The UK has struggled to find its footing since the country officially exited the EU in January 2020.

Political instability – with four different prime ministers in five years – and slower growth have brought periods of volatility and economic stagnation.

Yet the market has proven more resilient. Over the past five years, the IA UK All Companies sector has returned 59.1% on average, ranking eighth among all Investment Association sectors.

As part of an ongoing Trustnet series, we looked at how funds in IA UK All Companies performed over the half-decade using the upside and downside capture ratios and comparing performance against the FTSE All Share.

An upside capture ratio of over 100% means the fund outperformed the FTSE All Share when markets rose, whereas a downside capture below 100% means it fell less than the index during downturns.

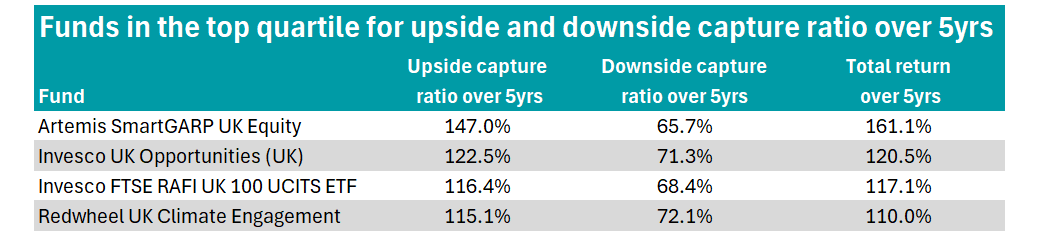

With over 30 funds managing to both capitalise on the good times and protect when markets fell, Trustnet looked to identify those that were in the first quartile in the sector across all three parameters: upside capture ratio, downside capture ratio and total return over five years.

As shown in the table below, just four funds managed to be top quartile across the piece.

Source: FE Analytics

Top of the table was Artemis SmartGARP UK Equity, which delivered a five-year upside capture ratio of 147%, downside capture ratio of 65.7% and total return of 161.1%.

Managed by Philip Wolstencroft since 2010, the fund has high exposure to UK banks, with Barclays, Lloyds Banking Group and NatWest Group all featuring in the top 10.

Wolstencroft designed the firm’s SmartGARP (or ‘Smart Growth at a Reasonable Price’) investment process, which serves as a stock-screening tool that scores companies against eight complementary factors believed to drive share prices. These include growth, valuation, momentum and ESG.

In second place, the £1.7bn Invesco UK Opportunities (UK) – which achieved 122.5% and 71.3% on the upside and downside capture ratios respectively – has also beaten the sector for total returns over one, three, five and 10 years, gaining 141% over the decade.

RSMR analysts said: “[The fund] has been managed with a consistent, large-cap, valuation-led strategy for many years, producing strong risk-adjusted returns for investors.

“Bottom-up fundamental proprietary research leads to a high-conviction fund that should outperform the peer group average over a full cycle.”

Invesco UK Opportunities (UK) has been managed by Martin Walker since 2008 and Bethany Shard since 2023.

The analysts added that the fund will perform well when value is “in vogue” but warned the opposite will be true during strongly rising markets led by growth stocks.

Invesco FTSE RAFI UK 100 UCITS ETF also made the list, with the passive vehicle looking to replicate the performance of the UK’s largest companies, such as Shell, BP and Glencore.

Managed by John Teahan, Ian Lance and Nick Purves since it was launched in 2010, Redwheel UK Climate Engagement is the fourth fund offering investors a first-quartile performance across the five-year upside and downside capture ratios and total return.

Categorised as Article 8 under the EU’s Sustainable Finance Disclosure Regulation (SFDR), the fund accounts for ESG-related characteristics when making investment decisions.

