Nine UK investment trusts have turned around some lacklustre performance in 2020 by going from bottom quartile of their sector to top so far this year, Trustnet has discovered.

This upending of performance tables has been catalysed by a shift in market leadership as the growth style has recently given way to value stocks during the Covid-19 recovery. The shift in markets in this year was largely due to the anticipated economic recovery following the rollout of the coronavirus vaccine.

With economies expected to reopen as global vaccine programmes progress, there is an expectation that the hardest hit value sectors will see a resurgence thanks to their more cyclical nature.

This occurred in tangent with a sell-off in government bond markets due to concerns that the economic rebound would lead to higher inflation.

Concerns over inflation filtered into equity markets with growth stocks, which led markets in the initial Covid rally last year, falling and the previously ignored value stocks rallying.

With a more supportive environment for value now occurring, Trustnet focused this study on the UK, a market which is recognised as have a cyclical bias because of large weighting to sectors such as energy, commodities, oil & gas and banks.

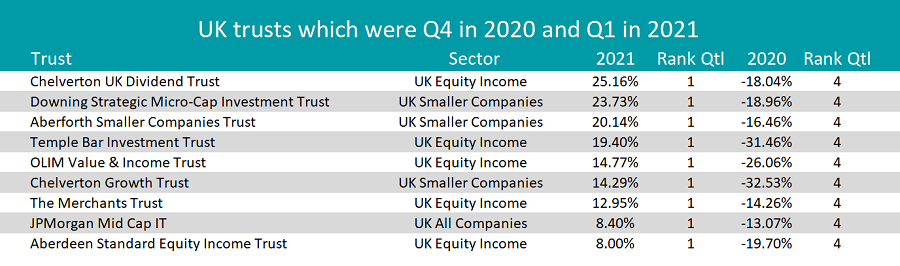

The study looked at the performance of investment trusts in the IT UK All Companies, IT UK Equity Income and IT UK Smaller Companies sectors in 2020 and up to 25 March 2021.

More specifically, it looked for trusts which had been fourth quartile in 2020 and had jumped to top quartile in 2021.

The study found that nine UK investment trusts had been able to completely overturn their performance.

Source: FE Analytics

The best performer was the Chelverton UK Dividend Trust, which has made 25.16 per cent over 2021 so far. This is significantly higher than its returns for the entirety of 2020 when it lost 18.04 per cent overall.

Indeed all nine of these trusts lost money last year and have so-far generated positive returns in 2021.

The Chelverton UK Dividend Trust is also the top performer for the IT Equity Income sector overall in 2021.

It has been run by David Horner since launch in 1999 with Oliver Knott joining at the start of this year. The £64.9m trust mainly invests in the mid and small-cap companies, aiming to provide both income and capital growth.

At the moment it currently has a dividend yield of 5 per cent and is trading at a 38 per cent premium.

Seeing a UK dividend trust performing well in 2021 is indicant of the recovery in the UK income space after a savage sell-off in 2020 due to the pandemic.

In the first half of 2020 saw many UK companies cancel or reduced their dividends to help cope with the financial impact of the pandemic.

Last year dividends from UK companies fell to the lowest levels since 2011, decreasing by 44 per cent to £61.9bn, according to the UK Dividend Monitor from Link Group.

More positive signs were seen at the end of 2020 as UK banks were allowed to restart their dividend payments. While Link Group forecasts that it will take at least five years to make up the lost ground, it said that the worst at least has passed.

Horner also runs the Chelverton Growth Trust, which was one of the IT UK Smaller Companies funds to move up from fourth to first quartile as well. It has made a total return of 14.29 per cent so far this year.

Horner manages this trust with David Taylor, investing in companies in the Alternative Investment Market (AIM) with a market cap of up to £50m which they believe are “at a point of change.”

There were two other IT UK Smaller Companies trusts on the list, the Downing Strategic Micro-Cap Investment Trust and the Aberforth Smaller Companies Trust.

The Aberforth Smaller Companies Trust is run by veteran manager Alistair Whyte along with a six strong management team. The £1.3bn trust has a value approach with the managers looking for companies that they calculate are selling below its intrinsic value.

One well-known trust on the list is Simon Gergel’s The Merchants Trust.

In the latest fund commentary Gergel noted the change in markets, saying: “A year after the coronavirus pandemic first rocked markets, there was a clear change in market sentiment in February.

“With evidence mounting that vaccines are proving effective at reducing the spread of the virus and the rate of hospital admissions, there was rising optimism about the economic outlook.”

The trust has made a total return of 12.95 per cent so far this year, making it the fourth best performer out of 23 trusts in the IT UK Equity Income sector.

Another well-known trust which went from Q4 to Q1 performance was the £758.3m Temple Bar trust, returning 23.73 per cent last year.

The trust has had a recent change in management, moving from Ninety One (it had been run by Alastair Mundy until his retirement on ill health) to RWC Asset Management’s Ian Lance and Nick Purves.

Lance and Purves will continue with a long-term, deep value process, as was seen under Mundy, investing predominantly in the FSTE 350 index.

Temple Bar was previously heralded for consistently increasing its dividend over a significant number of years, but it was forced to cut its dividend 25 per cent last year. This cut was not unexpected given the intense environment of the UK income market but compounded how challenging the 2020 growth environment had been for the value trust.

This of course has now shifted, as it’s the second-best performer in the IT UK Equity Income sector year-to-date.

There was only one IT UK All Companies member on the list, the £285.6m JPMorgan Mid Cap trust.

Run by Georgina Brittain and Katen Patel, the trust has made a total return of 8.4 per cent in 2021 so far, overturing its 13.07 per cent loss last year.

Investing in the FTSE 250 market, it operates between 5 and 25 per cent gearing in ‘normal markets’. It currently has 10 per cent gearing with a 2.4 per cent dividend yield.

The other trusts which have turned around its performance were the OLIM's Value & Income Trust and the Aberdeen Standard Equity Income Trust.