Thirty years from when it was first established, there is concern that the Alternative Investment Market (AIM) has fallen short of its promise to be a springboard for high-growth UK companies.

Rob Burgeman, wealth manager at RBC Brewin Dolphin, said the UK junior market – created to encourage more companies to list and to give investors more options to choose from – has been “a nice idea in theory, but disappointing in reality”.

“It is hard to say the index has been a phenomenal success – albeit there have been some good companies that have outgrown the index and gone on to bigger things. But, it hasn’t exactly been the conveyor belt of success stories many would have hoped for,” he argued.

However, with just two companies migrating from the AIM market last year (and it has been a single-digit number every year since 2010), the index has failed to springboard companies to the upper echelons of the UK market.

Below, Burgeman identified four core challenges facing the index as it approaches its 30th anniversary.

Companies are staying private for longer

Rather than going through the “faff and palaver” of a market listing, an increasing number of companies are choosing to stay private for longer, instead opting for investment from private equity or venture capital.

He also pointed to well-publicised instances of companies collapsing, arguably partially as a result of the lower governance standards that are allowed for AIM-listed companies, and a growing number of examples of junior companies shrinking to the point of having to delist and try their luck in other illiquid markets.

Pros and cons of tax relief

AIM’s generous inheritance tax break, which currently allows 100% relief after two years of holding, is set to be halved next year.

Although 50% remains a “generous incentive”, Burgeman said the tax break has proven to be a “double-edged sword”.

“There are plenty of cases where companies get to the point of being eligible to move to the main market, only to decide not to because the investment vehicles that own them would then be forced to sell their shares,” he said.

Subpar returns

Performance has also disappointed. “There are few funds that provide access to only the AIM market, which in itself says something,” he said.

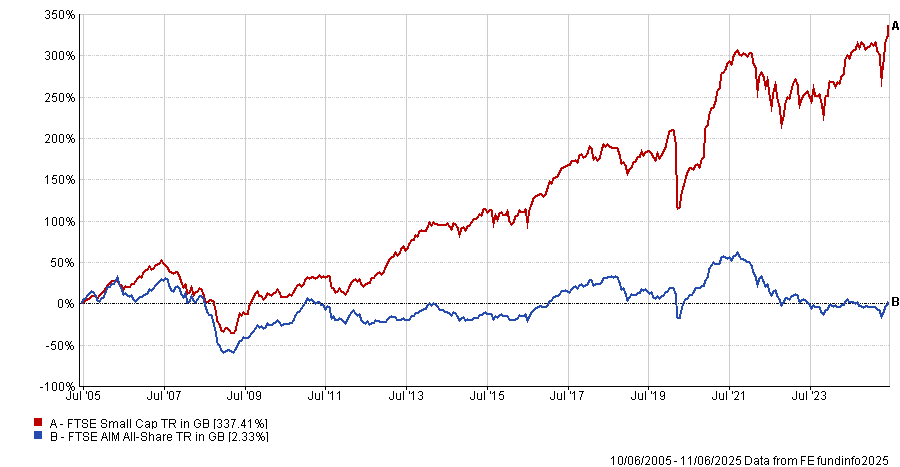

Any potential returns have been “lacklustre”. In the past five years, AIM has delivered a loss of 4.3%, and has made just 2.3% over 20 years. Since March 1996, the return has been 6.1% compared to the FTSE 100’s 467%.

Performance of indices over 20yrs

Source: FE Analytics

Comparing AIM with the FTSE Small Cap index is equally disappointing, with the latter delivering a total return of 337.4% over the same period.

“The reality is you would more than likely have been far better off investing in the FTSE Small Cap or FTSE 100 indices and paying inheritance tax on any gains than investing in AIM,” Burgeman argued.

Falling relevance

With the UK now making up just 4% of the MSCI World index – down from more than double that 30 years ago – the UK’s junior market has lost relevance, said Burgeman.

While one might expect AIM to be dominated by fast-growth tech, as can be seen in the US market, the index instead more closely reflects the broader UK market, he noted, with 18.1% industrials, 13.4% resources, 12.1% technology, and 11% financial services.

“A good number of the larger companies are also long-established, with little prospect for serious growth in the near future.”

What can be done?

One of the issues already being looked at is more pension fund money being allocated to UK small companies, said Burgeman, which should be a net benefit for the junior market.

“With defined benefit schemes being shoehorned into gilts rather than being used to support up-and-coming companies, there are some positive-sounding discussions that would move in this kind of direction.”

The other is inheritance tax relief, which he said needs “careful consideration”. For example, if the tax breaks were to be reduced further, it could “precipitate a rush of money out of an already illiquid market”.

“That said, it is acting as an impediment to companies taking the next step beyond the junior index,” he concluded.