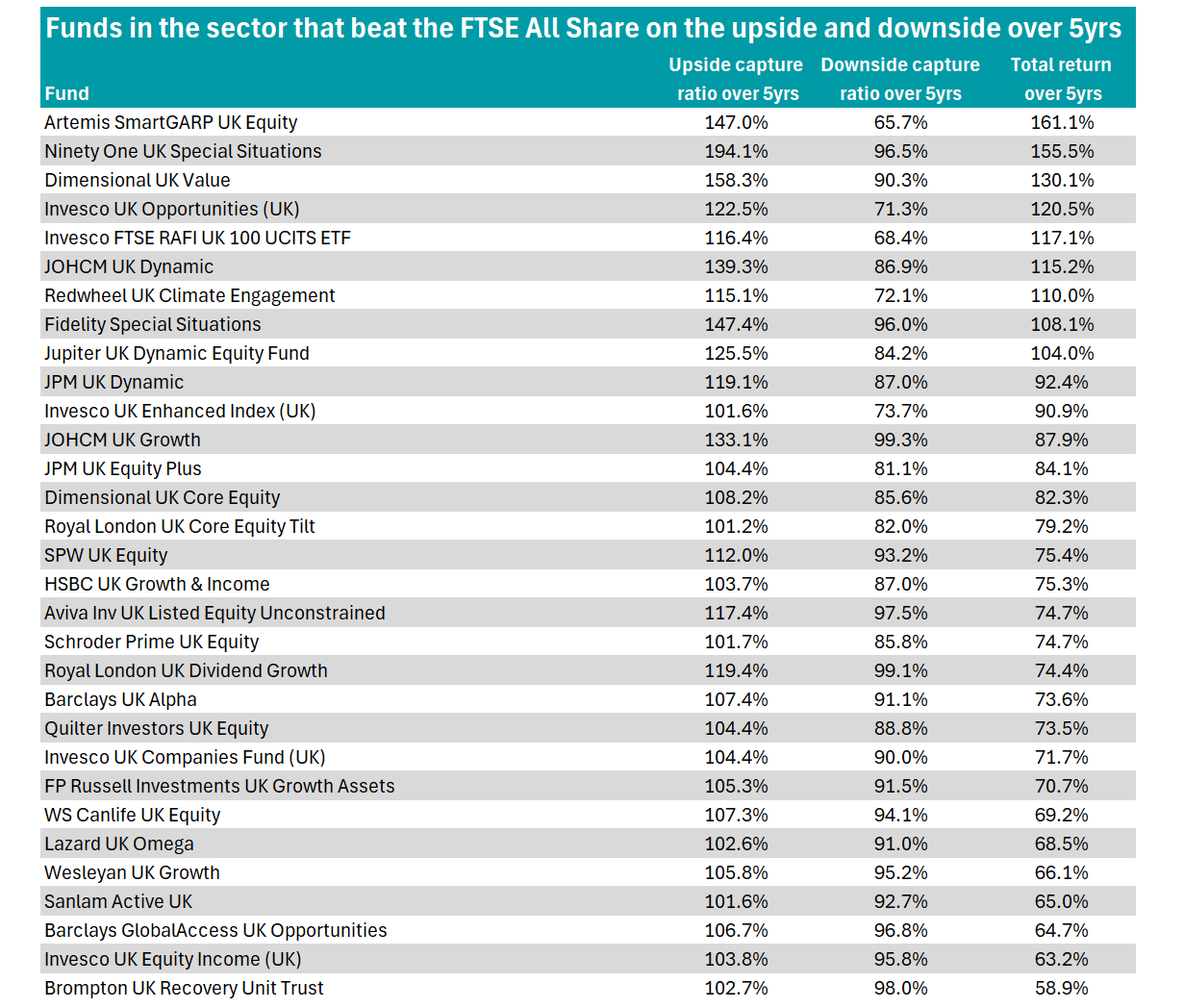

Funds that outperformed in all market conditions

More broadly, 31 funds beat FTSE All Share on both the upside and downside.

Source: FE Analytics

Artemis SmartGARP UK Equity once again features at the top of the table, delivering the highest total return and best downside protection over five years.

Meanwhile, Ninety One UK Special Situations came out on top on the upside, with a capture ratio of 194.1%.

The £742.6m fund aims to provide capital growth and income over five years by investing primarily in UK companies and related derivatives.

RSMR analysts recommend the fund, citing its contrarian, value-based and differentiated approach.

