Asset management giant BlackRock has moved to an overweight stance on UK equities on the back of an improving global outlook and the removal of Brexit uncertainty.

Investors have been avoiding the UK for some time, as uncertainty over its future relationship with the EU and a lacklustre handling of the coronavirus pandemic soured sentiment. The UK stock market has lagged its global peers in recent years, while UK funds have suffered persistent outflows.

However, in its latest update, the BlackRock Investment Institute revealed the “debut” of an overweight towards the UK.

“We are overweight UK equities,” it said. “The removal of uncertainty over a Brexit deal should see the risk premium on UK assets attached to that outcome erode. We also see UK large-caps as a relatively attractive play on the global cyclical recovery as it has lagged peers.”

Rising optimism for UK equities

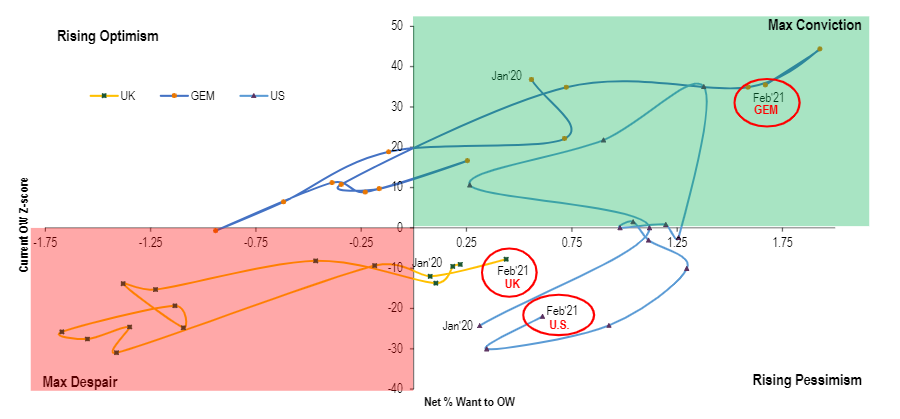

Source: Bank of America Global Fund Manager Survey

There have been other signs that fund managers are starting to warm towards the UK after its long period in the cold.

The latest edition of the Bank of America Global Fund Manager Survey found asset allocators’ sentiment towards the UK has shifted from ‘max despair’ to a slightly better ‘rising pessimism’, as shown in the chart above.

While the UK remains the most heavily avoided region among BofA Global Fund Manager Survey participants, this now stands at a net 10 per cent underweight – down from 15 per cent in January and a net 34 per cent underweight just three months ago.

Meanwhile, BlackRock – which with assets under management of $8.7trn is the biggest fund manager in the world – has taken an underweight in governments bonds while broadening out its tilt towards cyclical assets, or those that would do better in an economic recovery.

The BlackRock Investment Institute said it has ‘refreshed’ the asset views that it only laid out in December 2020 in light of “major developments” such as the coronavirus vaccine rollout and the potential for up $2.8trn of additional US fiscal spending this year.

BlackRock has three themes for the year ahead: ‘new nominal’, ‘globalisation rewired’ and ‘turbocharged transformations’. The new nominal theme concerns a more muted response in nominal bond yields to stronger growth and rising inflation than in the past.

The firm estimates that a 1 per cent increase in 10-year US breakeven inflation rates (a measure of market inflation expectations) has typically led to 0.9 per cent rise in 10-year Treasury yields since 1998.

But the breakeven inflation has climbed 1.2 per cent since March last year and nominal yields are only 0.5 percentage points higher. This means that real yields, or those adjusted for inflation, have fallen further into negative territory as a result.

BlackRock noted that the unique nature of the coronavirus crisis means economic growth has restarted much faster than seen in past business cycle recessions and this could mean “unusually high growth rates” as the vaccine rollout allows a wider re-opening of the global economy.

“We expect a strengthening economy, a huge fiscal impulse and rising inflation to further drive up nominal yields this year, albeit by less than in similar periods in the past,” it said.

“We expect central banks to lean against any market concerns around rising debt levels and to keep interest rates low for now. Yet if the narrative on high debt levels, combined with rising inflation, were to change, it could eventually undermine the markets’ faith in the low-rate regime – with implications across asset classes.

“We have downgraded government bonds to underweight on a tactical basis, with an increased underweight in US Treasuries. We also downgrade euro area peripheral bonds to neutral, as peripheral yields have fallen to near record lows and spreads have narrowed. We downgrade credit to neutral on a tactical horizon, as spreads have narrowed to historical lows, but still like high yield for its income potential.”

On a tactical basis, BlackRock now prefers stocks over credit, as it sees equity valuations as more attractive.

It has broadened its cyclical tilt by upgrading European equities to neutral, as its sees room for the market to close its valuation gap versus the rest of the world with the restart becoming more entrenched. However, the slow vaccine rollout and more muted fiscal support could act as headwinds.

As well as the overweight in UK equities in the wake of Brexit, the firm stays overweight US and emerging market equities, while underweight Japan as it expects lower risk-adjusted returns.

“We expect our new nominal theme of stronger growth and a muted response in nominal bond yields to higher inflation to further play out, even after significant market moves. This supports our tactically pro-risk stance,” BlackRock finished.

“A key risk is a further increase in long-term yields as markets grapple with an economic restart that could beat expectations. This could spark bouts of volatility, even though we believe the Fed would lean against any sharp moves for the time being.”