Fixed income was jolted back to life in 2022 after years of drifting below the surface.

When inflation returned, the long-duration bonds that had dominated suddenly weren’t the only way to make money.

Fund managers who built their careers between 2010 and 2015 may have been caught off guard, while veterans with longer track records were better placed to respond. As Fairview Investing director Ben Yearsley put it: “I like fund managers with grey or no hair.”

The challenge has only deepened in recent years. New US trade and industrial policies have reshaped the way investors think about global capital flows, currency and interest rates – shifts that require an experienced hand to navigate.

Last week, we profiled eight equity ‘super veterans’. Today, we turn to the fixed income market, where the number of seasoned managers every investor should know is smaller.

M&G’s Richard Woolnough

Darius McDermott, managing director at Chelsea Financial Services, put forward Richard Woolnough, the FE fundinfo Alpha Manager of the M&G Optimal Income, M&G Corporate Bond and M&G Strategic Corporate Bond funds and “one of the standout figures in bond investing over the past 20 years”.

Woolnough earned his reputation during the financial crisis, protecting capital when credit markets collapsed, but he has also shown how to make money in the very different environment of the quantitative-easing era and then again in the sharp reset of 2022, according to McDermott.

Today, all three of his funds exceed £1bn of assets under management (AUM). The largest of the three is Optimal Income, which struggled in 2024 with a fourth-quartile return against the IA Sterling Strategic Bond sector, but recovered this year and was the second-best in the 80-strong sector in 2023.

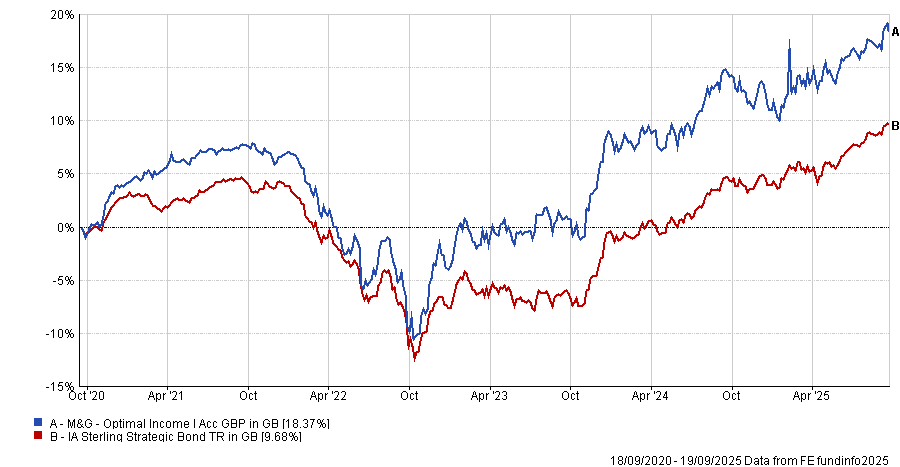

Performance of fund against index and sector over 5yrs

Source: FE Analytics

“Woolnough’s flexibility in moving between government debt, investment-grade bonds and high yield shows the value of experience across multiple cycles,” McDermott said.

Artemis’ Stephen Snowden

The second name on McDermott’s list was Artemis’ Stephen Snowden.

His career spans the most volatile periods in credit markets – from the global financial crisis though the European sovereign debt crisis and to the more recent surge in inflation and interest rates.

At Artemis, he runs both the “mainstream” Artemis Corporate Bond fund and the more flexible Artemis Short-Duration Strategic Bond strategy, “demonstrating the breadth and depth of his approach”.

With spreads between government and corporate bonds compressed, the latter have been a tougher hunting ground as investors sought the safety of sovereigns. Even so, Artemis Corporate Bond is currently in the first or second quartile of the IA Sterling Corporate Bond sector over one, three and five years as well as in every calendar year since launch in 2019.

