The UK’s consumer prices index (CPI) rose by 0.7 per cent in the 12 months to March 2021, up from an inflation reading of 0.4 per cent to February.

According to the Office for National Statistics (ONS), the largest upward contributions came from rising prices for transport and clothing.

Businesses preparing for the end of lockdown would expect a spike in consumer spending and this drove up prices in areas of post-lockdown demand.

The ONS added that the effect of the pandemic had skewed traditional seasonal prices for clothing and footwear, recording a 1.6 per cent increase in March.

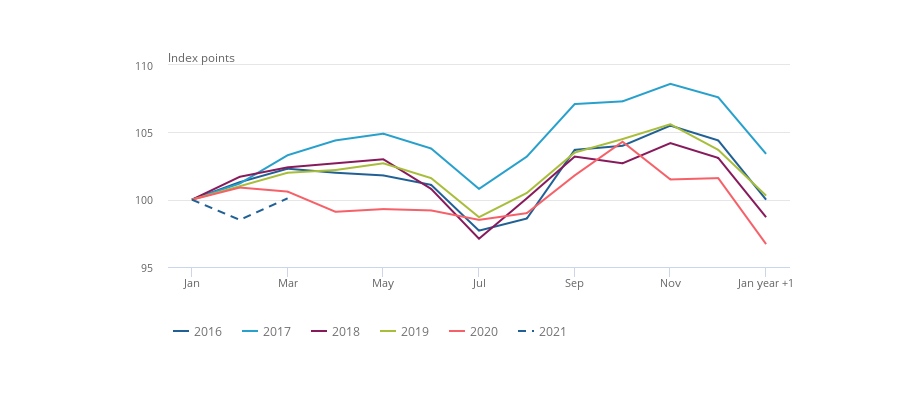

Clothing and footwear prices influenced by the Covid pandemic, January 2016 to March 2021

Source: ONS

Adam Vettese, analyst at multi-asset investment platform eToro, said: “The fact transport and fuel costs were the biggest contributors to inflation in March suggests both individuals and firms are taking back to the road, which is a tell-tale sign of increased economic activity.

“In normal times, a 0.3 percentage point rise in inflation might be enough to cause unease among Bank of England officials and investors, but it’s likely both will stomach rising prices as a consequence of the economic recovery for now.”

Vettese added that while inflation is still below the BoE’s 2 per cent target, the central bank would be under pressure to raise rates if inflation starts to run away with itself.

Derrick Dunne, chief executive of Beaufort Investment, commented: “With inflation now expected to keep rising over the coming months, it’s becoming more likely the Bank of England will be forced to adjust its base rate to stop inflation from exceeding its 2 per cent target.

“While exactly what those measures will look like remains to be seen, it would be sensible for investors to review their plans and ensure they are equipped to keep delivering the desired returns in an inflationary environment, especially as further rises in prices of goods and services are expected.”

Laith Khalaf, financial analyst at AJ Bell, added: “For the moment, inflation looks well contained, but if there is a shift in inflationary expectations, this would have big ramifications for investors and markets.

“Inflation is a potential problem for 2022 rather than 2021, but if markets get a whiff of it coming down the road, prices could adjust rapidly.”