Global equities have surprised on the upside this year and while some are considering taking some risk off, Shard Capital has pushed its allocation even further to 41%, overweighting most equity markets.

Within that, the best opportunities right now are in value-focused active funds, according to Ernst Knacke, head of research at the firm. Below, he highlighted five “exceptional” equity funds for investors who believe equity markets have room to run.

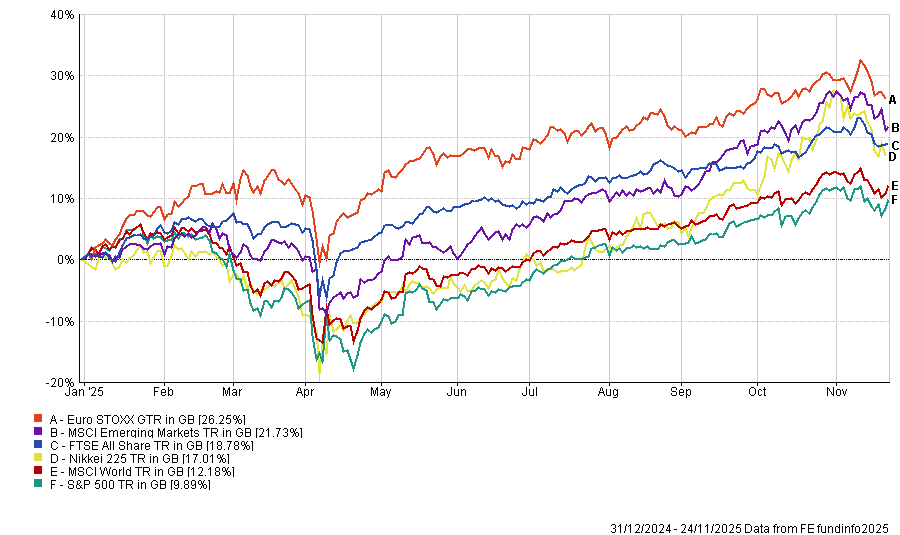

Performance of indices YTD

Source: FE Analytics

Global Equities

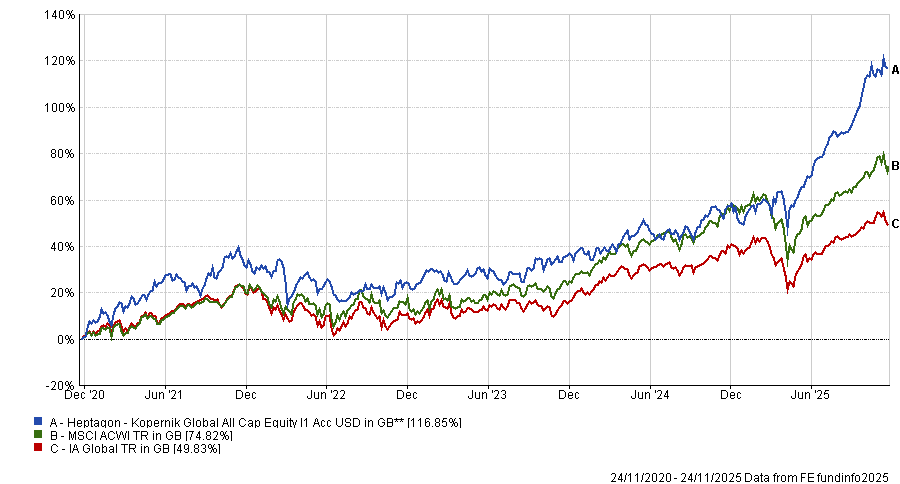

“If I were building a portfolio, the first name I’d write is Heptagon Kopernik Global All-Cap equity,” Knacke said.

Lead manager Dave Iben is an “exceptional long-term investor” who follows a consistent and robust process and takes a “deep value” approach to global equity markets, targeting companies that are misperceived and undervalued by the market.

This leads to an approach that is very differentiated from the benchmark, the MSCI All Country World index.

For example, just 11.4% of the fund is in North American stocks, compared to 64.8% in the index. It also holds just 0.1% in information technology stocks, compared to 28.5% in the wider global market.

Despite this low allocation to top-performing names such as the ‘Magnificent Seven’, it has posted top-quartile returns in the IA Global sector over one, three and five years.

Performance of the fund vs the sector and benchmark over past 5yrs

Source: FE Analytics

North America

For investors hoping to increase their allocation to the US market, a value-focused fund such as Eagle Capital US Equity is a compelling choice, Knacke said.

Even excluding the ‘Magnificent Seven’, US valuations are stretched, with even mid-caps and small-caps seeming expensive, meaning a “robust valuation discipline” is crucial for any US fund.

Eagle Capital is a strong choice because of its “focused, disciplined approach to equity selection”, which targets 25-35 stocks that are attractively priced compared to their intrinsic value. The team judges businesses based on their forward potential, looking for the quality of their companies, good margin potential and strong earnings expectations.

However, while the team sees themselves as value managers, they will “not dismiss a company because the price to earnings ratio (P/E) is high”, Knacke said.

This allows it to own stocks that would not traditionally be considered in value funds, such as Amazon and Microsoft, contributing to “exceptional” long-term performance.

Emerging Markets

Knacke also pointed to emerging market funds as an area of interest, which have been “strong for a long time now” and have room left to run.

