Cautious optimism characterised the final quarter of 2025, which was relatively quiet compared with the rest of the tumultuous year.

Despite the US government shutting down for more than a month, global markets delivered positive returns to round out a solid year of gains across all major asset classes. Between October and December the FTSE All Share led the way among major equity markets.

Francis Kinniry, head of the Vanguard Investment Advisory Research Center, said: “It’s often said that bull markets climb a wall of worry – and the fourth quarter of 2025 stands as a compelling testament to that adage.

“Despite the longest US government shutdown in history, a spike in job cuts, consumer sentiment hovering near record lows and a relentless stream of negative headlines, risk assets maintained their upward trajectory.”

Japanese, European and emerging market stocks were all higher, with the US languishing at the bottom of the rankings (although still up 2.7%).

Equities were not the only asset class that benefited investors during the quarter, as fixed income also posted positive as the Federal Reserve and Bank of England cut interest rates.

“From a portfolio perspective, a balanced 60/40 stock/bond portfolio returned [around] 2% for the quarter,” Kinniry said.

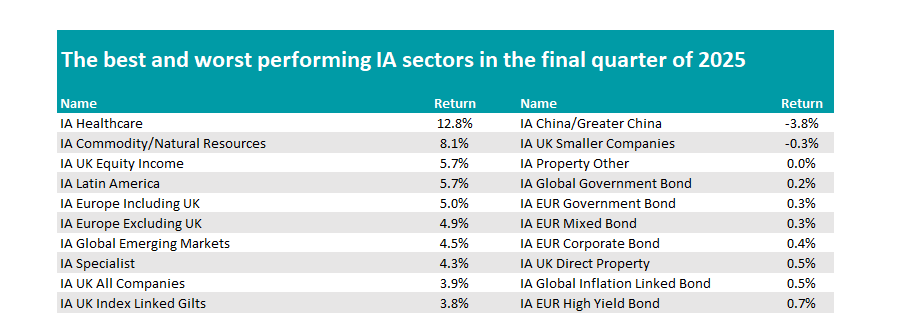

Source: FE Analytics

Among funds, healthcare specialists led the way between October and December as investors turned towards undervalued assets. Healthcare had underperformed for the past three years, making it a compelling entry point for the cost-conscious. Pictet Biotech topped the peer group, up 24.1%.

Meanwhile, commodity funds continued their strong year with gold funds once again performing well. WS Amati Strategic Metals topped the charts, up 32.5% in three months, while Ruffer Gold was in second place (29.2%).

Korea also enjoyed a strong bounce as investors backed the country, which has benefited from the restoration of political stability, corporate governance reforms and strong exposure to the global artificial intelligence (AI) boom.

China funds (down 3.8%) and those focusing on UK smaller companies (-0.6%) were at the bottom of the list and were the only two places investors would have lost money on average towards the end of the year. Both seemingly gave up some ground made in the third and second quarters respectively.

The fourth quarter was similar to the opening three months of the year, but more muted. Between January and March, markets were dominated by negative headlines around a potential trade war started by new US president Donald Trump and the risk of an economic slowdown.

US stocks sold off while equities outside of America (led by Latin America but including Europe, China and the UK) rallied. European equities in particular benefited from the rise of defence stocks, as countries committed to spend more on their military after Trump warned the US may not continue to back its allies in the same way as it has previously.

Arguably the most tumultuous period of 2025 occurred in the second quarter, however. Kicked off by Trump’s ‘Liberation Day’ tariffs, markets were sent into a tailspin on fears that the US government could be resetting a new world order.

Risk assets went into freefall in April as the US hit trading partners with higher tariffs than investors were expecting. Shortly after, a 90-day pause was introduced as bond markets in particular took umbrage with the measures.

Stocks rallied in relief and a new term was coined to describe the US president’s negotiating style: TACO (Trump always chickens out).

The relief rally was stronger than the fall, with many major markets ending June at or around record highs. Technology stocks were the big winners, recovering from their falls during the first quarter, while risk-on assets such as US and UK smaller companies jumped as investors became more comfortable adding to riskier positions.

AI remained the key theme driving markets higher, with market leaders such as Nvidia and Microsoft delivering strong returns during the second-quarter earnings season.

The healthcare sector was the biggest loser at this time, as investors worried about a concerning mix of regulatory uncertainty, pricing pressures and persistent investor rotation.

In particular, US policies expanding Medicare’s negotiating power and imposing international price comparisons intensified worries about future revenue and margins.

Chinese equities also continued their yo-yoing, making a 3.1% loss having been near the top of the tables in the first quarter.

As the summer rolled on to the third quarter, markets continued to melt higher, hitting ever-greater heights and passing new records along the way as trade-war tensions between the US and its trading partners lifted.

Meanwhile, the Federal Reserve moved to a rate-cutting stance with inflation slowing, a boost to equity valuations as lower rates reduce borrowing costs and boost risk appetite.

This benefited Chinese stocks, which rose 23.9% between July and September, although it was not the only factor.

Zara Nokes, global market analyst at JP Morgan Asset Management, said: “Policy support for domestic chipmakers, alongside an acceleration in AI spend and product rollout from some of China’s biggest tech names fuelled the rally.”

Wider Asian and emerging market equity funds also performed strongly, while US and tech funds also had a decent quarter and outperformed their global peers, with UK and European funds trailing behind.

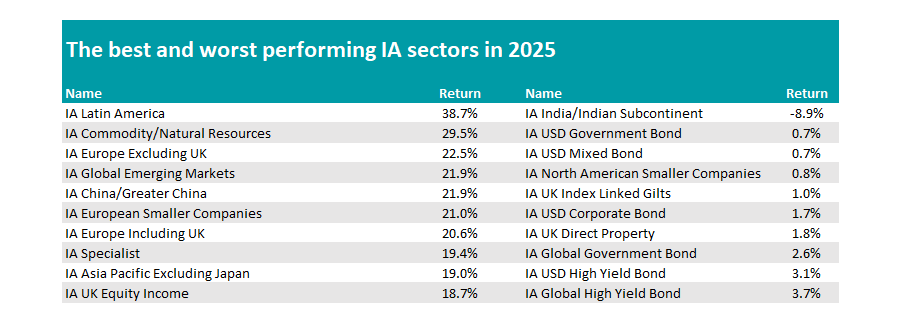

With all quarters combined, it was commodity-heavy areas that won out last year, with IA Latin America and IA Commodity/Natural Resources taking the top two spots among Investment Association sectors.

However, there was a clear broadening out as investors moved away from the US and diversified to other markets, with Europe and China also making strong gains despite some up and down periods throughout the year.

Source: FE Analytics

At the other end of the spectrum, the IA India/Indian Subcontinent peer group was the only one to make a loss in 2025, giving back some of the strong gains made in 2023 and 2024 (up around 17% in each year) as investors took profits.