall, senior investment analyst at Hargreaves Lansdown, said: “Alternative investments could be considered by those seeking further sources of diversification or, in some cases, balance to their existing portfolio.”

However, she argued that alternatives should “only form a small part of a well-diversified investment portfolio”, up to around 10%. A higher allocation may be appropriate for investors with a specific objective or attitude to risk.

Trustnet spoke to fund experts to see which alternative funds they would recommend adding to an investor’s traditional 60/40 portfolio.

Ittan Ali, research manager at Titan Square Mile, pointed to JPM European Equity Absolute Alpha and Premier Miton Tellworth UK Select.

The former is a long/short equity strategy focused on Pan-European equities, while the latter is a long/short equity market neutral strategy focused on the UK market across the market capitalisation spectrum.

Both funds have common characteristics, he said, highlighting their low to negative correlation to equity and bond markets, stable and experienced management teams and established and consistent performance records.

JPMorgan’s €1.9bn fund has an FE fundinfo Crown Rating of five and is managed by Nicholas Horne, Ben Stapley and Matt Jones. It has outperformed its sector over one, three, five and 10 years, managing a 61.1% return over a decade.

Ali said the fund targets an annualised volatility of 6% and a Sharpe ratio of 1 (meaning the fund is expected to deliver returns that are well-compensated for the level of risk taken). He said this “suggests a gross return of 6% before fees”.

Although its gross exposure is sometimes higher than peers at an average of 180%, it tends to have a very low, almost market neutral, net exposure, he said.

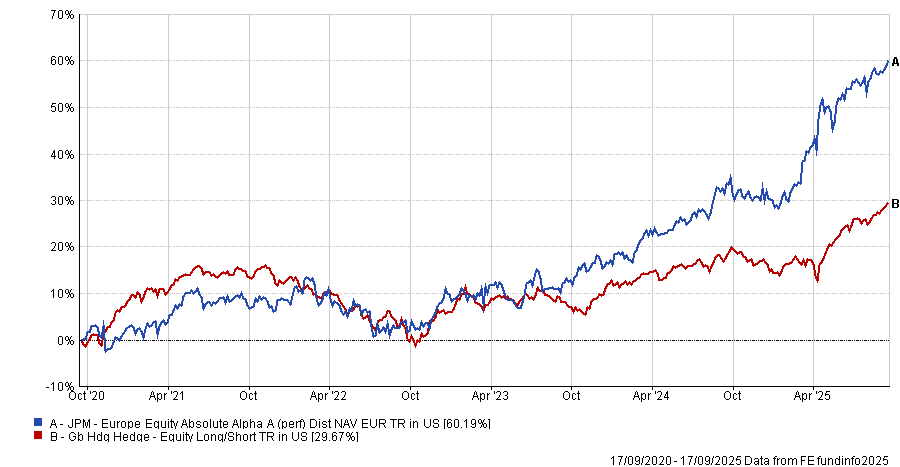

Performance of fund vs sector over 5yrs

Source: FE Analytics

Meanwhile, Premier Miton Tellworth UK Select targets an annualised volatility of 5-7% and Sharpe ratio of 1, which Ali said implies a return target of “at least cash +5% before fees”.

“It has more of a traditional bottom-up stock-picking approach, harnessing the expertise of the managers who have an extensive background in UK equity stock selection, both for long and short idea generation,” he added.

Ryan Hughes, managing director at AJ Bell, also picked Premier Miton’s fund, pointing to the “long experience” of managers John Warren and Paul Marriage.

“Over the past decade, the fund exhibits zero correlation to the UK gilt market and negative correlation to MSCI World, making it an ideal holding to add in alongside traditional assets,” he said.

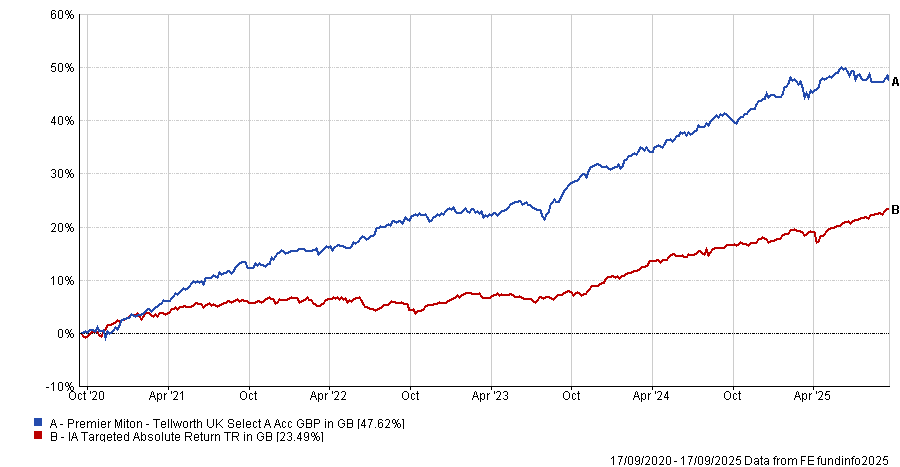

Performance of the fund vs sector over 5yrs

Source: FE Analytics

Hughes picked Premier Miton Tellworth UK Select and Personal Assets Trust as two complementary funds to add into a traditional 60/40 portfolio.

He said he would allocate 10% to each, taking this evenly from the equity and bond allocations.

Personal Assets Trust, which is managed by FE fundinfo Alpha Manager Sebastian Lyon and Charlotte Yonge, has delivered strong returns in exchange for less than half of the volatility of traditional equity markets, according to Hughes. It is trading on a slight 0.8% discount to net asset value (NAV).

