If mergers and acquisitions (M&A) is the ultimate litmus test for value, biotech seems to be stealing the show. After a brief hiatus around the US elections, dealmaking has come roaring back in 2025.

Johnson & Johnson kicked off the year with its $15bn swoop on Intra-Cellular, followed by Sanofi’s $9bn purchase of Blueprint Medicines and Merck’s $4bn move on SpringWorks. The Nasdaq Biotech Index has shown similar momentum, bouncing back from its April wobble to post a 30% year-to-date gain.

The structural drivers are also strengthening for the biotech sector. An ageing global population, on track to hit two billion over-65s by 2068, is fuelling the need for treatments for chronic diseases such as cancer and diabetes.

Rising wealth in emerging markets is boosting healthcare spending, while advances in gene therapy and editing are opening doors to previously untreatable conditions.

And that’s before we get to the looming patent cliff. Blockbuster drugs still generate over 80% of revenues at pharma giants such as BMS, Eli Lilly and AbbVie, but once exclusivity expires, generic versions can erode up to 80% of sales in the first year.

Deloitte estimates that 190 drugs will lose exclusivity by 2030, creating a potential $240bn revenue gap, with Novo Nordisk’s Ozempic among the high-profile names facing patent expiries over the next decade.

With big pharma sitting on a $1.3trn war chest, biotech has become the prime hunting ground for replenishing pipelines. Biotech firms now deliver the lion’s share of global drug approvals, powered by nimble, capital-light research and development (R&D) that slots neatly into pharma’s global sales and distribution networks.

That said, it hasn’t all been plain sailing. Some investors sat out the initial turbulence around tariff and concern over the Most Favoured Nation drug-pricing and changes at the Food & Drug Administration (FDA), which regulates drugs in the US.

Despite this, the drug approval process has ticked along steadily and the FDA’s pilot ‘national priority voucher’ program aims to cut approval timelines from a year to just a couple of months.

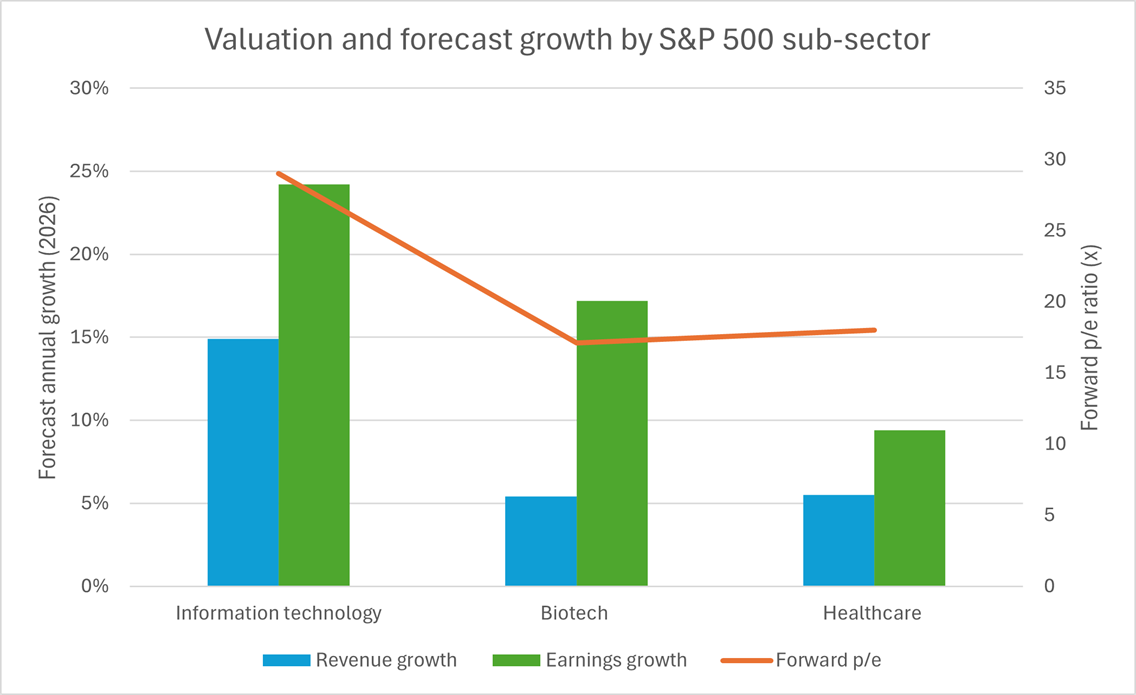

Valuations also remain appealing for growth-minded investors, with many small- and mid-caps still trading below their cash levels. As the chart below shows, the S&P 500 biotech sector currently trades at a near 40% discount to the technology sector on a forward price-earnings (P/E) ratio, while boasting a healthy 17% forecast increase in earnings.

Source: Yardeni Research (as at 17/11/2025)

The Darwinian shake-out of the frothy valuations of the pandemic has left behind a higher-quality universe, with a rising number of smaller-caps now clinically de-risked with at least one approved product and a clear path to revenue. Falling interest rates add another kicker given the sector’s historical inverse relationship with yields.

However, this is a sector where active strategies offer a real advantage, bringing specialist expertise, deep scientific understanding and the ability to decode complex clinical read-outs.

One of the standout options is the International Biotechnology Trust (IBT), which has outperformed its benchmark over one, three, five and 10 years in share price returns.

Managers Ailsa Craig and Marek Poszepczynski bring more than three decades of combined experience across the biotech ecosystem, with Poszepczynski’s background in launching biotech companies providing a particular edge in assessing valuation.

Their focus is on companies addressing meaningful unmet medical needs, backed by strong intellectual property and pricing power. This has meant trimming exposure to the increasingly crowded oncology space in favour of rare diseases – a major focus of the FDA and generally cheaper to develop.

Risk management also plays a central role, with the managers using a basket approach (rather than trying to pick the eventual winner) and dialling down exposure ahead of binary clinical events.

IBT also has an enviable strike-rate for M&A, thanks to its focus on de-risked, later-stage biotech companies. The trust has notched up more than 30 M&A deals since 2020, including nine this year alone. Notable deals include Novartis’s $12bn purchase of Avidity at a 46% premium and Intra-Cellular going at a 40% premium.

For a wider remit, Scottish Mortgage Trust (SMT) may be best known for its Magnificent Seven and Space X stakes but healthcare still accounts for nearly 10% of the portfolio.

Holdings include artificial intelligence (AI) enabled data platform provider Tempus AI (which SMT invested in prior to its IPO), as well as large-cap Moderna, a leader in mRNA technology.

Franklin Global Trust (FRGT) takes a benchmark-agnostic stance tied to long-term themes such as ageing societies. Its holdings span Illumina, the heavyweight in next-generation gene sequencing, to Sartorius Stedim in single-use bioprocessing and Veeva’s sector-specific software.

Looking ahead, there’s plenty coming down the pipeline, not least Novo Nordisk’s Evoke trial to test whether GLP-1s can slow the progression of Alzheimer’s. While the jury’s still out on the likelihood of success, even a modest delay in patients entering residential care could yield vast cost savings.

Innovations such as these underline why biotech could offer compelling opportunities for growth investors looking beyond the technology sector.

Jo Groves is an investment specialist at Kepler Partners. The views expressed above should not be taken as investment advice.