After the events of 2020, seasoned investors or younger investors entering the market for the first time might want to choose funds which have a riskier profile with the possibility of greater returns.

Panellists on the FE fundinfo AFI (Adviser Fund Index) panel are asked to select funds for a person in their late-20s with a longer time until retirement when constructing the Aggressive portfolio.

As such, Trustnet asked five fund pickers for their picks for an investor with that risk profile as we head into the uncertain waters of 2021.

Aberforth Smaller Companies

Rob Morgan, pensions and investment analyst at Charles Stanley Direct, picked the £1.1bn Aberforth Smaller Companies trust for the first aggressive pick.

“Value investing is still relevant and seeking out long-suffering value managers with a decent pedigree may be a worthwhile strategy in 2021 as the world recovers from the pandemic,” said Morgan.

He said while investors continue to view the UK stock market with scepticism, experienced stockpickers can add substantial value through picking the best of the opportunities and avoid so-called ‘value traps’.

“The trust’s investing style has been horribly at odds with the market action for the past couple of years but it’s still a high-quality investment that follows a defined and disciplined process,” Morgan added.

“The management team has a value-based investment philosophy that has the aim of unearthing cheap companies whose longer-term potential they believe has been misunderstood or underestimated by the market as a whole.”

Performance of fund vs sector & benchmark over 5yrs

Source: FE Analytics

Over five years, the Aberforth Smaller Companies trust has made a total return of 14.88 per cent, against a return of 44.95 per cent for the average fund in the IT UK Smaller Companies sector and 33.84 per cent for the Numis Smaller Companies 1000 ex Investment Companies index.

The trust is currently trading at a 3.6 per cent discount to net asset value (NAV), is 5 per cent geared, and has ongoing charges of 0.77 per cent, according to the Association of Investment Companies (AIC).

Fidelity Asia Pacific Opportunities

The second choice is the £895m Fidelity Asia Pacific Opportunities fund run by FE fundinfo Alpha Manager Anthony Srom, chosen by Fairview Investing co-founder Ben Yearsley.

“He’s a contrarian investor who runs a very tight portfolio of around 25-35 companies,” said Yearsley. “The fund typically has a bias towards growth companies and despite the contrarian nature of the manager, is keen to buy into ideas before others have noticed them.”

He added. “I’m also a big fan of Asia as a long-term investment theme.”

The fund’s top holdings include Taiwan Semiconductor Manufacturing, Techtronic Industries and Chinese beverage company, Kweichow Moutai.

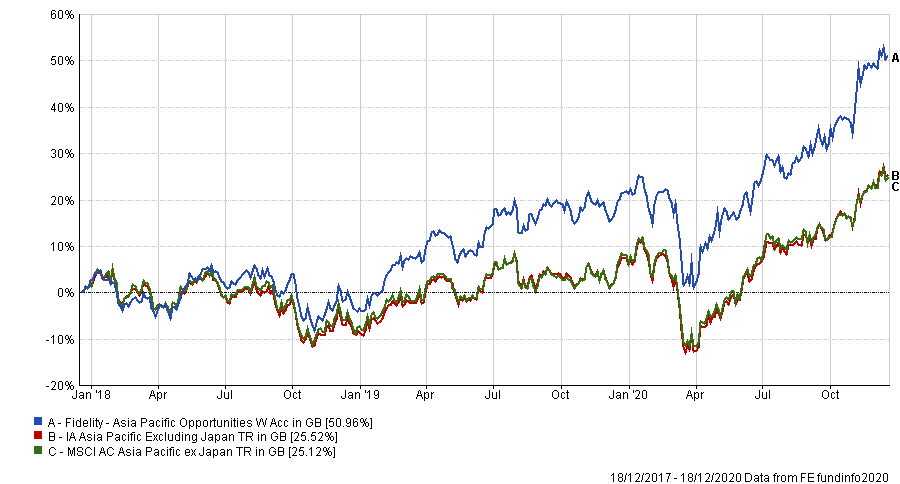

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

The Fidelity Asia Pacific Opportunities fund has returned 50.96 per cent over the last three years, compared with 25.52 per cent for the average IA Asia Pacific Ex Japan peer, and 25.12 per cent from the MSCI AC Asia Pacific ex Japan benchmark.

It has an ongoing charges figure (OCF) of 0.90 per cent.

HanETF Emerging Markets Internet and Ecommerce

Andy Merricks, manager of the EF 8am Focused fund has opted for an exchange-traded fund (ETF): the $219.4m HanETF Emerging Markets Internet and Ecommerce strategy.

“It’s already had a tremendous year but, if you can accept short-term volatility, it potentially has a lot more to offer in the coming years,” said Merricks.

He said many people are forecasting emerging markets to have a good year in 2021, particularly if the US dollar continues to weaken.

“The emerging market consumer is an exciting place to focus upon and the growth of online services and ecommerce has only been accelerated by the pandemic,” Merricks added. “A risk is a Chinese clampdown on the likes of Alibaba and JD.com but the whole sector looks like a train that’s worth boarding.”

Performance of fund vs sector since launch

Source: FE Analytics

The HanETF Emerging Markets Internet and Ecommerce fund has returned 105.05 per cent since its launch in 2018, compared to 25.52 per cent gain from the average peer in the Gbl ETF Equity – Tech Media & Telecom sector. It has an OCF of 0.86 per cent.

MI Somerset Global Emerging Markets

Adrian Lowcock, head of personal investing at Willis Owen, has opted for the MI Somerset Global Emerging Markets fund managed by Edward Robertson as his aggressive pick.

Lowcock said the manager employs a style which focuses on quality companies with healthy balance sheets, high returns on equity, strong cash flow and sustainable margins.

“Robertson is prepared to pay a higher price for these characteristics,” he added. “The approach means the fund is likely to perform well in more difficult market conditions while it may lag behind during momentum-driven rallies in technology shares that do not meet the investment criteria.”

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over three years, the £335.7m MI Somerset Global Emerging Markets fund has made a total return of 17.41 per cent, against a gain of 17.43 per cent for the average IA Global Emerging Markets fund and 19.80 per cent for MSCI Emerging Markets index. It has an OCF of 0.95 per cent.

Embark Horizon Multi-Asset V

Finally, Alex Farlow – head of risk-based solutions research at Square Mile Investment Consulting & Research – has picked the Embark Horizon Multi-Asset V fund run by FE fundinfo Alpha Manager Alex Lyle.

The Embark Horizon fund range consists of five funds, each targeting a different risk profile and the Horizon V strategy is designed to be the highest risk fund in the range.

“Embark outsource management of this fund to Columbia Threadneedle Investment’s multi-asset team, who manage it, so it remains aligned with [digital financial planner] EValue’s Risk Profile 5,” said Farlow.

“The fund is actively managed, and investment will be predominantly in global equities via a range of Columbia Threadneedle investment funds. Columbia Threadneedle as a house have a growth bias to their investment style and therefore these portfolios will also contain a growth bias.”

Performance of fund vs sector over 3yrs

Source: FE Analytics

The Embark – Horizon Multi-Asset V fund has returned 28.63 per cent over the last three years, compared to a gain of 15.33 per cent from the average peer in the IA Flexible Investment sector. It has an OCF of 0.82 per cent.