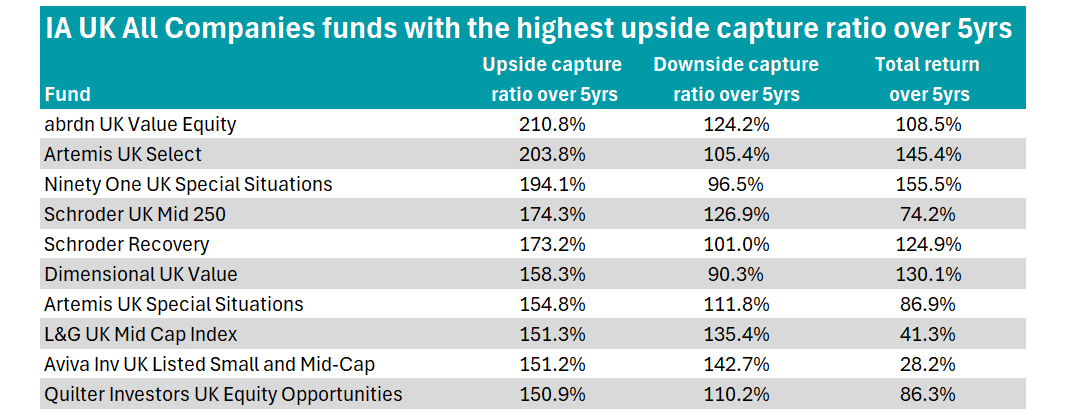

The best when the market rose…

Meanwhile, when looking only at which funds delivered the strongest upside capture ratio, abrdn UK Value Equity was top of the table at 210.8%.

Source: FE Analytics

However, it offered less protection when markets fell, with a downside capture ratio of 124.2%.

Investors who chose to stick it out over the half-decade nonetheless would have enjoyed a 105.5% return.

Dimensional UK Value led the group of 10 funds with the best upside capture ratio when the market fell, with a downside capture ratio score of 90.3%. As the name suggests, the fund utilises a value-based strategy, with top holdings including HSBC, Shell and Tesco.

Interestingly, despite the well-documented struggles for UK small- and mid-caps in recent years, small- and mid-cap-focused funds also featured in the first quartile for upside capture ratio, including Schroder UK Mid 250 and Aviva Inv UK Listed Small and Mid Cap.

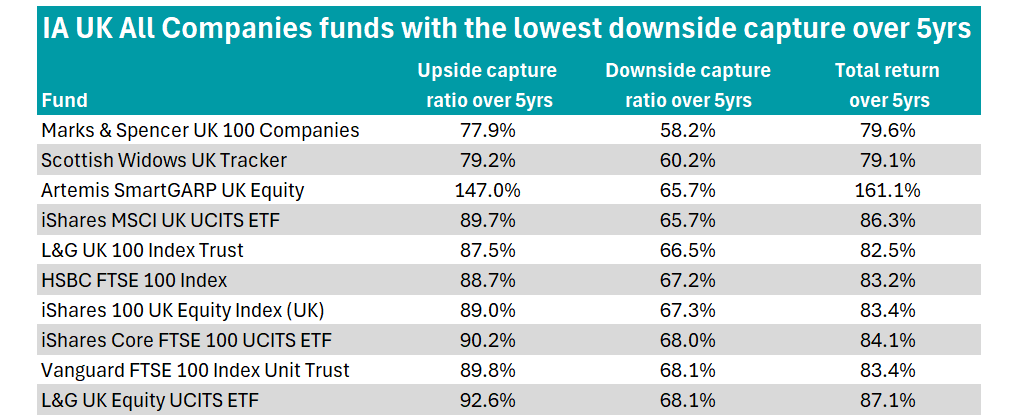

…And when the market fell

When looking at funds offering the best protection when markets fell, the top performers table is dominated by exchange-traded funds (ETFs) – most of which track the FTSE 100.

Source: FE Analytics

With the likes of Marks & Spencer UK 100 Companies and Scottish Widows UK Tracker top of the table, Artemis SmartGARP UK Equity was the sole actively-managed fund to make the top 10.