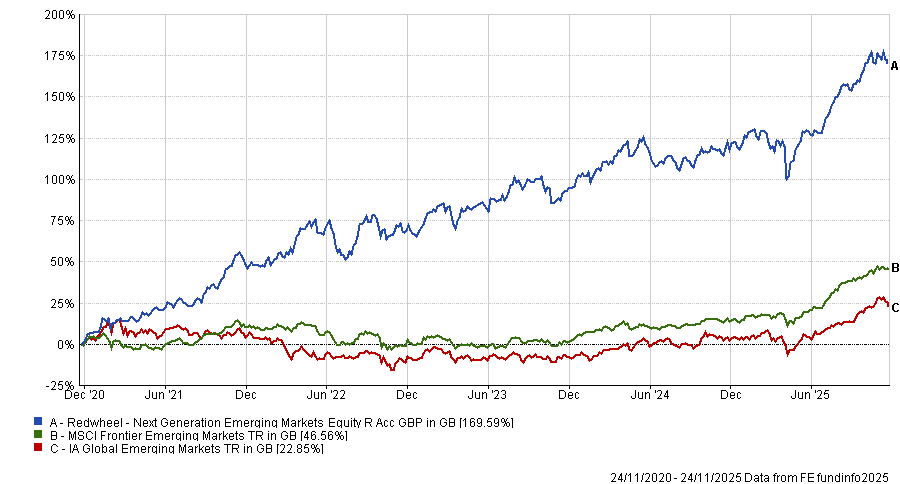

His favourite choice is the “exceptional” Redwheel Next Generation Emerging Markets Equity fund led by James Johnstone.

The strategy uses a macro and thematic approach to identify the best 60-80 ideas in smaller and frontier emerging markets. It is up 169.6% over the past five years, outperforming the closest competitor in the IA Global Emerging Markets sector by more than 60 percentage points.

Performance of fund vs sector and benchmark over past 5yrs

Source: FE Analytics

It is another “very valuation-focused product”, but this makes it the “right choice” in emerging markets, where fund managers need to be discerning if they want to find the best opportunities over the long term.

Japan

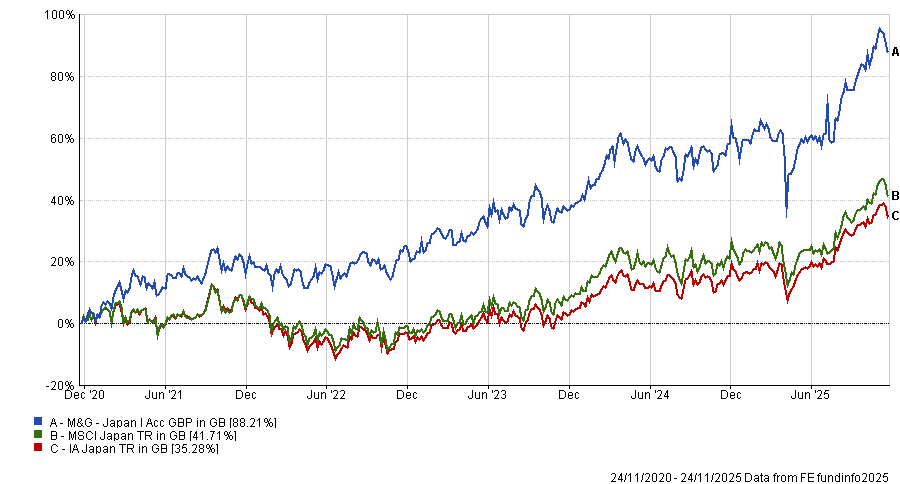

Investors have a range of options in Japan, but M&G Japan is a favourite for Shard Capital.

Managed by FE fundinfo Alpha Manager Carl Vine and co-manager Dave Perrett since 2019, the fund employs a bottom-up stock-picking approach that benefits from ongoing tailwinds in the region.

Japan is undergoing a “radical change, with increased efforts to make themselves more shareholder-friendly and many companies reforming their businesses to take advantage of this.

While some of the returns and changes have already started to come through, it is still early days and the market is “yet to fully value” the impact of these changes, according to Knacke.

Many companies “are still overcapitalised” and returns on equity remain low, meaning skilled active managers with an emphasis on encouraging corporate reform, such as Vine and Perrett, look well placed.

Indeed, Vine and Perrett’s focus on stock picking and undervalued companies has paid off with the fund up 88.2% over the past five years.

Performance of the fund vs the sector and benchmark YTD

Source: FE Analytics

Other favourite options for Shard Capital include Zennor Japan and AVI Japan Opportunity Trust.

Alternatives

Finally, Shard Capital is bullish on healthcare stocks through Bluebox Precision Medicine.

Led by Mark Dainty and Polina Suiter, the fund invests in global stocks that have their profits in the pharmaceuticals, biotechnology and life sciences sectors.

Healthcare and biotech stocks have lagged “too much” in recent years, as investors became worried that any potential benefits from artificial intelligence are “too far into the future” to be investable. While this is understandable, this “does not mean the technology and potential aren’t real,” Knacke said.

Because investors became nervous about healthcare and biotech, many companies are now trading at substantial discounts to their actual value, which skilled active managers such as Dainty and Suiter can exploit.

Indeed, their fund is up 21.6% (in dollars) to the end of October, outperforming its comparison index, the SMI BMI Healthcare index, which climbed 8.8% by comparison.