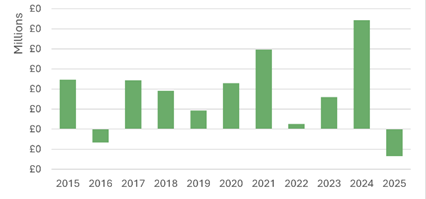

Equity funds recorded their worst year on record in 2025 for fund flows, with investors withdrawing £6.7bn over the year as concerns over valuations, policy risk and market concentration drove a sustained move away from risk assets, data from the Calastone Fund Flow Index shows.

While December marked a seventh consecutive month of net selling, it also brought a sharp slowdown in outflows, suggesting that clarity following the autumn Budget helped stabilise sentiment among UK investors.

The report found that equity fund outflows peaked during the summer and autumn, before easing materially at the end of the year. Investors withdrew a net £188m from equity funds in December, the smallest monthly outflow since June and a significant improvement on the July-November period, when monthly redemptions regularly exceeded £3bn. Despite this late-year moderation, the scale and duration of selling in 2025 was unprecedented in Calastone’s 11-year dataset.

The overall annual figure was more than double the previous record of £3.3bn set in 2016 following the Brexit referendum. Net selling between June and December alone totalled £10.6bn, making it the longest and largest continuous period of equity fund withdrawals on record.

Equity funds’ net flows by year

Source: Calastone

The pressure was not evenly distributed across the market. Actively managed equity funds bore the brunt of the exodus, losing £18.9bn over the year. In contrast, passively managed equity strategies attracted £12.2bn of net inflows.

This shift reflects both cost sensitivity and growing scepticism about the ability of active managers to add value during a year dominated by sharp market moves and elevated volatility.

The preference for passive exposure was particularly pronounced within global equity allocations, where investors appeared more comfortable maintaining broad market exposure rather than making active regional or style calls.

December’s improvement in flows was evident across all equity sectors, although most remained in net outflow. North American equity funds saw the most dramatic turnaround, moving from an £812m outflow in November to a £107m inflow in December. Global equity funds followed a similar pattern, reversing a £747m outflow in November to record £174m of net inflows in the final month of 2025.

UK-focused equity funds, which have struggled for much of the past decade, remained out of favour. Net selling eased from £847m in November to £541m in December, but full-year withdrawals still reached £9.5bn.

This was broadly in line with 2024’s £9.6bn and marked the tenth consecutive year of net outflows, despite UK share prices reaching all-time highs during 2025.

The persistence of withdrawals from domestic equity funds highlights the disconnect between headline index performance and investor confidence. While valuations improved and dividends remained resilient, concerns around economic growth, political risk and the UK’s long-term market appeal continued to weigh on allocations.

Edward Glyn, head of global markets at Calastone, attributed the late-year slowdown in equity selling partly to reduced policy uncertainty following the Budget. He said: “The sudden, dramatic slowdown in outflows between November and December is a clear indicator that months of pre-Budget speculation contributed to the record outflows from equity funds between June and Budget Day.”

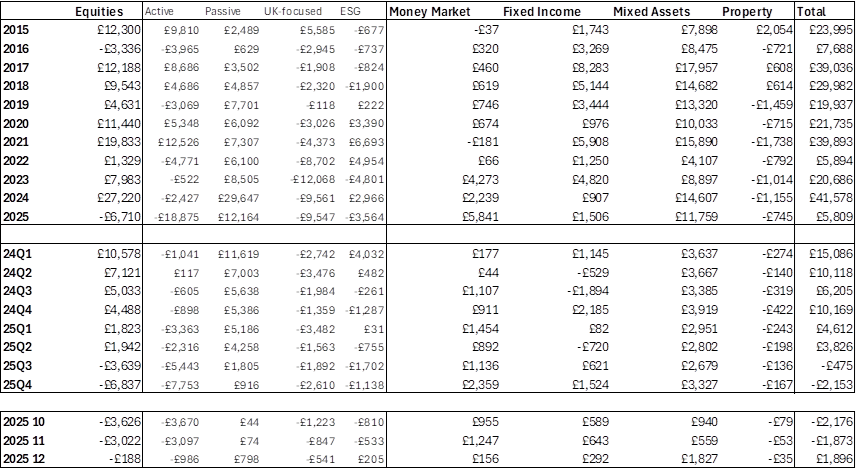

However, Glyn cautioned that easing outflows should not be interpreted as a decisive return to risk. Outside equities, lower-risk asset classes benefited from a clear flight to safety, with diversified mixed-asset funds attracting £11.7bn over the year. Although this was lower than in 2024, it was broadly in line with the sector’s 10-year average, indicating continued demand for balanced portfolios during periods of uncertainty.

Money market funds recorded a particularly strong year, absorbing £5.8bn of net inflows – a record annual figure. Fixed-income funds also saw renewed interest, with inflows rising by half to £1.5bn, although this remained less than half the decade average, reflecting ongoing volatility in bond markets.

All three asset classes recorded net inflows in December, reinforcing the view that investors were repositioning rather than exiting markets entirely.

Selected asset classes’ net flows by year

Source: Calastone, in £m

“Record money market inflows point to investors favouring the safety of cash, suggesting they perceive equity valuations to be teetering after a dramatic 2025 bull run,” Glyn said.

“Solid inflows to mixed asset funds and fixed income support the notion that risk-off is the name of the game at present.”