Giant active funds garner investor interest by producing strong returns that can’t easily be replicated, but they will not work out every year.

On balance, 2025 was a middling year for following the herd, data from FE Analytics shows. Of 29 actively managed equity funds with more than £5bn in assets under management, most (20) sat in the second or third quartile of their respective sectors. Just five managed a top-quartile return, while only four resided in the bottom 25% of their peer group.

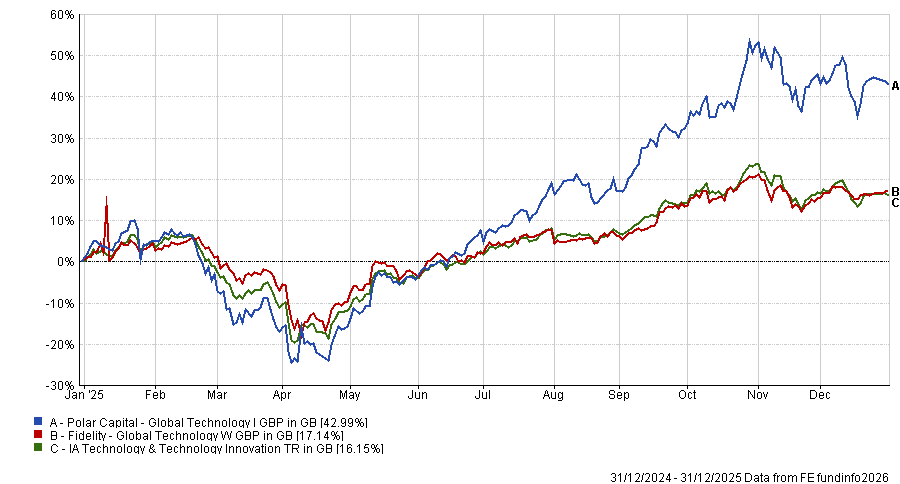

The best performer was the £7.9bn Polar Capital Global Technology, which made the highest return in the IA Technology & Technology Innovation sector.

Performance of funds vs sector in 2025

Source: FE Analytics

Managed by Ben Rogoff, Nick Evans, Fatima Iu and Xuesong Zhao, the fund is managed by “experienced investors”, analysts at Titan Square Mile, “who are skilled in identifying changing industry trends and the companies that are poised to benefit as a result.

“Technology is constantly evolving and continued vigilance is required by the managers to keep informed of developments.”

It made second-quartile returns in 2024 and 2023 but shot to the top of the tables last year, making 43%. The only other technology fund on the list, Fidelity Global Technology, also rewarded investors, up 17.1%, a second-quartile effort.

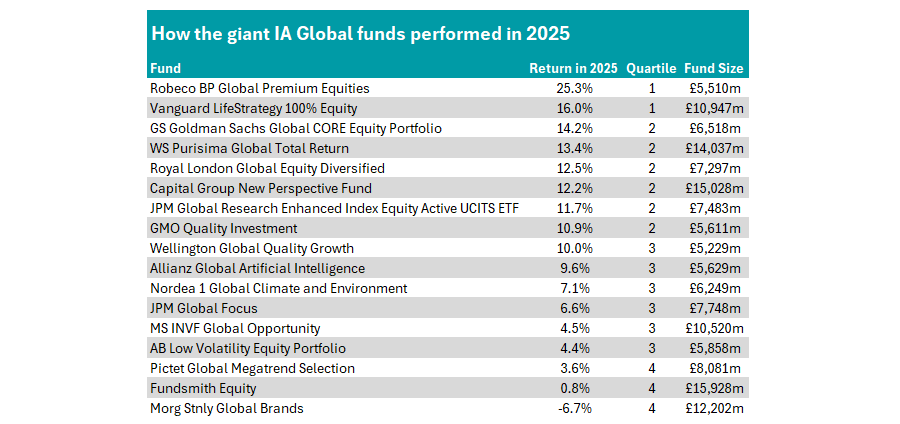

Global giants

In the IA Global sector, 17 active funds hold more than £5bn in assets under management (AUM). It was a mixed bag for investors in this area, with two funds at the top of the rankings, while three sat in the fourth quartile.

Robeco BP Global Premium Equities topped the table below with a 25.3% return in 2025. It was helped by the resurgence of markets outside the US, as its 35.8% weighting is far below the benchmark.

The £5.5bn fund does not include any of the ‘Magnificent Seven’ stocks in its top 10 holdings, which may have helped its performance in the first half of 2025 as these stocks proved volatile.

Vanguard LifeStrategy 100% Equity came in second place, although there is debate as to whether the fund is active. It invests in a range of passive funds, but its asset allocation is materially different to the benchmark, with 25% invested in the UK.

Six funds sat in the second quartile of the sector last year, including the £14bn Purisima Global Total Return and £15bn Capital Group New Perspective funds, with the same number occupying the third quartile.

Source: FE Analytics

At the bottom of the rankings, the £15.9bn Fundsmith Equity struggled, up 0.8% over the course of 2025. Veteran manager Terry Smith invests in quality-growth stocks with a large weighting to US names, which will have hindered performance as American stocks lagged the rest of the world last year.

