Exchange traded funds (ETFs) such as iShares NASDAQ 100, L&G ROBO Global Robotics and Automation, and Xtrackers MSCI Europe Small Cap have entered the top of the performance tables as soon as they have been included in the Investment Association sectors, Trustnet research shows.

ETFs from 11 providers, including BlackRock, Fidelity International, HSBC Asset Management, Legal & General Investment Management and Vanguard, have just been added to the various Investment Association sectors.

Jonathan Lipkin, director for policy, strategy and research at the Investment Association, said: “ETFs are a rapidly growing part of the UK fund market.

“Their inclusion in the IA sector framework recognises this, helping savers and their advisers to make comparisons and choose funds to meet their long-term financial goals.”

Of the 530 or so ETFs that have just been added to the Investment Association universe, 244 have a track record of five years or more and reside in sectors where quartile rankings are appropriate.

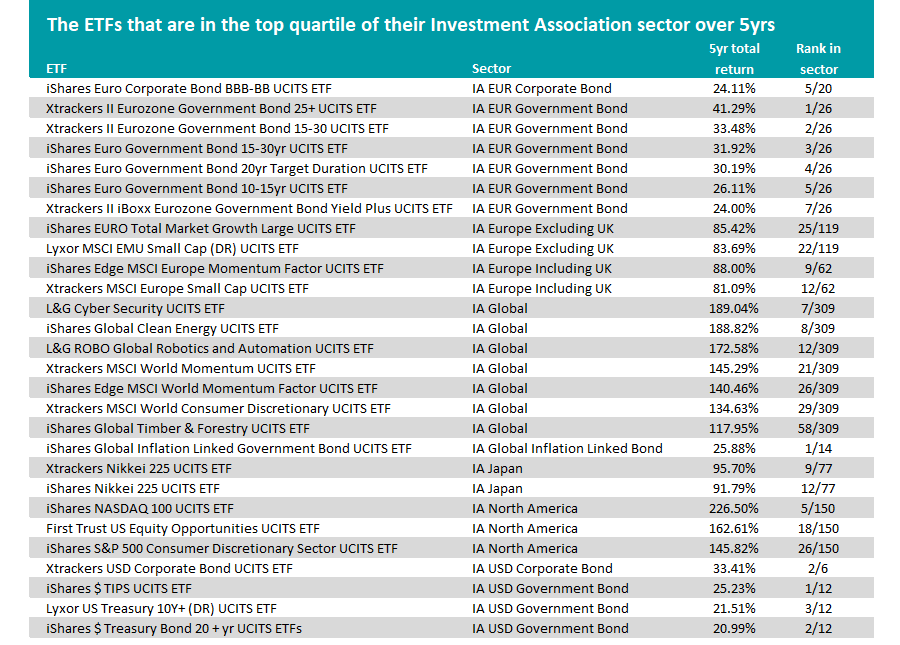

Given that ETFs are new to the Investment Association peer groups, Trustnet looked at the five-year performance of these trackers to see which are currently sitting in the top quartile of their new sector over the past five years.

There are 28 that have achieved first-quartile total returns over this period, as shown in the table below. We’ve grouped them by sector and included their absolute rank in their peer group.

Source: FE fundinfo

While the 28 ETFs in that table are all top quartile over the past five years, some have generated their sector’s very highest returns over the period.

The inclusion of ETFs in the Investment Association universe has led to the creation of some new fixed income sectors. As the IA Global Bonds sector would have grown by 50 per cent thanks to the inclusion of 129 ETFs, it has been split into 14 new bond sectors, broken down by the type of bond, credit type and currency focus.

It is in some of these sectors where ETFs are leading the pack.

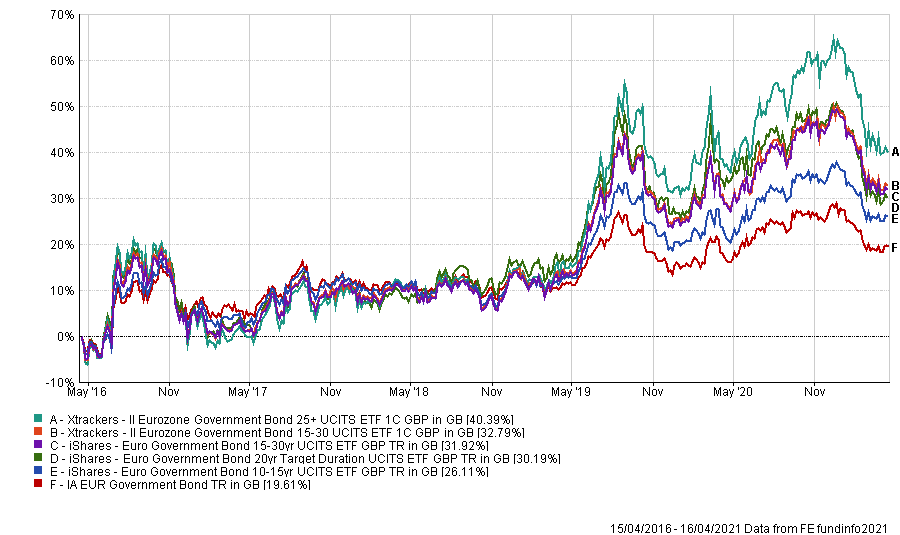

In the new IA EUR Government Bond sector – which home to funds that invest at least 80 per cent of their assets in euro-denominated government bonds (issued or explicitly guaranteed by European governments) – the five highest-returning strategies are all ETFs.

Xtrackers II Eurozone Government Bond 25+ UCITS ETF leads the peer group with a 41.29 per cent five-year total return. It tracks the Markit iBoxx Euro Sovereigns Eurozone 25+ index, which built from bonds issued by the French, German, Italian, Dutch and Spanish governments.

Performance of top 5 ETFs in IA EUR Government Bond sector

Source: FE Analytics

Meanwhile, the three strongest IA USD Government Bond members are all ETFs, with iShares $ TIPS UCITS ETF – which invests in US Treasury Inflation Protected Securities bonds – making the highest return of 25.23 per cent.

Furthermore, the iShares Global Inflation Linked Government Bond UCITS ETF is the highest returning member of the new IA Global Inflation Linked Bond sector.

The biggest share of ETFs in the top quartile, however, reside in the IA Global sector. Some 71 ETFs have just been added to the sector (only IA Specialist received more with 79) and seven of these are in its top quartile over five years.

None of these first-quartile ETFs track mainstream indices like the MSCI World, but focus on specific themes, factors or themes.

L&G Cyber Security has made the highest return of the ETFs entering the IA Global sector after gaining 189.04 per cent over the past five years (the peer group’s seventh-best result), while iShares Global Clean Energy isn’t far behind with a 188.82 per cent total return.

The other five – which track indices made up of momentum stocks, robotics companies, consumer discretionary names and timber businesses – are all up more than 100 per cent over the past five years.

The only other equity sectors where ETFs have entered the top quartile on a five-year view are IA Europe Including UK, IA Europe Including UK, IA Japan and IA North America.

Of course, the fact that 28 of the 244 ETFs we examined in this research – or just 11.5 per cent – are in the top quartile means that most of these trackers have not significantly outperformed the average active fund in their respective sectors.

Indeed, a deeper look at ETFs’ performance rankings shows that 68 (or 27.9 per cent of them) are in the second quartile while 70 (28.7 per cent) in the third quartile. But 78 – or close to one-third of the total – have made fourth-quartile total returns over the past five years.