It may be a cliché, but 2025 has certainly been a rollercoaster for investors, with tariff turmoil, bond market yips and geopolitical shocks all hurtling down the track at breakneck speed. It’s little surprise that even the trusty S&P 500 finally succumbed and dropped 10% during March’s trade skirmishes.

Diversification remains the textbook defence against stock market turbulence, yet is becoming harder to achieve in practice. The Magnificent Seven continue to dominate both developed and global markets, prompting investors to look afield to balance this narrow leadership. Emerging markets may seem an obvious antidote – but are they really delivering genuine diversification?

Well, probably not for passive investors, given that the powerhouses of China, Taiwan, India and South Korea corner three-quarters of the MSCI Emerging Markets index. And it’s not just about country-specific concentration either, with TSMC alone accounting for more than 10% of the index (a larger weight than even NVIDIA in the S&P 500).

Active management might appear to be the panacea at first glance but doesn’t always tick the diversification box either, with more than 70% of funds in the IA Global Emerging Markets sector holding TSMC and Tencent and the majority also owning Samsung and Alibaba. In fairness, these leviathans have earned their status as poster children for Asian equities, as well as sidestepping smaller-cap liquidity issues, but concentration risk inevitably rears its head once again.

And this brings us full circle to the US tech sector. Looking at TSMC as an example, it’s NVIDIA’s primary manufacturer, as well as a key supplier to Apple, AMD and Intel. As a result, its performance is closely aligned to the S&P 500, as shown in the chart below.

Source: Bloomberg (as at 16 Sep 2025)

In short, emerging markets have become less of a diversifier and more of a proxy for US tech. The solution may lie in frontier markets, which share many the same traits of rapid growth, youthful demographics and urbanisation, but with lower correlations to global markets and greater reliance on domestic drivers.

Finding the next frontier

The MSCI Frontier Markets index spans nearly 30 countries, covering smaller, less liquid markets typically at earlier stages of development, alongside a few outliers such as Bahrain and Iceland. Some funds also include off-benchmark smaller emerging markets with similar characteristics.

While the ‘frontier’ label might evoke images of the Wild West, these markets have actually posted lower volatility than both the MSCI Emerging Markets and USA indices over the last five years.

Using the so-called Liberation Day as a litmus test, the MSCI Frontier Markets index fell just 8% in the following week, while emerging markets, US, UK and Europe indices suffered steeper losses. The diversification benefits of frontier markets stem from low correlations to developed markets and also to each other, with domestic growth dynamics being a primary driver of returns.

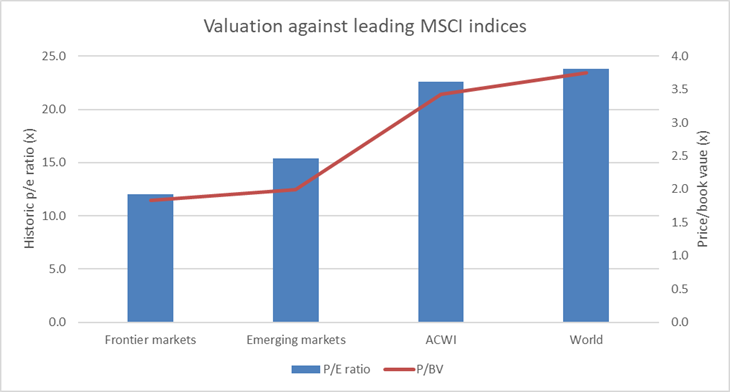

Frontier markets also boast attractive valuations, trading at a 20% discount to the MSCI Emerging Markets index and at half the valuation of the ACWI and World indices, as shown below:

Source: MSCI factsheets (as at 29 Aug 2025)

Investing successfully in these markets, however, requires deep local knowledge and on-the-ground research. BlackRock Frontiers (BRFI) stands out as one example, with managers Sam Vecht and Emily Fletcher bringing more than four decades of combined experience, supported by BlackRock’s extensive resources.

BRFI provides access to some of the world’s fastest-growing and least-covered equity markets, while deliberately excluding the eight largest emerging markets. The portfolio blends top-down country views with bottom-up stock selection, capturing diverse domestic themes from rising financial inclusion in Indonesia and Hungary to property demand in the UAE and gold mining in Turkey.

The trust’s returns are testament to the managers’ stock-picking capabilities, with a five-year share price return of more than 125% (to 31 July 2025), more than double its benchmark, alongside a 4.5% dividend yield.

For investors seeking single-country exposure in the frontier universe, Vietnam Enterprise Investments (VEIL) offers a focused way to tap into Vietnam’s reform-driven growth story. Government policy is geared toward boosting domestic growth via free enterprise and expanding foreign ownership of domestic equities.

While the MSCI Vietnam Index dipped 6% in April on tariff concerns, it has since resumed its climb, with a likely promotion to the FTSE Emerging Markets series providing a further catalyst in the coming months.

VEIL has delivered a share price total return of more than 70% over five years, including an eye-catching 29% gain over the past 12 months (GBP, to 31/08/2025), driven by strong contributions from banks and real estate holdings. However, it remains on a chunky discount of more than 15%.

Looking ahead, frontier markets remain an under-used source of real diversification beyond the Magnificent Seven. With returns driven by domestic demand, low correlations and attractive valuations, they offer a powerful mix of growth and resilience for patient investors.

Jo Groves is an investment specialist at Kepler Partners. The views expressed above should not be taken as investment advice.