Almost a third of the portfolio is invested in healthcare stocks, which had an up-and-down year. In the first half of 2025 investors worried about a concerning mix of regulatory uncertainty, pricing pressures and persistent investor rotation, although it recovered somewhat in the final few months.

Last year marked the first in the fund’s history that it made a bottom-quartile return over a calendar year, although it has failed to beat the average peer since 2022.

It was not the worst performer among the giant fund above, however, as Morgan Stanley Global Brands was at the bottom of the rankings, down 6.7%. Another with a high weighting to the US (76.5%) and a focus on quality stocks, the portfolio was one of the 10 worst IA Global funds investors could have owned last year.

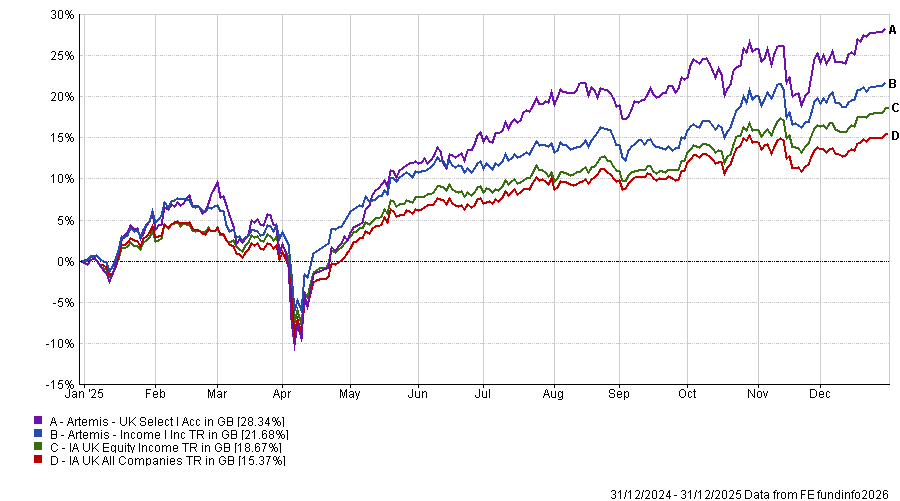

Domestic titans

Closer to home, there are very few funds that can boast an AUM of more than £5bn, but the two that investors have chosen to back significantly with their cash performed well last year.

The £5.2bn Artemis UK Select stood out, making 28.3%, good enough for a first-quartile return in the IA UK All Companies sector.

Headed by FE fundinfo Alpha Manager Ed Legget and Ambrose Faulks, the fund is predominantly invested in large-cap financials. Four of its top five holdings are banks (Standard Chartered, Barclays, Natwest and Lloyds) which all performed well in 2025, as did engine maker Rolls-Royce, its fifth largest position.

Performance of funds vs sector in 2025

Source: FE Analytics

From the same fund group, Artemis Income made a second-quartile return in the IA UK Equity Income sector. With £5.3bn in AUM, managers Adrian Frost, Nick Shenton, Andy Marsh and Jamie Lindsay are popular with investors looking for income.

Analysts at Barclays Smart Investor included the fund in their best-buy list, calling it “one of the stalwarts of the UK Equity Income market”.

“An experienced team adhering to a simple, but successful, investment philosophy, has delivered strong long-term returns and a sustainable income stream,” they said.

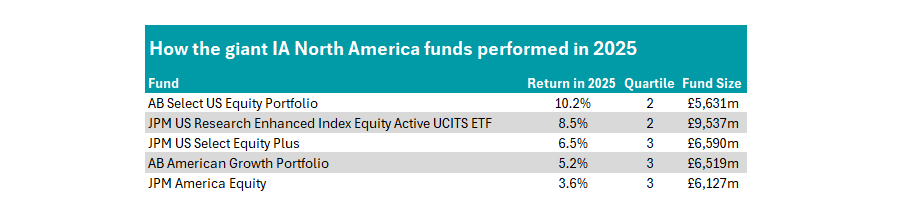

US behemoths

In the US, there were no big winners among the five giant funds, although there were no catastrophes either. AB Select US Equity Portfolio topped the charts with a 10.2% return, although it was the only fund with £5bn or more in AUM to make a double-digit return.

JPM US Research Enhanced Index Equity Active UCITS ETF (an active exchange-traded fund) also sat in the second quartile, while JPM US Select Equity Plus, AB American Growth Portfolio and JPM America Equity all were slightly below the average, as the table shows.

Source: FE Analytics

Other enormous funds

The IA Europe Including UK sector houses two active funds with assets under management of more than £5bn. GS Goldman Sachs Europe CORE Equity Portfolio got the better of Fidelity European Growth in 2025, with the former up 32% (a top-quartile effort), while the latter made 17.5% (third quartile).

Meanwhile, in the IA Global Equity Income peer group, Guinness Global Equity Income is the lone giant fund. It suffered last year with a return of 3.7%, placing it in the bottom 25% of the peer group.

FE Investment analysts said managers Matthew Page and Ian Mortimer have delivered “consistent, best-in-class performance over a long period”, although 2025 was a rare relative failure. Indeed, the fund has never been in the bottom quartile of the peer group in an individual calendar year prior to last year.