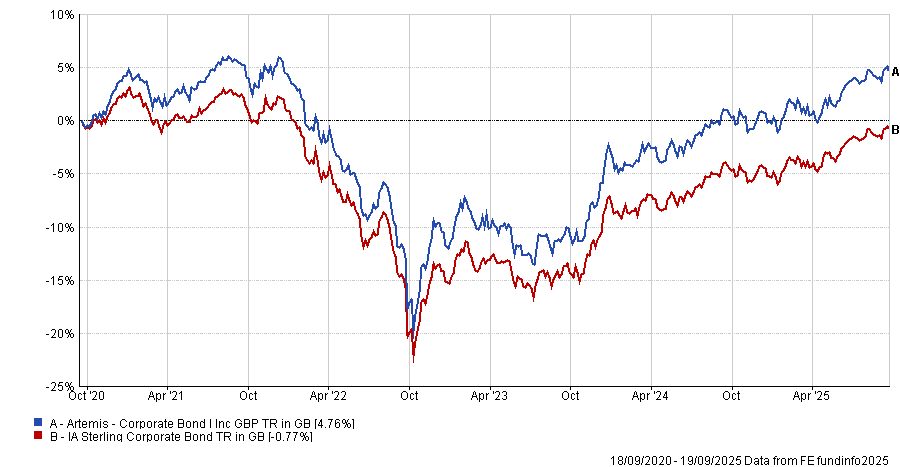

Performance of fund against index and sector over 5yrs

Source: FE Analytics

Jupiter’s Ariel Bezalel

Having been at Jupiter more than 20 years investing in different market cycles and economic environments, Ariel Bezalel deserves the title of super veteran, according to Yearsley.

His Jupiter Strategic Bond fund has struggled in recent years, but in 2025 it is showing signs of recovery, surpassing the sector average by three percentage points year to date.

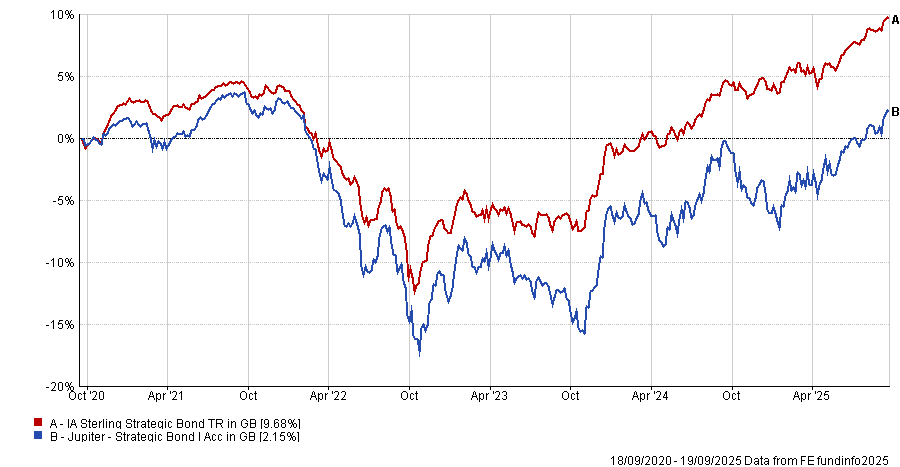

Performance of fund against index and sector over 5yrs

Source: FE Analytics

RSMR analysts said it remains “a strong offering in the sector” and rate it as a core option in fixed income.

Bezalel has recently positioned the fund defensively, using a ‘barbell’ approach that balances medium- and long-dated developed market government bonds with selective exposure to corporate credit and emerging markets.

Premier Miton’s Lloyd Harris

Put forward by his colleague Ian Rees, Premier Miton head of multi asset, Lloyd Harris has also admirers at Hawksmoor, whose multi-manager team invests in some of his strategies. Harris runs Premier Miton Strategic Monthly Income Bond, Premier Miton UK Money Market, Premier Miton Financials Capital Securities and Premier Miton Corporate Bond Monthly Income.

A bond manager since 2002, Harris has built skills in pockets outside the mainstream, as Rees explained: “Long-duration government bonds dominated from 2010 to 2022, but managers like him explored financial bonds, asset-backed and structured bonds, managing duration risk and delivering superior yields”.

These areas, especially financial bonds, emerged stronger after the financial crisis, offering “a strong valuation opportunity”.