However, it has underperformed the IT Flexible Investment sector over one, three, five and 10 years as markets have performed well, leaving the fund languishing against its equity-heavy peers.

“The team at Troy have long been advocates of gold as an investment and have 11% of the portfolio invested here, while over 30% is invested in inflation-protected government bonds, giving a strong real return look to the portfolio,” he said.

In addition, around 40% of the portfolio is invested in high-quality equities such as Unilever, Visa and Microsoft, with a view to long term compounding of returns.

“Given the multi-asset nature of the portfolio, correlations are higher towards equities than Premier Miton Tellworth UK Select, but with exposure to gold, TIPS and multi-currencies, it has a strong alternative look that complements traditional assets very well,” said Hughes.

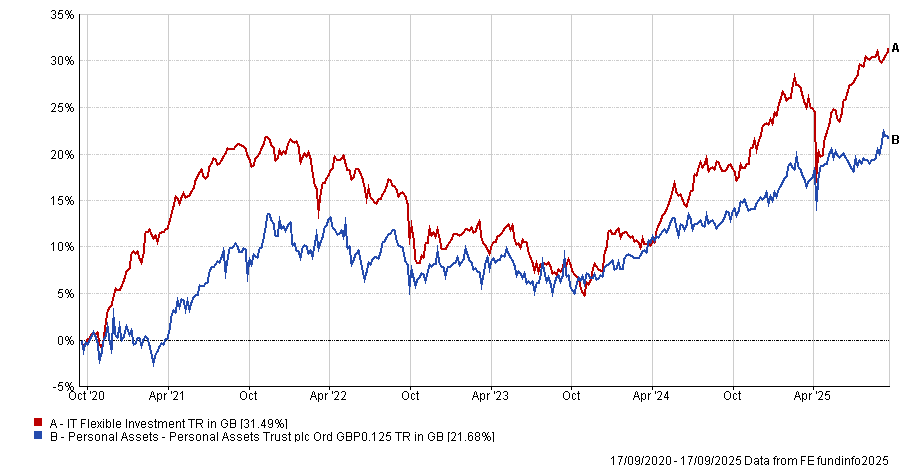

Performance of the trust vs sector over 5yrs

Source: FE Analytics

Meanwhile, Hargreaves Lansdown’s Marshall and Jason Hollands, managing director at Bestinvest, turned to specific assets: gold and infrastructure.

Hollands said gold can offer investors “a bit of an insurance policy” during times of turmoil and uncertainty, adding that it “also has some inflation-hedging qualities over the longer-term”.

He picked the exchange-traded fund (ETF) Invesco Physical Gold ETC as an option, which tracks the London Gold Market Fixing Ltd PM Fix Price/USD index, while Marshall’s pick was iShares Physical Gold ETC, which provides exposure to physical gold and therefore represents real gold bars held in a vault, with JPMorgan serving as the custodian.

Marshall said: “[Gold] has had a fantastic run so far in 2025, rising around 30%, and this might leave investors questioning whether they have missed the boat.”

“While we would not necessarily expect returns to continue at this pace, the uncertain outlook combined with increased buying from central banks, particularly in emerging markets, means that the commodity may well continue to enjoy support, or at least some ballast to a broader portfolio.”

Within infrastructure, Hollands suggested 3i Infrastructure, an investment company listed on the London Stock Exchange with a price-to-earnings ratio just shy of 10x. It provides exposure to unquoted businesses providing vital services.

“The management team has produced a consistently impressive record of deploying capital and executing business plans, and the investment trust has historically outperformed its return targets since its initial public offering in 2007,” he said.

With the UK expected to maintain its commitment to scaling domestic clean energy, there is opportunity in renewable energy infrastructure, added Marshall.

Her pick was Greencoat UK Wind, which invests solely in operating onshore and offshore UK wind farms that are currently producing income.

With a “resilient annual dividend [currently sitting at 9.5%] that increases in line with inflation, while preserving the value of an investment”, the £2.3bn investment trust could suit both investors seeking income and those looking for diversification, she said.

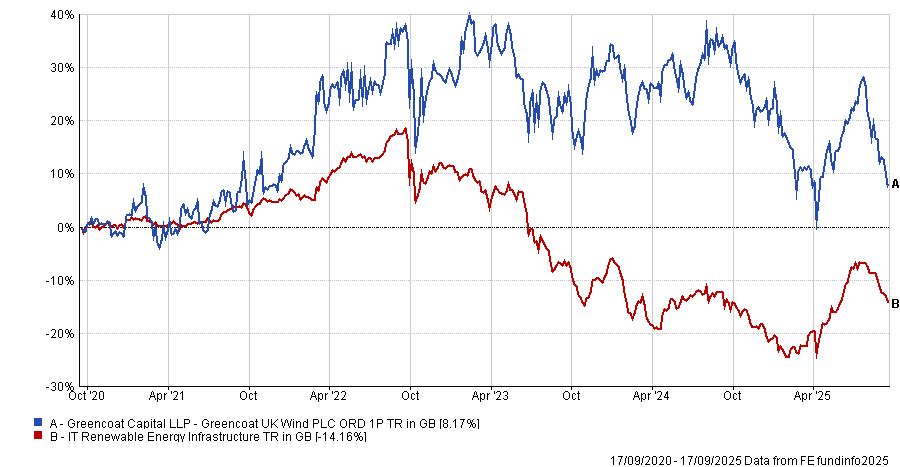

Performance of the trust vs sector over 5yrs

Source: FE Analytics