Pharon Independent Financial Advisors has boosted its allocation to cash this year up to between 11% and 12% of its model portfolio service (MPS) – a record for the firm.

Andrew O’Shea, investment director and head of fund solutions, explained this is much higher than the usual average of 2% in cash, which is sufficient to pay fees and give investors a safety net.

He explained that the cash allocation had been ramped up dramatically this year as a “defensive manoeuvre” because “we just got a bit nervous really at the end of 2024”. In the gap between Donald Trump’s election and his inauguration markets became too optimistic, “even euphoric”, under the assumption that Trump would bring a pro-business agenda that would help push stock markets even higher.

“It just all felt like it was too good to be true and when it feels like that, 99.9% of the time, I’d say it is.” Expecting a downturn, he argued that cash has become a much more attractive asset.

The biggest risk facing investors in periods of uncertainty is that their capital gets wiped out – not whether they have made high enough returns, he said.

“If there’s one eye-opening lesson I’ve learnt, it is that you should not get greedy. Be more concerned about the downside risks than the upside potential, because if you leave things long enough, they’ll grow, but it’s when you try and make a quick buck that you tend to lose the most.”

To this end, a higher-than-normal allocation towards cash makes sense. This increased allocation was achieved by adding the Fidelity Cash fund, managed by Tim Foster and Ravin Seeneevassen to the MPS range.

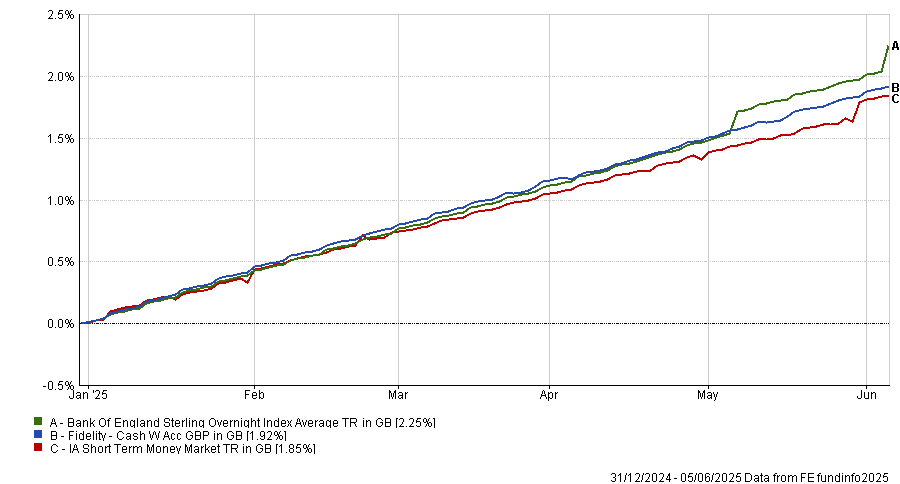

The fund aims to “favours capital security over the chase for capital, just what you want from a defensive position”, and is up 1.9% so far this year, just above the average return for the IA Short term Money Market sector, as demonstrated by the chart below.

Performance of the fund vs the sector and benchmark YTD

Source: FE Analytics

To make room for this heightened cash weighting, Pharon opted to trim part of their equity allocation selling two global market trackers and bringing the total number of funds in the portfolio to just 13. “We just thought they had a good run, and they were the easiest to sell”.

Additionally, he noted that if they were correct in the assumption that a downturn is incoming, then all the passive trackers would do was track the decline, limiting the rest of the portfolio’s returns.

However, O’Shea still likes several active managers, who he feels have the potential to outperform the market during recent uncertainty through careful stock selection and an emphasis on income.

One area he is particularly interested in is the UK, where the MPS range has been “ramping up exposure” significantly over the past six to nine months. While O’Shea explained that he has “always been a fan of the UK”, the current allocation is now 25-32% depending on the model portfolio, compared to a minimum of roughly 15%.

This increased allocation is because of the UK’s markets status as a high-dividend, low-valuation market. Dividends, he argued, are one of the best indications that you are in investing in a quality company because a business can “always fudge accounts” to make themselves seem more profitable or stable. However, if a business must pay out a dividend and can’t, they have no way of hiding this.

Additionally, in times of uncertainty investors often underestimate the benefits of an income strategy. “If you do not need the income, you can reinvest it, but it just gives you a safety net if you know you’re investing in conservatively managed companies. Then all you really have to do is pick a decent manager who will not fall for a value trap.”

To this end, he pointed to Artemis Income, managed by FE fundinfo Alpha manager Adrian Frost, Andy Marsh and Nick Shenton, as a favourite that he’s been adding to recently.

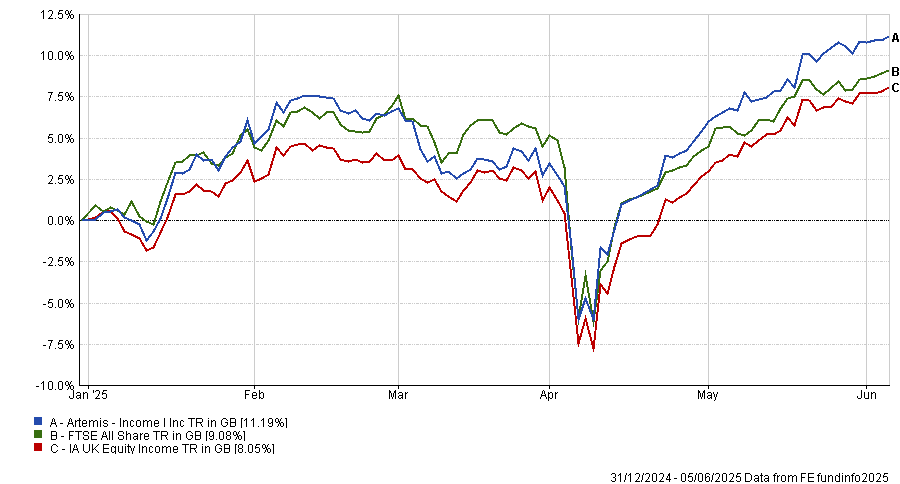

Year to date, the strategy is up 11.2%, a top-quartile result compared to its peers in the IA UK Equity Income sector and beating the FTSE All Share.

Performance of the fund vs the sector and benchmark YTD

Source: FE Analytics

Last week the fund went through its 25-year anniversary. Initially managed by Derek Stuart, one of Artemis’ founding partners, it was passed to Frost in 2002.

Frost said: “Much has changed over the past quarter century, with one of the biggest transformations being how much more short-term the market has become. Most market participants are only interested in the past 12 months and the year ahead, whereas we want to talk to company management teams about their vision three to five years from now. We are finding a lot of opportunities by putting the short-term noise into perspective and looking for long-term value.”