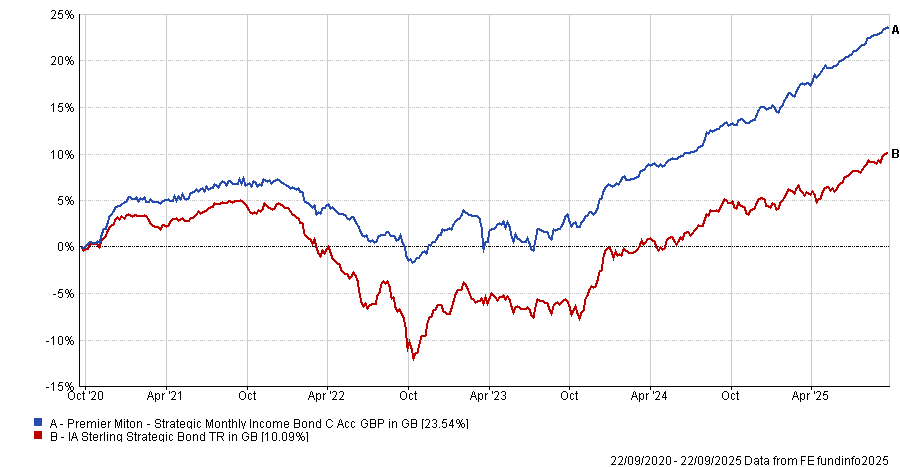

Performance of fund against index and sector over 5yrs

Source: FE Analytics

“Managers have built knowledge and delivered good risk-managed outcomes by managing duration risk and delivering superior yields from these types of credit instruments,” Rees continued. “The 2010s were a golden period to build that knowledge base and now they may be better rewarded as previous trends abate.”

Others

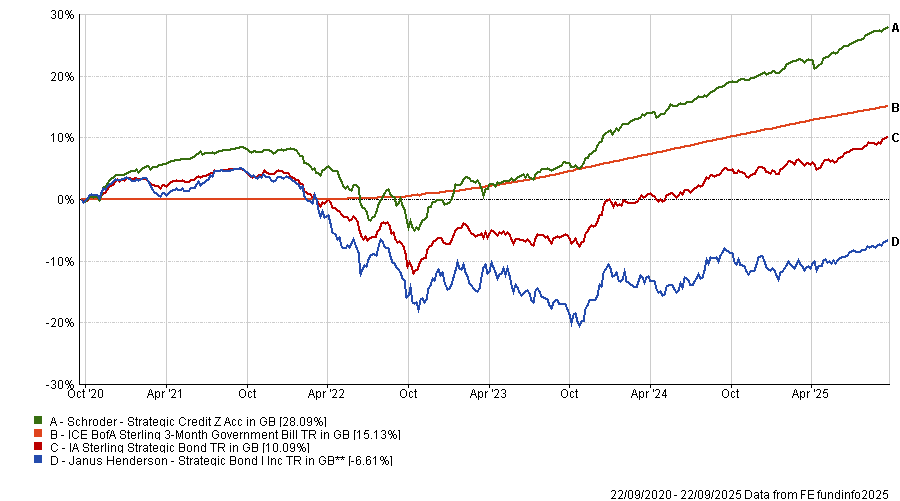

Ben Conway at Hawksmoor highlighted Jenna Barnard of the Janus Henderson Strategic Bond fund and Peter Harvey of Schroders Strategic Credit.

Performance of fund against index and sector over 5yrs

Source: FE Analytics

However, he cautioned that even the most seasoned bond managers have largely invested in just one environment, given that gilt yields fell for almost 50 years from the late 1970s until only recently.

“You could argue that even people with the longest careers have only really managed money in one super cycle,” he said. “You have to take every manager on their merits. Experience is one input, but no sufficient condition to determine whether someone is going to perform well in the future”.

Yearsley also noted that many funds are now less dependent on a single individual and instead emphasise the broader investment team – Pimco being a clear example.

Combined with the rise of passive investing, this has left the list of true bond ‘super veterans’ shorter than in equities, but those who remain are distinguished by their ability and adaptability.